Predictive analytics in banking utilizes data patterns and machine learning algorithms to forecast customer behavior, credit risk, and market trends, enabling more informed decision-making. Automated underwriting streamlines loan approval processes by using predefined criteria and AI to assess creditworthiness quickly and accurately, reducing human error and processing time. Discover how integrating these technologies can revolutionize financial services and risk assessment.

Why it is important

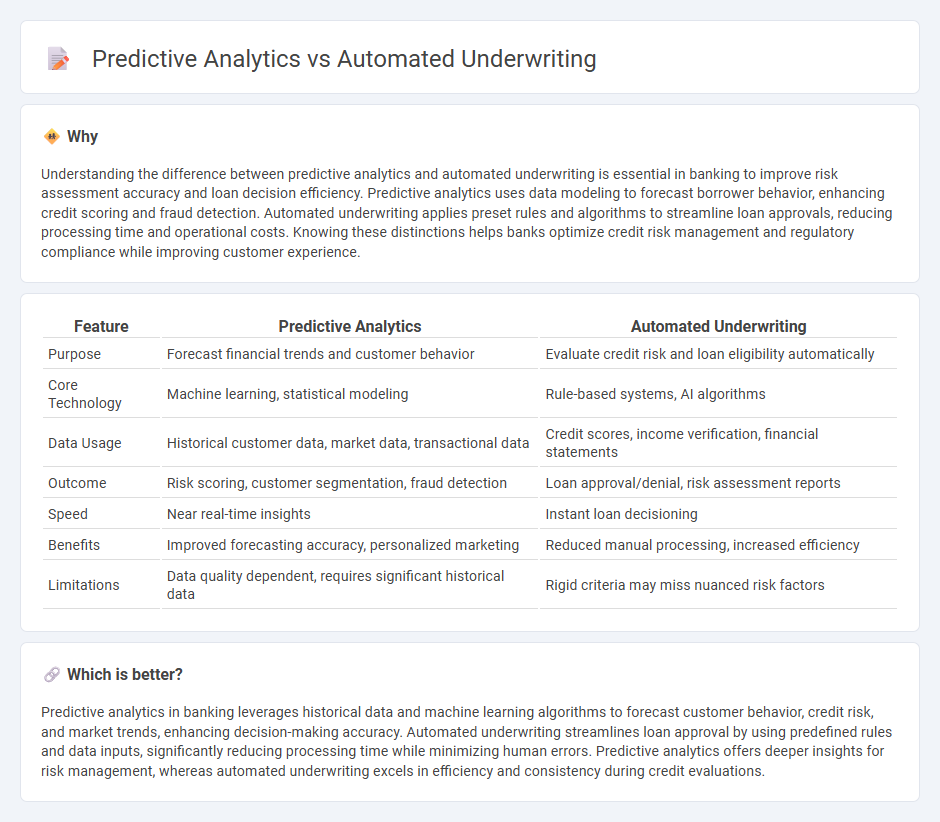

Understanding the difference between predictive analytics and automated underwriting is essential in banking to improve risk assessment accuracy and loan decision efficiency. Predictive analytics uses data modeling to forecast borrower behavior, enhancing credit scoring and fraud detection. Automated underwriting applies preset rules and algorithms to streamline loan approvals, reducing processing time and operational costs. Knowing these distinctions helps banks optimize credit risk management and regulatory compliance while improving customer experience.

Comparison Table

| Feature | Predictive Analytics | Automated Underwriting |

|---|---|---|

| Purpose | Forecast financial trends and customer behavior | Evaluate credit risk and loan eligibility automatically |

| Core Technology | Machine learning, statistical modeling | Rule-based systems, AI algorithms |

| Data Usage | Historical customer data, market data, transactional data | Credit scores, income verification, financial statements |

| Outcome | Risk scoring, customer segmentation, fraud detection | Loan approval/denial, risk assessment reports |

| Speed | Near real-time insights | Instant loan decisioning |

| Benefits | Improved forecasting accuracy, personalized marketing | Reduced manual processing, increased efficiency |

| Limitations | Data quality dependent, requires significant historical data | Rigid criteria may miss nuanced risk factors |

Which is better?

Predictive analytics in banking leverages historical data and machine learning algorithms to forecast customer behavior, credit risk, and market trends, enhancing decision-making accuracy. Automated underwriting streamlines loan approval by using predefined rules and data inputs, significantly reducing processing time while minimizing human errors. Predictive analytics offers deeper insights for risk management, whereas automated underwriting excels in efficiency and consistency during credit evaluations.

Connection

Predictive analytics enhances automated underwriting by using historical data and machine learning algorithms to assess credit risk more accurately, enabling faster and more precise loan approval decisions. This integration reduces manual errors and operational costs while increasing approval rates and customer satisfaction. Financial institutions leveraging this synergy achieve improved risk management and streamlined lending processes.

Key Terms

Risk Assessment

Automated underwriting leverages predefined rules and algorithms to rapidly assess credit risk by analyzing applicant data and documentation, streamlining decision-making in financial services. Predictive analytics employs machine learning models to identify patterns and forecast potential risks more dynamically, allowing for enhanced accuracy in predicting defaults or fraud. Explore how these technologies transform risk assessment strategies in lending and insurance sectors.

Credit Scoring

Automated underwriting streamlines credit scoring by rapidly evaluating borrower data through predefined rules and algorithms, enhancing decision speed and consistency. Predictive analytics leverages machine learning models to analyze vast datasets, identifying patterns and predicting credit risk with higher accuracy and adaptability. Explore how integrating these technologies can revolutionize credit risk management and improve lending outcomes.

Decision Algorithms

Automated underwriting uses decision algorithms to streamline risk assessment by applying predefined rules and criteria, while predictive analytics leverages machine learning models to analyze historical data and predict future outcomes with greater accuracy. Decision algorithms in automated underwriting provide quick, standardized responses, whereas predictive analytics offers dynamic insights that evolve with new data inputs. Explore how these technologies revolutionize risk management and improve underwriting efficiency.

Source and External Links

What is an Automated Underwriting System? - An Automated Underwriting System (AUS) is a computer program that rapidly evaluates loan applications using criteria like income, credit history, and debt-to-income ratio, enabling quick, uniform, and objective loan approval or denial decisions to save time and reduce manual underwriting costs.

How to Streamline Approvals with Loan Underwriting - Automated underwriting systems gather and verify borrower data using AI and intelligent document processing, then apply advanced risk models and machine learning algorithms to reduce bias, enhance decision-making, and generate accurate risk assessments for lending.

Automated Underwriting Explained: Types, Benefits, and ... - Automated underwriting uses AI-powered workflows, rule-based routing, and intelligent decision-making to speed underwriting while maintaining accuracy and compliance, with seamless integration into existing systems for streamlined and audit-ready processes.

dowidth.com

dowidth.com