Income streaming in banking generates consistent revenue through diversified financial products, enhancing long-term stability. Loan origination fees provide immediate, one-time income from processing new loans, contributing to short-term profit spikes. Explore the advantages and strategic use of both income streams in modern banking practices.

Why it is important

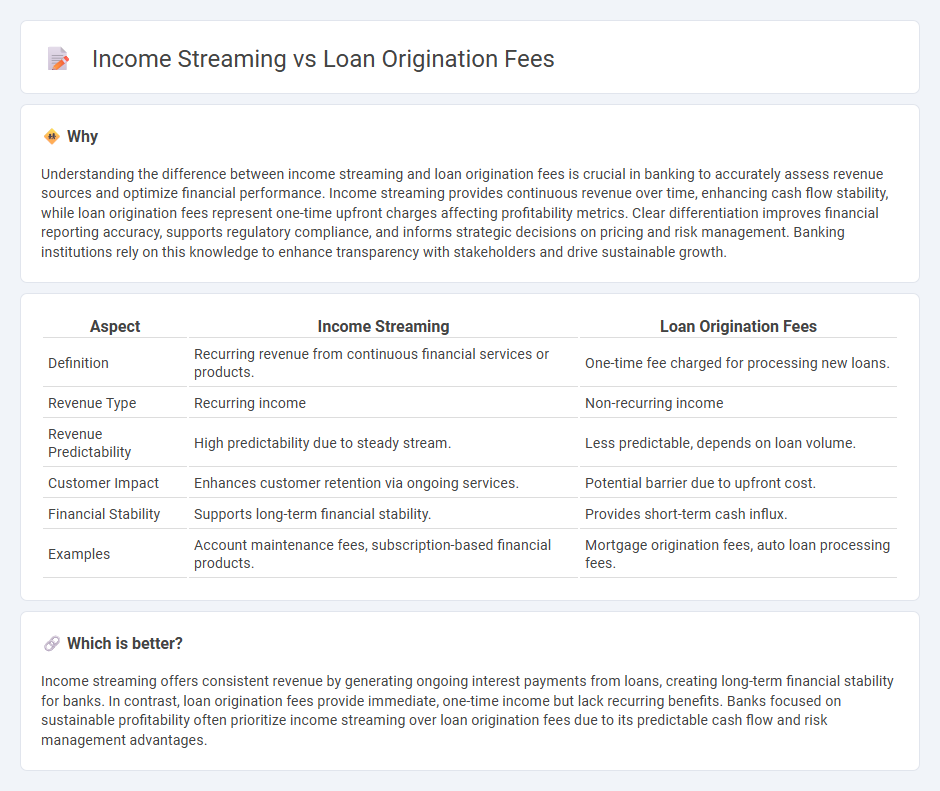

Understanding the difference between income streaming and loan origination fees is crucial in banking to accurately assess revenue sources and optimize financial performance. Income streaming provides continuous revenue over time, enhancing cash flow stability, while loan origination fees represent one-time upfront charges affecting profitability metrics. Clear differentiation improves financial reporting accuracy, supports regulatory compliance, and informs strategic decisions on pricing and risk management. Banking institutions rely on this knowledge to enhance transparency with stakeholders and drive sustainable growth.

Comparison Table

| Aspect | Income Streaming | Loan Origination Fees |

|---|---|---|

| Definition | Recurring revenue from continuous financial services or products. | One-time fee charged for processing new loans. |

| Revenue Type | Recurring income | Non-recurring income |

| Revenue Predictability | High predictability due to steady stream. | Less predictable, depends on loan volume. |

| Customer Impact | Enhances customer retention via ongoing services. | Potential barrier due to upfront cost. |

| Financial Stability | Supports long-term financial stability. | Provides short-term cash influx. |

| Examples | Account maintenance fees, subscription-based financial products. | Mortgage origination fees, auto loan processing fees. |

Which is better?

Income streaming offers consistent revenue by generating ongoing interest payments from loans, creating long-term financial stability for banks. In contrast, loan origination fees provide immediate, one-time income but lack recurring benefits. Banks focused on sustainable profitability often prioritize income streaming over loan origination fees due to its predictable cash flow and risk management advantages.

Connection

Income streaming in banking closely relates to loan origination fees as these fees represent a predictable revenue source generated during the initial phase of loan approval. Banks optimize income streams by incorporating loan origination fees as a key component of their lending business models, ensuring steady cash flow from new loans. This synergy between income streaming and loan origination fees enhances overall profitability and financial stability for financial institutions.

Key Terms

Upfront Charges

Loan origination fees represent a key upfront charge imposed by lenders to cover the cost of processing and underwriting a loan, typically amounting to 0.5% to 1% of the loan amount. In contrast, income streaming involves structuring payment schedules that optimize cash flow over time rather than requiring substantial initial fees. Explore further to understand the financial impact and strategic benefits of upfront charges versus income streaming in lending practices.

Recurring Revenue

Loan origination fees represent a one-time charge applied during the approval of new loans, generating immediate but non-recurring income. Income streaming, particularly through recurring revenue models such as subscription services or ongoing loan servicing fees, ensures a steady, predictable cash flow critical for long-term financial stability. Explore detailed strategies to optimize recurring revenue and enhance financial growth by understanding the balance between loan origination fees and income streaming.

Amortization

Loan origination fees are upfront costs charged by lenders for processing a new loan, often amortized over the loan term to reduce annual expenses and reflect true cost. Income streaming involves structuring multiple revenue streams to ensure consistent cash flow, enhancing financial stability during amortization periods. Explore more to understand the impact of amortization on loan origination fees and income streaming strategies.

Source and External Links

What Is a Personal Loan Origination Fee? - Discover - Loan origination fees are typically 0.5% to 1% of the loan amount, deducted upfront from the loan disbursement, meaning borrowers receive less than the loan amount but pay interest on the full amount borrowed.

What Is an Origination Fee? - Experian - Origination fees vary from 0.5% to 8% depending on loan type, credit score, and lender, with mortgage fees generally lower and personal loan fees higher; lower origination fees might be offset by higher interest rates.

Mortgage origination fee: The inside scoop - Rocket Mortgage - Mortgage origination fees cover processing costs and typically range from 0.5% to 1% of the loan amount; they pay for underwriting, documentation, and other loan application work.

dowidth.com

dowidth.com