Alternative credit data, such as utility payments and rental history, provides lenders with a broader view of a borrower's financial behavior beyond traditional credit scores. Education history offers insights into an individual's potential earning capacity and stability, often influencing creditworthiness assessments. Explore how combining these factors can enhance lending decisions and financial inclusion.

Why it is important

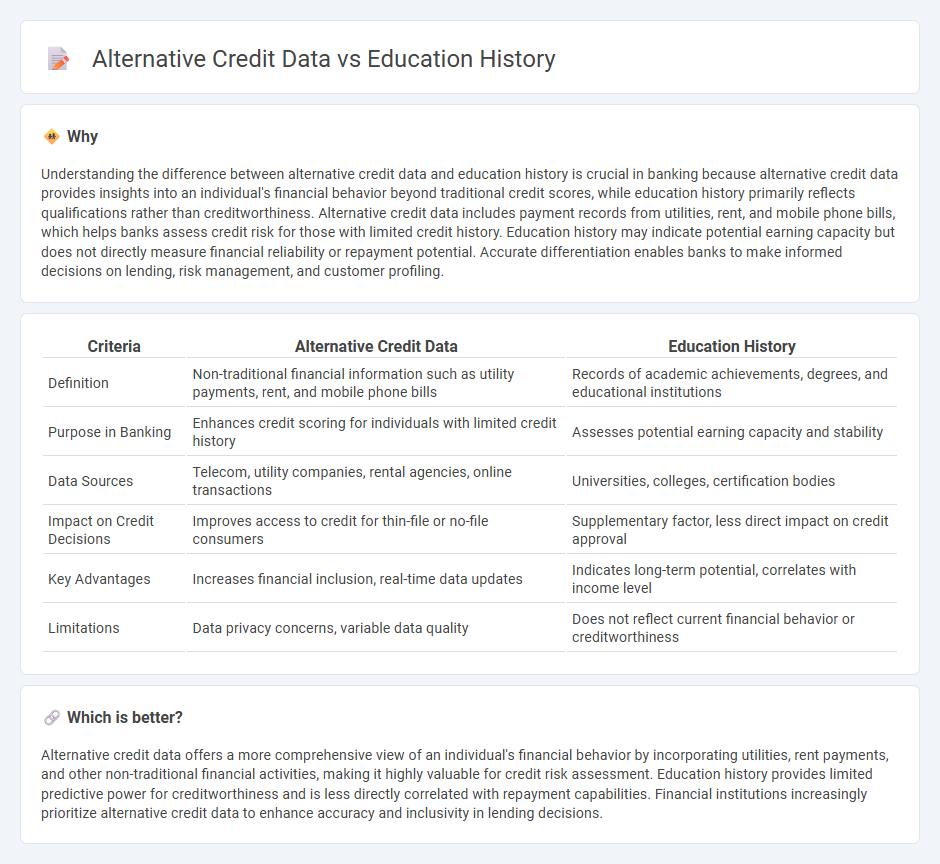

Understanding the difference between alternative credit data and education history is crucial in banking because alternative credit data provides insights into an individual's financial behavior beyond traditional credit scores, while education history primarily reflects qualifications rather than creditworthiness. Alternative credit data includes payment records from utilities, rent, and mobile phone bills, which helps banks assess credit risk for those with limited credit history. Education history may indicate potential earning capacity but does not directly measure financial reliability or repayment potential. Accurate differentiation enables banks to make informed decisions on lending, risk management, and customer profiling.

Comparison Table

| Criteria | Alternative Credit Data | Education History |

|---|---|---|

| Definition | Non-traditional financial information such as utility payments, rent, and mobile phone bills | Records of academic achievements, degrees, and educational institutions |

| Purpose in Banking | Enhances credit scoring for individuals with limited credit history | Assesses potential earning capacity and stability |

| Data Sources | Telecom, utility companies, rental agencies, online transactions | Universities, colleges, certification bodies |

| Impact on Credit Decisions | Improves access to credit for thin-file or no-file consumers | Supplementary factor, less direct impact on credit approval |

| Key Advantages | Increases financial inclusion, real-time data updates | Indicates long-term potential, correlates with income level |

| Limitations | Data privacy concerns, variable data quality | Does not reflect current financial behavior or creditworthiness |

Which is better?

Alternative credit data offers a more comprehensive view of an individual's financial behavior by incorporating utilities, rent payments, and other non-traditional financial activities, making it highly valuable for credit risk assessment. Education history provides limited predictive power for creditworthiness and is less directly correlated with repayment capabilities. Financial institutions increasingly prioritize alternative credit data to enhance accuracy and inclusivity in lending decisions.

Connection

Alternative credit data and education history provide a broader view of an individual's creditworthiness beyond traditional financial metrics. Incorporating education background, such as degree attainment and institution reputation, enhances predictive models for loan approvals and risk assessment. Financial institutions increasingly utilize these data points to improve credit inclusion and tailor banking products to underserved populations.

Key Terms

Creditworthiness Assessment

Education history provides a traditional metric for creditworthiness assessment by indicating an individual's potential earning capacity and stability, often influencing loan approval decisions. Alternative credit data, such as rental payments, utility bills, and gig economy transactions, offers a more inclusive and real-time picture of financial behavior, especially for those lacking formal credit histories. Explore how integrating these data sources can enhance accuracy and inclusivity in credit assessments.

Non-traditional Data Sources

Non-traditional data sources such as alternative credit data offer valuable insights beyond conventional education history, capturing real-world financial behaviors and social determinants relevant for credit risk assessment. These data points include utility payments, rental histories, and digital footprint analytics, enabling lenders to create a more comprehensive and inclusive borrower profile. Explore how leveraging alternative credit data transforms credit evaluation and opens new opportunities for underserved populations.

Financial Inclusion

Education history often serves as a traditional indicator of creditworthiness, yet it excludes large segments of the population lacking formal credentials, hindering financial inclusion. Alternative credit data, such as utility payments, rental history, and mobile phone usage, enables lenders to assess risk more accurately for underserved groups. Explore the transformative potential of integrating alternative credit data to enhance access to financial services for all.

Source and External Links

Historical Timeline of Public Education in the US | Race Forward - Public education in the US began in the 17th century with decrees like the 1647 Massachusetts Bay Colony law requiring towns to establish schools, evolving through legislative acts such as the 1827 Massachusetts law making public schooling free for all grades and early land grant laws that established state universities.

History of education - Wikipedia - The history of education traces back to ancient civilizations including formal schools in Egypt (circa 2000 BC), Vedic and Buddhist systems in India, and schools in ancient Greece and Rome, evolving through religious-centered education in medieval Europe to the establishment of some of the world's earliest universities such as Bologna (1088) and Paris (1160).

History of Public Education in the U.S | EBSCO Research Starters - Public education in the U.S. has a complex history starting with compulsory education laws in the 17th century Massachusetts Bay Colony, progressing through industrialization, desegregation, and legislation like the National Defense Education Act and the Elementary and Secondary Education Act aimed at expanding and improving education for all students.

dowidth.com

dowidth.com