Predictive analytics in banking leverages data models and machine learning algorithms to forecast customer behavior, optimize loan approvals, and detect fraud more efficiently. Regulatory compliance involves adhering to financial laws and standards such as AML, KYC, and Basel III to mitigate risks and avoid penalties. Explore how banks balance these advanced analytics with strict regulatory frameworks to enhance operational excellence.

Why it is important

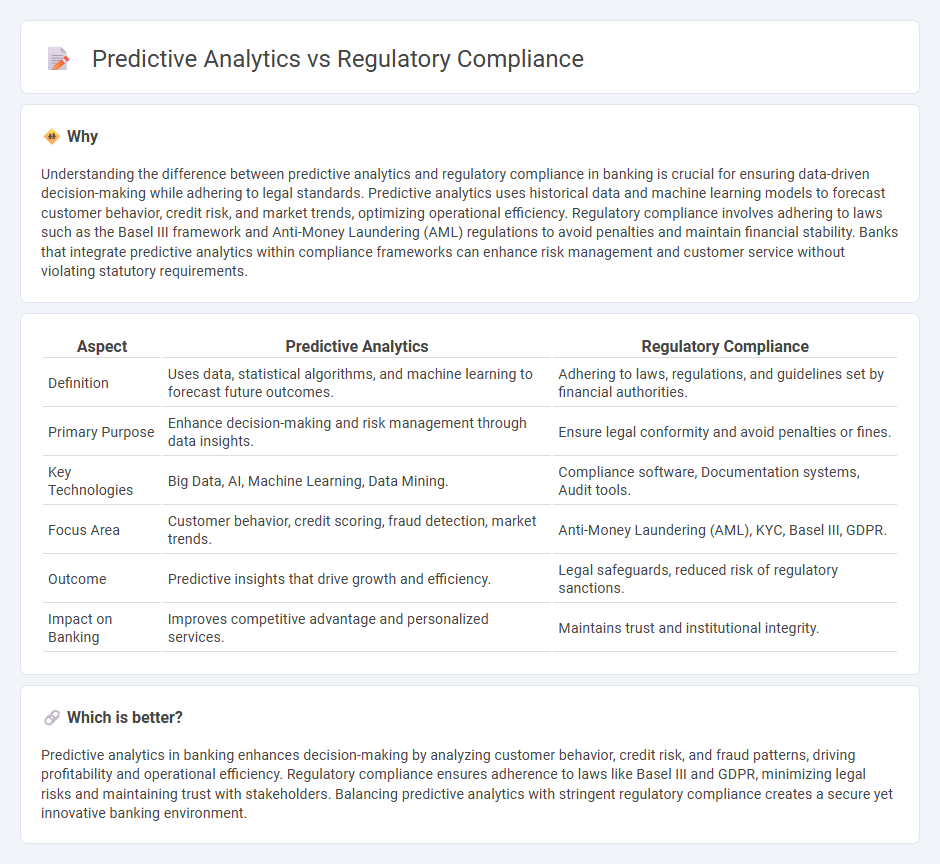

Understanding the difference between predictive analytics and regulatory compliance in banking is crucial for ensuring data-driven decision-making while adhering to legal standards. Predictive analytics uses historical data and machine learning models to forecast customer behavior, credit risk, and market trends, optimizing operational efficiency. Regulatory compliance involves adhering to laws such as the Basel III framework and Anti-Money Laundering (AML) regulations to avoid penalties and maintain financial stability. Banks that integrate predictive analytics within compliance frameworks can enhance risk management and customer service without violating statutory requirements.

Comparison Table

| Aspect | Predictive Analytics | Regulatory Compliance |

|---|---|---|

| Definition | Uses data, statistical algorithms, and machine learning to forecast future outcomes. | Adhering to laws, regulations, and guidelines set by financial authorities. |

| Primary Purpose | Enhance decision-making and risk management through data insights. | Ensure legal conformity and avoid penalties or fines. |

| Key Technologies | Big Data, AI, Machine Learning, Data Mining. | Compliance software, Documentation systems, Audit tools. |

| Focus Area | Customer behavior, credit scoring, fraud detection, market trends. | Anti-Money Laundering (AML), KYC, Basel III, GDPR. |

| Outcome | Predictive insights that drive growth and efficiency. | Legal safeguards, reduced risk of regulatory sanctions. |

| Impact on Banking | Improves competitive advantage and personalized services. | Maintains trust and institutional integrity. |

Which is better?

Predictive analytics in banking enhances decision-making by analyzing customer behavior, credit risk, and fraud patterns, driving profitability and operational efficiency. Regulatory compliance ensures adherence to laws like Basel III and GDPR, minimizing legal risks and maintaining trust with stakeholders. Balancing predictive analytics with stringent regulatory compliance creates a secure yet innovative banking environment.

Connection

Predictive analytics in banking enhances regulatory compliance by forecasting potential risks and identifying suspicious activities before they escalate. This technology leverages historical data and machine learning algorithms to detect fraud, money laundering, and credit defaults, supporting banks in meeting stringent regulatory requirements. Integration of predictive analytics streamlines compliance processes, reduces operational costs, and ensures adherence to regulations such as Basel III and GDPR.

Key Terms

**Regulatory Compliance:**

Regulatory compliance ensures that organizations adhere to laws, regulations, guidelines, and specifications relevant to their business processes, minimizing legal risks and financial penalties. It involves systematic monitoring, documentation, and reporting to meet industry standards such as GDPR, HIPAA, and SOX. Explore how integrating compliance frameworks can strengthen your operational integrity and risk management strategies.

Anti-Money Laundering (AML)

Regulatory compliance in Anti-Money Laundering (AML) ensures adherence to laws and guidelines set by authorities like the Financial Action Task Force (FATF) and the Bank Secrecy Act (BSA), focusing on transaction monitoring, customer due diligence, and reporting suspicious activities. Predictive analytics leverages machine learning algorithms and big data to identify patterns and anomalies in financial transactions, enhancing the detection of potential money laundering activities before they occur. Explore the latest advancements in AML technology to understand how predictive analytics is transforming regulatory compliance.

Know Your Customer (KYC)

Regulatory compliance in Know Your Customer (KYC) processes ensures adherence to legal standards by verifying customer identities and preventing financial crimes such as money laundering and fraud. Predictive analytics enhances KYC by leveraging data patterns and machine learning algorithms to assess risk levels and anticipate suspicious behaviors before they occur. Explore how integrating predictive analytics transforms KYC compliance and strengthens financial security measures.

Source and External Links

Comprehensive Guide to Regulatory Compliance - This guide provides an overview of regulatory compliance, its importance, benefits, consequences of non-compliance, and best practices across various industries.

What is Regulatory Compliance? Meaning and Best Practices Guide - Offers insights into regulatory compliance, including its definition, the role of compliance policies, and best practices for maintaining compliance effectively.

What Is Regulatory Compliance and Why Is It Important? - Explains the concept of regulatory compliance and its significance in ensuring businesses follow state, federal, and international laws relevant to their operations.

dowidth.com

dowidth.com