Blockchain remittance leverages decentralized ledger technology to enable faster, more secure cross-border payments with reduced fees compared to traditional wire transfers. Wire transfers rely on intermediary banks and established financial networks, often resulting in longer processing times and higher transaction costs. Explore the advantages and operational differences between blockchain remittance and wire transfer to optimize your banking strategy.

Why it is important

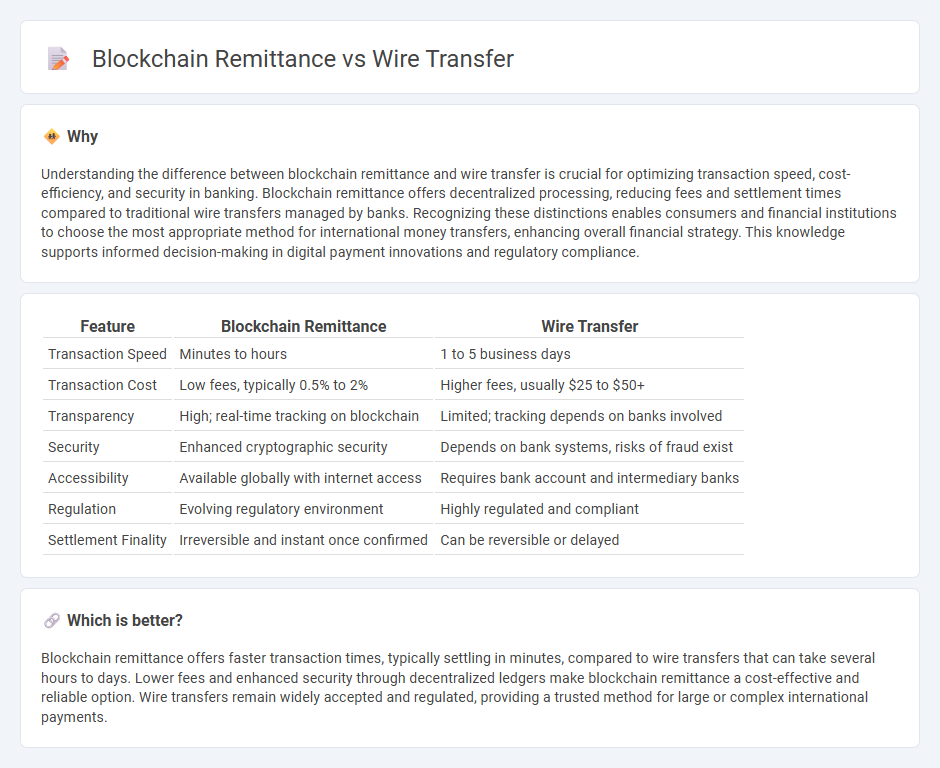

Understanding the difference between blockchain remittance and wire transfer is crucial for optimizing transaction speed, cost-efficiency, and security in banking. Blockchain remittance offers decentralized processing, reducing fees and settlement times compared to traditional wire transfers managed by banks. Recognizing these distinctions enables consumers and financial institutions to choose the most appropriate method for international money transfers, enhancing overall financial strategy. This knowledge supports informed decision-making in digital payment innovations and regulatory compliance.

Comparison Table

| Feature | Blockchain Remittance | Wire Transfer |

|---|---|---|

| Transaction Speed | Minutes to hours | 1 to 5 business days |

| Transaction Cost | Low fees, typically 0.5% to 2% | Higher fees, usually $25 to $50+ |

| Transparency | High; real-time tracking on blockchain | Limited; tracking depends on banks involved |

| Security | Enhanced cryptographic security | Depends on bank systems, risks of fraud exist |

| Accessibility | Available globally with internet access | Requires bank account and intermediary banks |

| Regulation | Evolving regulatory environment | Highly regulated and compliant |

| Settlement Finality | Irreversible and instant once confirmed | Can be reversible or delayed |

Which is better?

Blockchain remittance offers faster transaction times, typically settling in minutes, compared to wire transfers that can take several hours to days. Lower fees and enhanced security through decentralized ledgers make blockchain remittance a cost-effective and reliable option. Wire transfers remain widely accepted and regulated, providing a trusted method for large or complex international payments.

Connection

Blockchain remittance leverages decentralized ledger technology to facilitate faster, transparent cross-border transactions compared to traditional wire transfers. Wire transfers rely on intermediary banks and international networks like SWIFT, often resulting in longer processing times and higher fees. Integrating blockchain can streamline remittance by reducing middlemen, lowering costs, and enhancing transaction security within the global banking ecosystem.

Key Terms

Intermediary Bank

Wire transfers typically rely on intermediary banks to facilitate cross-border payments, often leading to higher fees and extended transfer times due to multiple correspondent banking relationships. Blockchain remittance eliminates the need for intermediary banks by enabling direct peer-to-peer transactions on a decentralized ledger, which enhances transparency, reduces costs, and accelerates settlement. Explore the advantages of blockchain remittance to understand how it is transforming international money transfers.

Decentralization

Wire transfers operate through centralized banking networks, relying on intermediaries such as correspondent banks to process cross-border payments, which can lead to higher fees and longer settlement times. Blockchain remittance leverages decentralized ledger technology, enabling direct peer-to-peer transactions with increased transparency, reduced costs, and faster settlement. Explore how decentralization is transforming global remittance systems by learning more about blockchain solutions.

Transaction Fees

Wire transfer fees typically range from $25 to $50 per transaction, depending on the bank and transfer amount, often including additional charges for currency conversion and intermediary banks. Blockchain remittance platforms usually offer lower fees, often between 0.5% to 2% of the transaction value, benefiting from decentralized networks that reduce overhead costs and eliminate intermediaries. Explore the cost-efficiency and specific fee structures of wire transfers versus blockchain remittance to make informed financial decisions.

Source and External Links

The ins and outs of wire transfers - This webpage explains the basics of wire transfers, including their use, speed, and security, and when they are most beneficial.

Wire transfer - This Wikipedia article provides a comprehensive overview of wire transfers, including their definition, types, and how they work within financial systems.

What is a wire transfer - This article from Wise provides an in-depth look at wire transfers, focusing on their costs, process, and alternatives for international transactions.

dowidth.com

dowidth.com