Central bank digital currencies (CBDCs) offer enhanced transaction speed, security, and traceability compared to traditional physical cash, enabling governments to implement more efficient monetary policies. Unlike physical cash, CBDCs reduce the costs associated with printing and handling currency while facilitating financial inclusion through digital access. Explore how CBDCs are reshaping the future of money and transforming global banking systems.

Why it is important

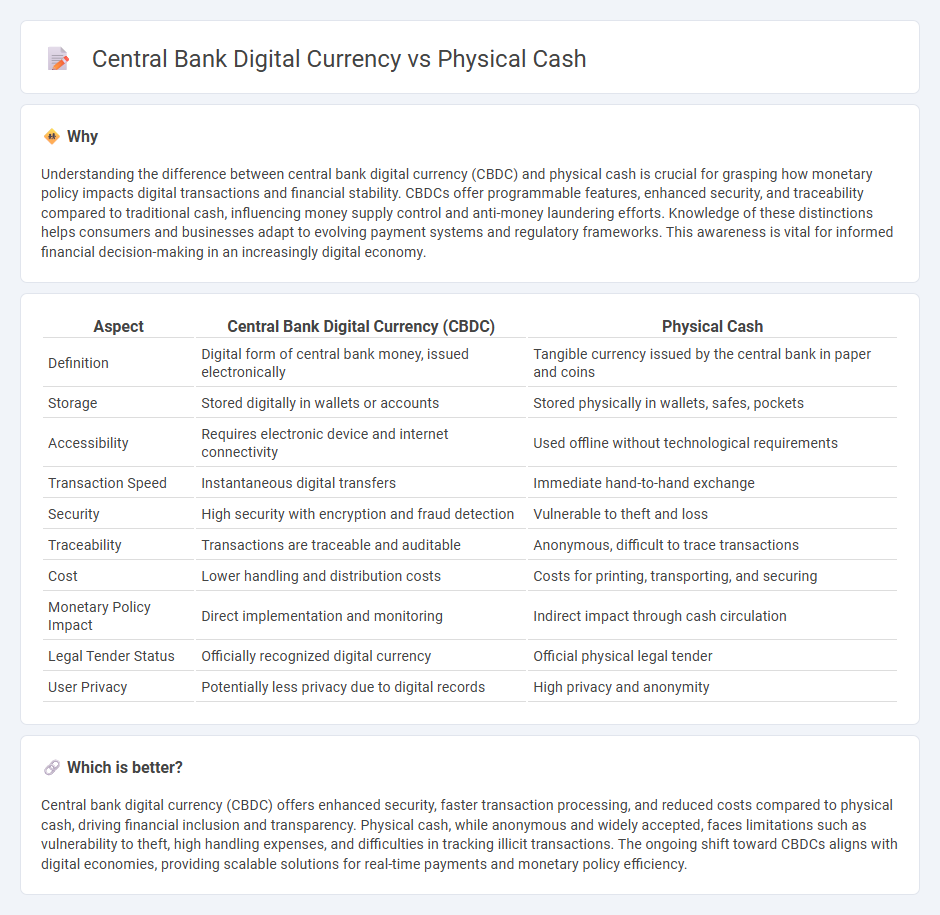

Understanding the difference between central bank digital currency (CBDC) and physical cash is crucial for grasping how monetary policy impacts digital transactions and financial stability. CBDCs offer programmable features, enhanced security, and traceability compared to traditional cash, influencing money supply control and anti-money laundering efforts. Knowledge of these distinctions helps consumers and businesses adapt to evolving payment systems and regulatory frameworks. This awareness is vital for informed financial decision-making in an increasingly digital economy.

Comparison Table

| Aspect | Central Bank Digital Currency (CBDC) | Physical Cash |

|---|---|---|

| Definition | Digital form of central bank money, issued electronically | Tangible currency issued by the central bank in paper and coins |

| Storage | Stored digitally in wallets or accounts | Stored physically in wallets, safes, pockets |

| Accessibility | Requires electronic device and internet connectivity | Used offline without technological requirements |

| Transaction Speed | Instantaneous digital transfers | Immediate hand-to-hand exchange |

| Security | High security with encryption and fraud detection | Vulnerable to theft and loss |

| Traceability | Transactions are traceable and auditable | Anonymous, difficult to trace transactions |

| Cost | Lower handling and distribution costs | Costs for printing, transporting, and securing |

| Monetary Policy Impact | Direct implementation and monitoring | Indirect impact through cash circulation |

| Legal Tender Status | Officially recognized digital currency | Official physical legal tender |

| User Privacy | Potentially less privacy due to digital records | High privacy and anonymity |

Which is better?

Central bank digital currency (CBDC) offers enhanced security, faster transaction processing, and reduced costs compared to physical cash, driving financial inclusion and transparency. Physical cash, while anonymous and widely accepted, faces limitations such as vulnerability to theft, high handling expenses, and difficulties in tracking illicit transactions. The ongoing shift toward CBDCs aligns with digital economies, providing scalable solutions for real-time payments and monetary policy efficiency.

Connection

Central bank digital currency (CBDC) represents a digital form of a country's sovereign currency, complementing physical cash by providing a secure and accessible payment method. Both CBDC and physical cash serve as legal tender issued by the central bank, ensuring public trust and monetary sovereignty. The integration of CBDCs with existing cash infrastructure aims to enhance financial inclusion and transaction efficiency across the banking system.

Key Terms

**Fiat Currency**

Fiat currency, traditionally issued as physical cash by central banks, represents government-backed money without intrinsic value but widely accepted as a medium of exchange. Central Bank Digital Currency (CBDC) digitalizes fiat money, offering enhanced transaction speed, reduced costs, and improved traceability while maintaining government backing and legal tender status. Explore how the transformation from physical cash to CBDCs reshapes the future of fiat currency and monetary policy.

**Digital Ledger**

Physical cash operates without a digital ledger, relying on tangible notes and coins for transactions, which limits traceability and transparency. Central Bank Digital Currency (CBDC) utilizes a secure, blockchain-based digital ledger that records every transaction, enhancing transparency, security, and reducing fraud risks. Explore the mechanics and benefits of digital ledgers in CBDCs to understand their impact on modern financial systems.

**Monetary Policy**

Physical cash enables direct, anonymous transactions that can limit the central bank's ability to implement negative interest rates and control money supply effectively. Central bank digital currency (CBDC) allows for precise tracking and programmable monetary policies, enhancing the transmission mechanisms of interest rate changes and liquidity management. Explore how CBDCs could transform monetary policy frameworks and economic control in the digital age.

Source and External Links

Cash - Wikipedia - Physical cash refers to money in the form of banknotes and coins used for transactions, holding value, and anonymous payments, and is driven by economic motives including transactions, precautionary, and speculative reasons.

Opinion: Is Physical Money Still Necessary In Today's Society? - Despite digital payment rise, over half of Americans still use physical cash regularly, though its convenience and security are increasingly challenged by electronic alternatives.

How Much Cash Should You Keep At Home? | Bankrate - Keeping a small, reasonable amount of physical cash at home is recommended for emergency use, typically enough to cover bare necessities for about two months in adverse scenarios.

dowidth.com

dowidth.com