Composable banking offers modular, flexible solutions built on APIs, enabling banks to quickly adapt to changing customer needs and market trends. Traditional banking relies on monolithic core systems that often hinder innovation and slow down digital transformation efforts. Explore the benefits of composable banking to understand how it is reshaping the future of financial services.

Why it is important

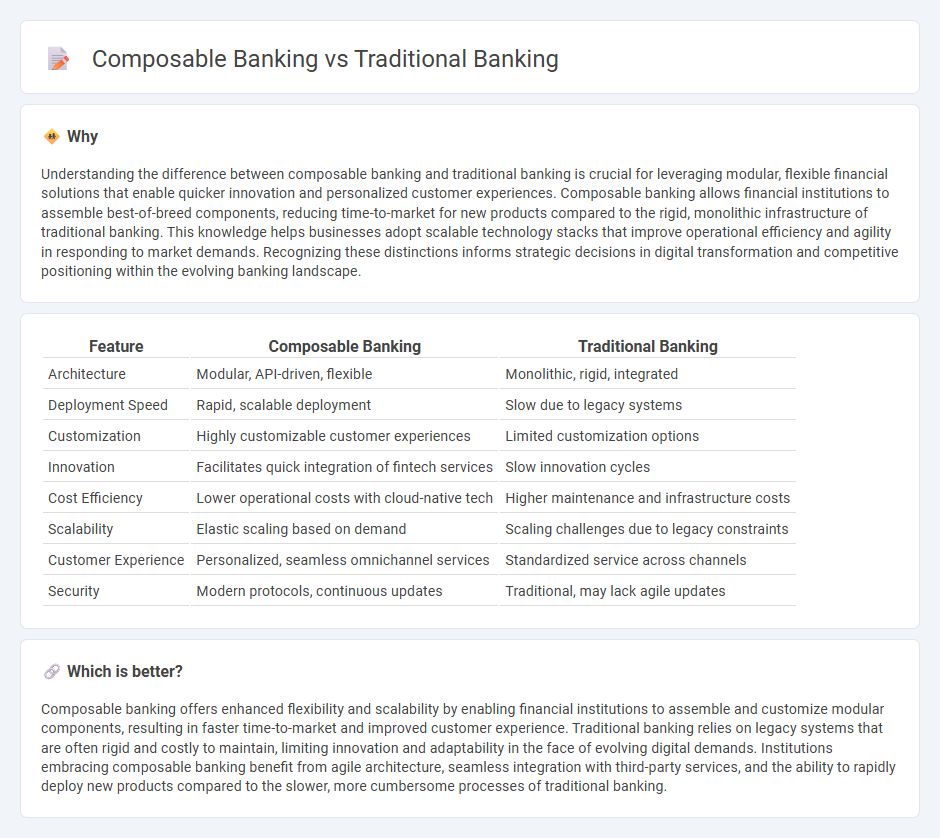

Understanding the difference between composable banking and traditional banking is crucial for leveraging modular, flexible financial solutions that enable quicker innovation and personalized customer experiences. Composable banking allows financial institutions to assemble best-of-breed components, reducing time-to-market for new products compared to the rigid, monolithic infrastructure of traditional banking. This knowledge helps businesses adopt scalable technology stacks that improve operational efficiency and agility in responding to market demands. Recognizing these distinctions informs strategic decisions in digital transformation and competitive positioning within the evolving banking landscape.

Comparison Table

| Feature | Composable Banking | Traditional Banking |

|---|---|---|

| Architecture | Modular, API-driven, flexible | Monolithic, rigid, integrated |

| Deployment Speed | Rapid, scalable deployment | Slow due to legacy systems |

| Customization | Highly customizable customer experiences | Limited customization options |

| Innovation | Facilitates quick integration of fintech services | Slow innovation cycles |

| Cost Efficiency | Lower operational costs with cloud-native tech | Higher maintenance and infrastructure costs |

| Scalability | Elastic scaling based on demand | Scaling challenges due to legacy constraints |

| Customer Experience | Personalized, seamless omnichannel services | Standardized service across channels |

| Security | Modern protocols, continuous updates | Traditional, may lack agile updates |

Which is better?

Composable banking offers enhanced flexibility and scalability by enabling financial institutions to assemble and customize modular components, resulting in faster time-to-market and improved customer experience. Traditional banking relies on legacy systems that are often rigid and costly to maintain, limiting innovation and adaptability in the face of evolving digital demands. Institutions embracing composable banking benefit from agile architecture, seamless integration with third-party services, and the ability to rapidly deploy new products compared to the slower, more cumbersome processes of traditional banking.

Connection

Composable banking leverages modular APIs to enable rapid customization and integration of banking services, enhancing the flexibility of traditional banking systems. Traditional banking institutions adopt composable banking frameworks to accelerate digital transformation, improve customer experience, and reduce time-to-market for new financial products. This connection drives innovation by combining the stability of legacy systems with the agility of modern, cloud-native technologies.

Key Terms

Core Banking System (CBS)

Traditional banking relies on monolithic Core Banking Systems (CBS) that centralize functions but often lack flexibility and scalability. Composable banking leverages modular, API-driven CBS components, enabling seamless integration, faster innovation, and personalized customer experiences. Explore how composable banking transforms core banking operations for enhanced agility and competitive advantage.

Modular Architecture

Traditional banking relies on monolithic systems with limited flexibility, making it challenging to quickly adapt to new market demands or integrate innovative technologies. Composable banking leverages modular architecture, enabling banks to customize, upgrade, or replace individual components independently, thus enhancing agility and personalized customer experiences. Explore how modular architecture transforms banking operations and drives competitive advantage.

Interoperability

Traditional banking systems often rely on monolithic architectures that limit interoperability between disparate financial services, causing integration challenges and reduced flexibility. Composable banking leverages modular, API-driven components that enable seamless interoperability, allowing banks to quickly adapt and integrate third-party services for enhanced customer experiences. Explore how composable banking transforms interoperability to stay ahead in the competitive financial landscape.

Source and External Links

Online vs. Traditional Banking: Differences, Pros, and Cons | Brex - Traditional banking refers to financial institutions with physical branches and ATMs offering in-person services alongside digital options, valued for personal relationships, cash handling, and a broad range of financial products under one roof.

Traditional Banking and Mobile Banking: Differences, Pros, and Cons - Traditional banking is the classic system involving physical bank locations where customers can visit to access services and interact with staff in person, regulated by government licenses, and includes commercial banks, microfinance banks, and credit unions.

Online Banking vs. Traditional Banking - Chase.com - Traditional banks provide a greater range of financial services, including cash deposits, well-developed ATM networks, and in-person customer service offering relationship banking, though they may require inconvenient branch visits and service levels can vary by location.

dowidth.com

dowidth.com