Super apps integrate multiple financial services, including payments, loans, and investments, into a single platform, offering seamless user experiences and convenience. Wealth management platforms specialize in personalized investment strategies, portfolio management, and financial planning, targeting affluent clients with tailored solutions. Explore how each approach transforms banking and investment opportunities to better suit your financial goals.

Why it is important

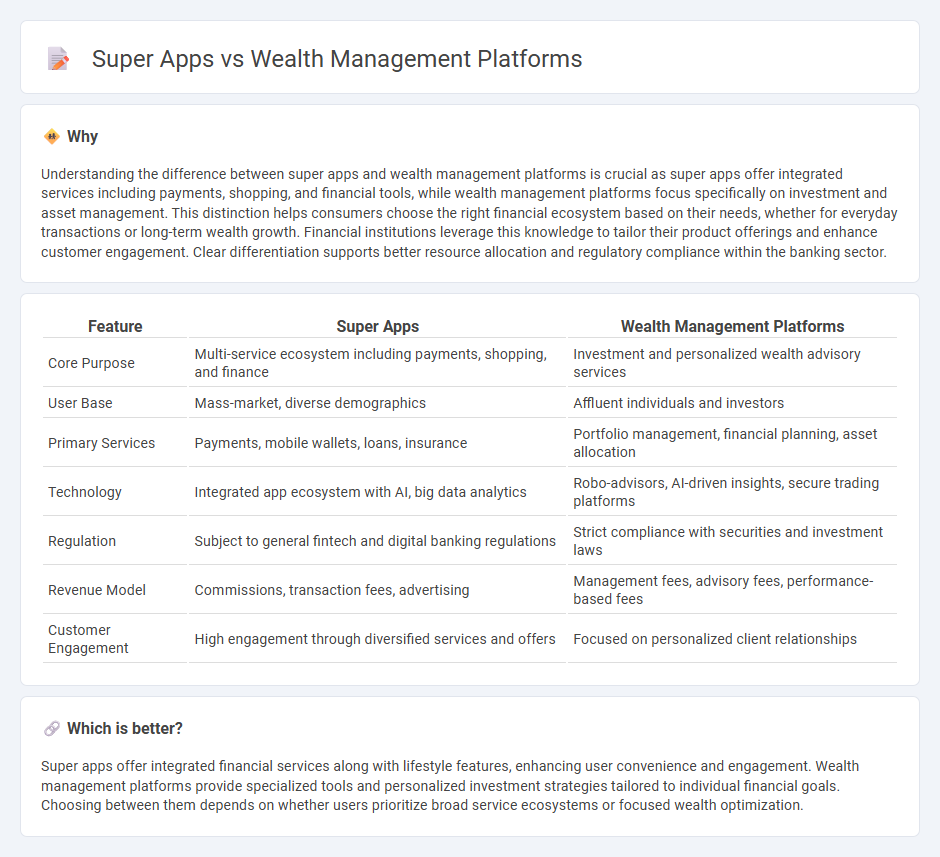

Understanding the difference between super apps and wealth management platforms is crucial as super apps offer integrated services including payments, shopping, and financial tools, while wealth management platforms focus specifically on investment and asset management. This distinction helps consumers choose the right financial ecosystem based on their needs, whether for everyday transactions or long-term wealth growth. Financial institutions leverage this knowledge to tailor their product offerings and enhance customer engagement. Clear differentiation supports better resource allocation and regulatory compliance within the banking sector.

Comparison Table

| Feature | Super Apps | Wealth Management Platforms |

|---|---|---|

| Core Purpose | Multi-service ecosystem including payments, shopping, and finance | Investment and personalized wealth advisory services |

| User Base | Mass-market, diverse demographics | Affluent individuals and investors |

| Primary Services | Payments, mobile wallets, loans, insurance | Portfolio management, financial planning, asset allocation |

| Technology | Integrated app ecosystem with AI, big data analytics | Robo-advisors, AI-driven insights, secure trading platforms |

| Regulation | Subject to general fintech and digital banking regulations | Strict compliance with securities and investment laws |

| Revenue Model | Commissions, transaction fees, advertising | Management fees, advisory fees, performance-based fees |

| Customer Engagement | High engagement through diversified services and offers | Focused on personalized client relationships |

Which is better?

Super apps offer integrated financial services along with lifestyle features, enhancing user convenience and engagement. Wealth management platforms provide specialized tools and personalized investment strategies tailored to individual financial goals. Choosing between them depends on whether users prioritize broad service ecosystems or focused wealth optimization.

Connection

Super apps integrate multiple financial services including wealth management platforms, enabling users to access investment options, portfolio tracking, and personalized financial advice within a single interface. These platforms utilize data analytics and AI to offer tailored wealth growth strategies, enhancing customer engagement and retention. By embedding wealth management features, super apps transform traditional banking into a seamless, all-encompassing digital experience.

Key Terms

Investment advisory

Wealth management platforms specialize in personalized investment advisory services, leveraging advanced algorithms and data analytics to tailor portfolios based on individual risk profiles and financial goals. Super apps, while offering a broad range of financial services including investment options, often provide more generalized advice and prioritize convenience and integration over customized investment strategies. Discover how these approaches differ in enhancing your investment outcomes and choose the optimal financial advisory tool for your needs.

Ecosystem integration

Wealth management platforms excel in ecosystem integration by offering specialized financial services such as portfolio management, investment analytics, and personalized advisory within a cohesive environment. Super apps provide broader ecosystem integration by combining finance, e-commerce, social networking, and lifestyle services, creating a versatile digital hub. Explore how these integrated ecosystems impact user engagement and service efficiency in diverse markets.

Personalization

Wealth management platforms leverage advanced algorithms and AI-driven insights to deliver highly personalized investment strategies tailored to individual risk profiles and financial goals. Super apps integrate multiple services, including wealth management, offering convenience but often with less depth in customization specific to financial planning. Explore how personalized wealth management solutions can enhance your financial growth with tailored strategies.

Source and External Links

Temenos Wealth Management | End-to-End Digital Wealth Platform - Temenos provides a unified digital platform for wealth management, offering automated front and back-office operations, personalized client experiences, and integration of portfolio management, risk, compliance, and reporting tools across all wealth segments.

Black Diamond Wealth Platform - Black Diamond delivers a cloud-based, comprehensive wealth management platform featuring intuitive dashboards, automated data reconciliation, robust reporting, client portals, and seamless integration with over 45 partner solutions for advisors and firms of all sizes.

Top Wealth Management Software Providers in 2025 | Velmie - Velmie offers a modular, API-driven banking platform tailored for wealth management, enabling custom integrations, omnichannel client engagement, strong compliance, and full tech support for wealth firms and private banks.

dowidth.com

dowidth.com