Real-time payments enable instant fund transfers and settlements, offering seamless financial transactions 24/7 with enhanced speed and convenience. IMPS (Immediate Payment Service) provides quick interbank electronic fund transfers within minutes, primarily catering to mobile and internet banking users. Discover the key differences between real-time payments and IMPS to optimize your banking experience.

Why it is important

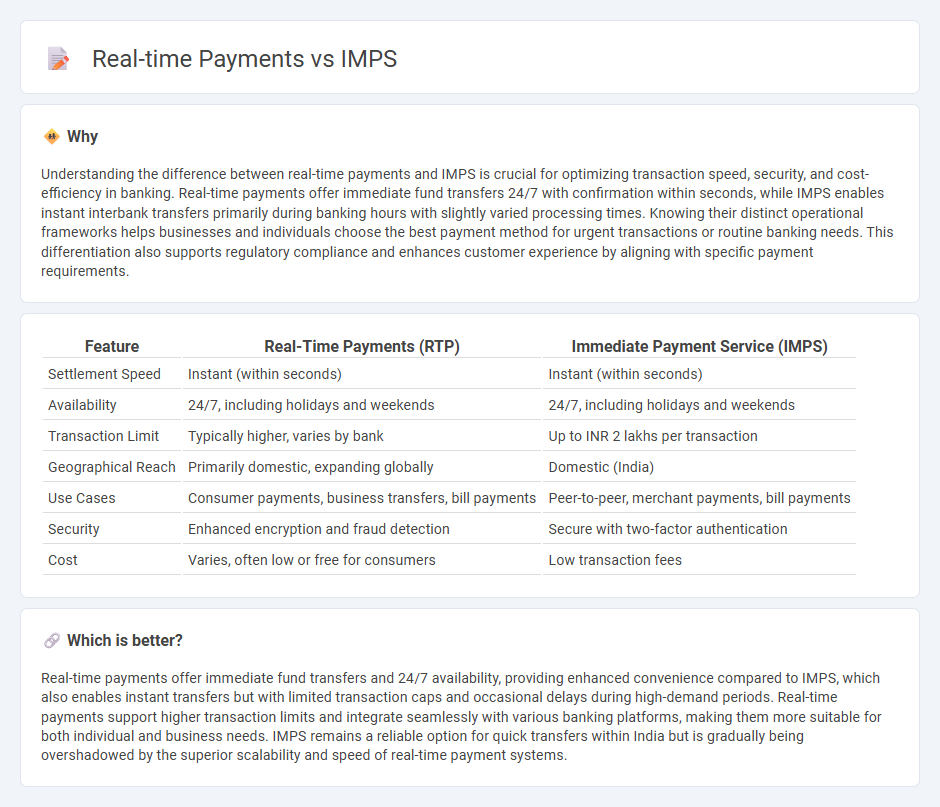

Understanding the difference between real-time payments and IMPS is crucial for optimizing transaction speed, security, and cost-efficiency in banking. Real-time payments offer immediate fund transfers 24/7 with confirmation within seconds, while IMPS enables instant interbank transfers primarily during banking hours with slightly varied processing times. Knowing their distinct operational frameworks helps businesses and individuals choose the best payment method for urgent transactions or routine banking needs. This differentiation also supports regulatory compliance and enhances customer experience by aligning with specific payment requirements.

Comparison Table

| Feature | Real-Time Payments (RTP) | Immediate Payment Service (IMPS) |

|---|---|---|

| Settlement Speed | Instant (within seconds) | Instant (within seconds) |

| Availability | 24/7, including holidays and weekends | 24/7, including holidays and weekends |

| Transaction Limit | Typically higher, varies by bank | Up to INR 2 lakhs per transaction |

| Geographical Reach | Primarily domestic, expanding globally | Domestic (India) |

| Use Cases | Consumer payments, business transfers, bill payments | Peer-to-peer, merchant payments, bill payments |

| Security | Enhanced encryption and fraud detection | Secure with two-factor authentication |

| Cost | Varies, often low or free for consumers | Low transaction fees |

Which is better?

Real-time payments offer immediate fund transfers and 24/7 availability, providing enhanced convenience compared to IMPS, which also enables instant transfers but with limited transaction caps and occasional delays during high-demand periods. Real-time payments support higher transaction limits and integrate seamlessly with various banking platforms, making them more suitable for both individual and business needs. IMPS remains a reliable option for quick transfers within India but is gradually being overshadowed by the superior scalability and speed of real-time payment systems.

Connection

Real-time payments and Immediate Payment Service (IMPS) are closely connected as IMPS is a type of real-time payment system enabling instant money transfers between banks in India, available 24/7. IMPS leverages an interconnected network of banks and payment service providers to facilitate immediate fund settlements, enhancing liquidity and reducing transaction time significantly compared to traditional methods. This integration supports seamless digital banking and boosts the overall efficiency of the Indian financial ecosystem.

Key Terms

Settlement Speed

IMPS processes funds instantly but often experiences slight delays during peak hours, while real-time payments guarantee immediate settlement 24/7 without interruptions. The average IMPS transaction settles within seconds but may extend to a few minutes under heavy load, contrasting with real-time payments that ensure consistent sub-second finality. Explore detailed comparisons and benefits of each payment method to optimize your transactional strategy.

Transaction Limits

IMPS typically supports transaction limits up to Rs2 lakhs per day, while Real-Time Payments (RTP) platforms often allow higher limits, reaching Rs5 lakhs or more depending on the bank's policies. RTP systems provide faster settlement and enhanced liquidity management for businesses needing larger, instantaneous transfers. Explore detailed comparisons to understand which payment method best suits your transaction volume requirements.

Availability (24/7 vs. limited hours)

IMPS (Immediate Payment Service) offers 24/7 availability, allowing users to transfer funds anytime, including weekends and holidays, ensuring constant access for urgent transactions. In contrast, many real-time payment systems operate within limited hours, often restricted to business days and certain cut-offs, which can delay processing outside these windows. Explore this comparison further to understand which payment system best suits your needs for continuous or time-bound money transfers.

Source and External Links

Immediate Payment Service - Wikipedia - IMPS is an instant, 24/7 interbank electronic funds transfer system in India, managed by the National Payments Corporation of India (NPCI), enabling real-time money transfers between participating banks.

What is IMPS? - Features, Meaning & Full Form of IMPS - Axis Bank - IMPS allows users to transfer money instantly via mobile, internet, ATM, or SMS, supports up to Rs5 lakh per day, and is used for payments, bill settlements, and mobile recharges across various platforms.

IMPS (Immediate Payment Service) - Instant fund transfer - NPCI - IMPS provides a secure, economical, and robust real-time fund transfer service accessible through multiple channels, with participation open to all RBI-licensed banks and prepaid payment instrument providers.

dowidth.com

dowidth.com