Core banking modernization transforms legacy systems into agile platforms, enhancing real-time processing and customer experience. API banking enables seamless integration with third-party services, driving innovation and expanding financial product offerings. Discover how these technologies revolutionize banking efficiency and connectivity.

Why it is important

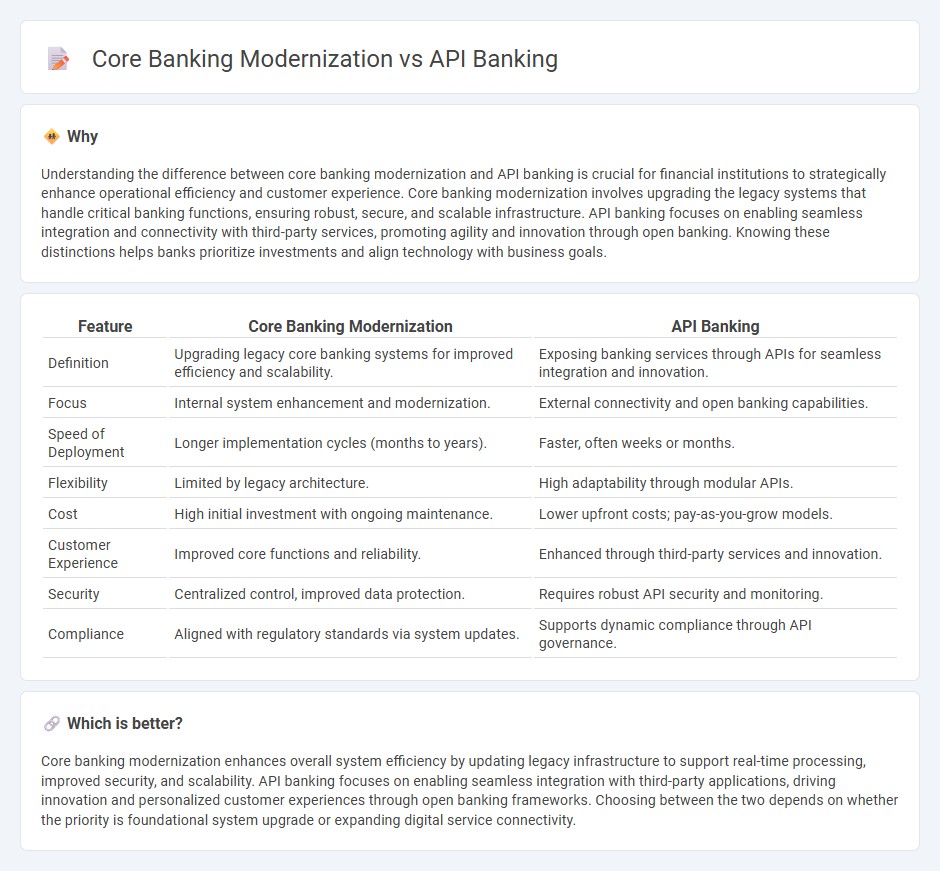

Understanding the difference between core banking modernization and API banking is crucial for financial institutions to strategically enhance operational efficiency and customer experience. Core banking modernization involves upgrading the legacy systems that handle critical banking functions, ensuring robust, secure, and scalable infrastructure. API banking focuses on enabling seamless integration and connectivity with third-party services, promoting agility and innovation through open banking. Knowing these distinctions helps banks prioritize investments and align technology with business goals.

Comparison Table

| Feature | Core Banking Modernization | API Banking |

|---|---|---|

| Definition | Upgrading legacy core banking systems for improved efficiency and scalability. | Exposing banking services through APIs for seamless integration and innovation. |

| Focus | Internal system enhancement and modernization. | External connectivity and open banking capabilities. |

| Speed of Deployment | Longer implementation cycles (months to years). | Faster, often weeks or months. |

| Flexibility | Limited by legacy architecture. | High adaptability through modular APIs. |

| Cost | High initial investment with ongoing maintenance. | Lower upfront costs; pay-as-you-grow models. |

| Customer Experience | Improved core functions and reliability. | Enhanced through third-party services and innovation. |

| Security | Centralized control, improved data protection. | Requires robust API security and monitoring. |

| Compliance | Aligned with regulatory standards via system updates. | Supports dynamic compliance through API governance. |

Which is better?

Core banking modernization enhances overall system efficiency by updating legacy infrastructure to support real-time processing, improved security, and scalability. API banking focuses on enabling seamless integration with third-party applications, driving innovation and personalized customer experiences through open banking frameworks. Choosing between the two depends on whether the priority is foundational system upgrade or expanding digital service connectivity.

Connection

Core banking modernization enhances legacy systems by integrating flexible, scalable architectures that support real-time processing and cloud-based solutions. API banking leverages these modernized platforms to enable seamless connectivity between banks and third-party providers, driving innovation in services like digital payments and personalized financial products. The synergy between core banking modernization and API banking creates a robust ecosystem for faster transactions, improved customer experience, and expanded open banking initiatives.

Key Terms

Open Banking APIs

Open Banking APIs enable seamless integration between banks and third-party providers, fostering innovation and customer-centric services beyond traditional core banking systems. Core banking modernization involves upgrading legacy infrastructure to support real-time transactions, scalability, and regulatory compliance, essential for adopting Open Banking standards. Explore how combining API banking with core modernization drives competitive advantages and enhanced digital banking experiences.

Legacy Systems

API banking enhances legacy systems by enabling seamless integration and real-time data exchange, transforming aged core banking platforms into agile, customer-centric ecosystems. Core banking modernization targets foundational technology upgrades, addressing outdated infrastructure and improving scalability, security, and operational efficiency. Explore how upgrading legacy systems with API banking and core modernization can drive innovation and competitive advantage in financial services.

Middleware Integration

API banking enhances financial services by enabling seamless third-party integrations, improving customer experience and accelerating innovation. Core banking modernization centralizes and updates legacy systems to support real-time transactions and scalable operations, often requiring robust middleware to bridge old and new technologies. Explore how strategic middleware integration can harmonize API banking and core banking modernization for optimal efficiency.

Source and External Links

Banking application programming interfaces (APIs) - Stripe - API banking uses APIs to enable better interoperability between banks and third-party developers, allowing financial institutions to offer modular, flexible services like payments and identity verification, leading to innovative financial products and partnerships with fintech companies.

API Banking and Banking as a Service | Deloitte US - API banking allows banks to provide external parties access to customer data, transaction initiation, and updates securely, enabling instant payments, real-time alerts, and reducing costs, while Banking as a Service (BaaS) lets nonbank companies offer banking features without direct licensing.

API Banking: The Power, Definitions, Types, and Benefits - Banks can use APIs to rapidly develop and integrate new products and services, improve internal efficiency, and monetize APIs by enabling third-party developers to create value-added services, thus generating new revenue streams.

dowidth.com

dowidth.com