Neobanking offers digital-first financial services with streamlined user experiences and lower fees, appealing to tech-savvy customers. Community banking focuses on personalized service and local economic support, fostering trust and close customer relationships. Discover how these two banking models meet different financial needs and preferences.

Why it is important

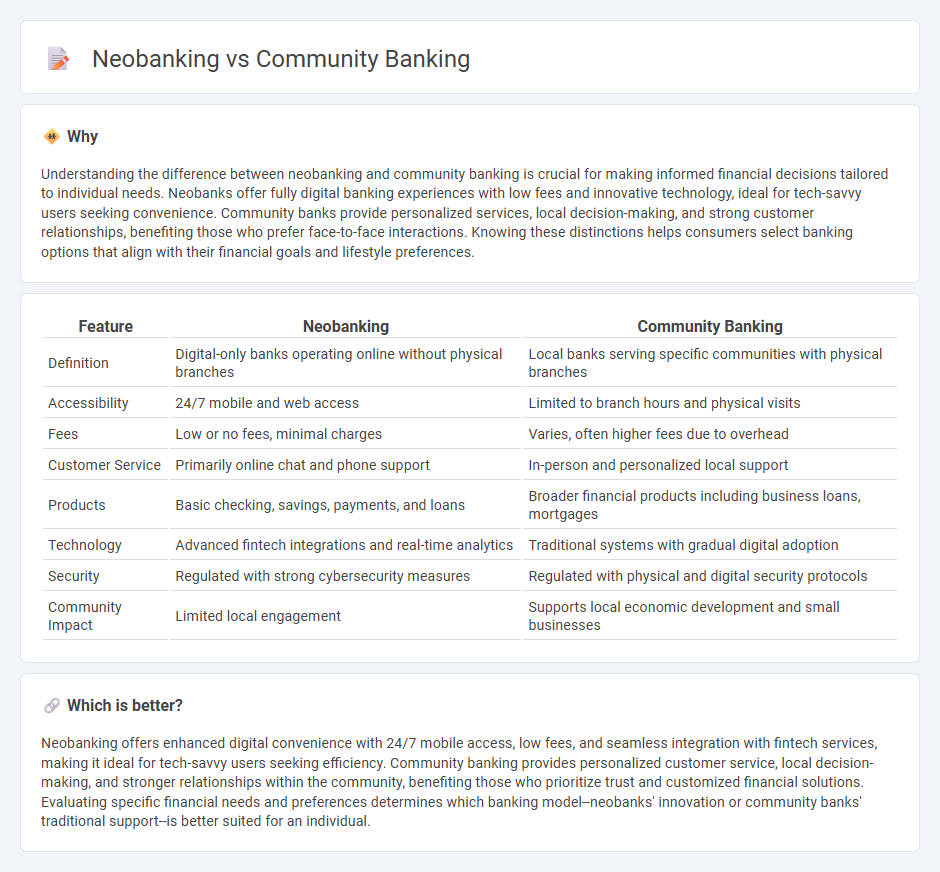

Understanding the difference between neobanking and community banking is crucial for making informed financial decisions tailored to individual needs. Neobanks offer fully digital banking experiences with low fees and innovative technology, ideal for tech-savvy users seeking convenience. Community banks provide personalized services, local decision-making, and strong customer relationships, benefiting those who prefer face-to-face interactions. Knowing these distinctions helps consumers select banking options that align with their financial goals and lifestyle preferences.

Comparison Table

| Feature | Neobanking | Community Banking |

|---|---|---|

| Definition | Digital-only banks operating online without physical branches | Local banks serving specific communities with physical branches |

| Accessibility | 24/7 mobile and web access | Limited to branch hours and physical visits |

| Fees | Low or no fees, minimal charges | Varies, often higher fees due to overhead |

| Customer Service | Primarily online chat and phone support | In-person and personalized local support |

| Products | Basic checking, savings, payments, and loans | Broader financial products including business loans, mortgages |

| Technology | Advanced fintech integrations and real-time analytics | Traditional systems with gradual digital adoption |

| Security | Regulated with strong cybersecurity measures | Regulated with physical and digital security protocols |

| Community Impact | Limited local engagement | Supports local economic development and small businesses |

Which is better?

Neobanking offers enhanced digital convenience with 24/7 mobile access, low fees, and seamless integration with fintech services, making it ideal for tech-savvy users seeking efficiency. Community banking provides personalized customer service, local decision-making, and stronger relationships within the community, benefiting those who prioritize trust and customized financial solutions. Evaluating specific financial needs and preferences determines which banking model--neobanks' innovation or community banks' traditional support--is better suited for an individual.

Connection

Neobanking and community banking intersect through their shared focus on personalized financial services and enhancing customer experience using digital platforms. Neobanks leverage technology to provide seamless, accessible banking solutions, while community banks emphasize local relationships and trust, often integrating digital tools to compete effectively. Both models complement each other by combining innovation with community-centric values to meet evolving consumer demands.

Key Terms

Physical Branches

Community banking emphasizes extensive physical branches that foster local relationships, personalized services, and trust within the community, often serving rural or underserved areas. Neobanking operates primarily online with minimal to no physical branches, leveraging digital platforms for convenience, lower fees, and rapid transaction processing. Explore the differences in branch strategies to understand how each banking model meets customer needs effectively.

Digital-Only Platform

Community banking offers personalized financial services through physical branches, fostering local relationships and trust, while neobanking operates exclusively on digital-only platforms, emphasizing seamless mobile and online banking experiences with lower fees and faster transactions. Neobanks utilize advanced technology like AI and real-time analytics to enhance user convenience and financial management tools, appealing to tech-savvy customers seeking innovative solutions. Explore the evolving landscape of digital-only banking platforms to understand which option aligns best with your financial needs.

Personalized Service

Community banking excels in delivering personalized service through local branch interactions and deep community ties, offering tailored financial solutions based on personal relationships. Neobanking leverages advanced digital platforms and AI-driven tools to provide customized user experiences, focusing on convenience and real-time responsiveness. Explore the distinct advantages of community banking and neobanking to determine which personalized service model best suits your financial needs.

Source and External Links

About Community Banking - ICBA - Community banks reinvest local dollars back into their communities, creating local jobs and supporting economic growth.

The Critical Role of Community Banks - Community banks serve as relationship bankers, providing personalized service, understanding local customer needs, and playing a crucial role in lending especially to small businesses, agriculture, and in times of economic stress.

Community bank - Wikipedia - A community bank is a locally owned and operated depository institution focused on the financial needs of local businesses and families, with lending decisions made by individuals familiar with local market conditions.

dowidth.com

dowidth.com