Hyperpersonalization in banking leverages artificial intelligence and real-time data analytics to deliver highly tailored financial products and services, surpassing traditional personalization methods that primarily rely on basic demographic information. By analyzing customer behavior, preferences, and transaction patterns, banks can create individualized experiences that drive engagement and improve customer satisfaction. Discover how hyperpersonalization transforms banking relationships and enhances financial outcomes.

Why it is important

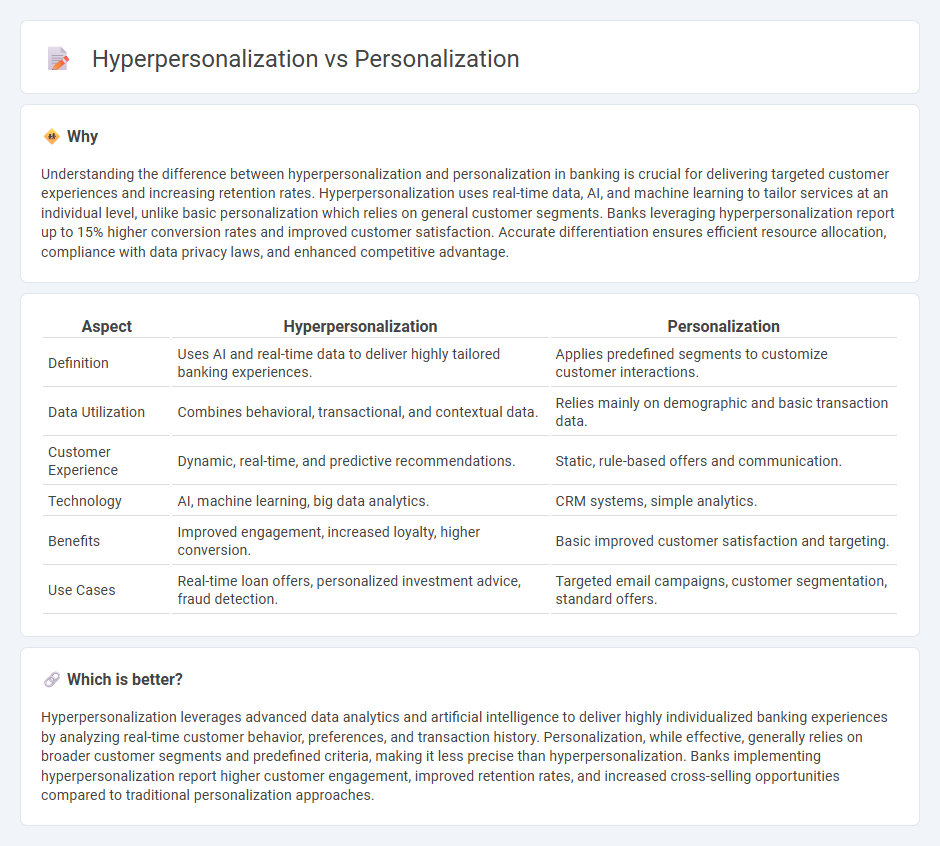

Understanding the difference between hyperpersonalization and personalization in banking is crucial for delivering targeted customer experiences and increasing retention rates. Hyperpersonalization uses real-time data, AI, and machine learning to tailor services at an individual level, unlike basic personalization which relies on general customer segments. Banks leveraging hyperpersonalization report up to 15% higher conversion rates and improved customer satisfaction. Accurate differentiation ensures efficient resource allocation, compliance with data privacy laws, and enhanced competitive advantage.

Comparison Table

| Aspect | Hyperpersonalization | Personalization |

|---|---|---|

| Definition | Uses AI and real-time data to deliver highly tailored banking experiences. | Applies predefined segments to customize customer interactions. |

| Data Utilization | Combines behavioral, transactional, and contextual data. | Relies mainly on demographic and basic transaction data. |

| Customer Experience | Dynamic, real-time, and predictive recommendations. | Static, rule-based offers and communication. |

| Technology | AI, machine learning, big data analytics. | CRM systems, simple analytics. |

| Benefits | Improved engagement, increased loyalty, higher conversion. | Basic improved customer satisfaction and targeting. |

| Use Cases | Real-time loan offers, personalized investment advice, fraud detection. | Targeted email campaigns, customer segmentation, standard offers. |

Which is better?

Hyperpersonalization leverages advanced data analytics and artificial intelligence to deliver highly individualized banking experiences by analyzing real-time customer behavior, preferences, and transaction history. Personalization, while effective, generally relies on broader customer segments and predefined criteria, making it less precise than hyperpersonalization. Banks implementing hyperpersonalization report higher customer engagement, improved retention rates, and increased cross-selling opportunities compared to traditional personalization approaches.

Connection

Hyperpersonalization and personalization in banking both leverage advanced data analytics and artificial intelligence to tailor financial products and services to individual customer needs. Personalization uses demographic and behavioral data for targeted offers, while hyperpersonalization incorporates real-time context, preferences, and predictive insights to deliver highly customized experiences. This connection enhances customer engagement, satisfaction, and loyalty by providing relevant banking solutions through multiple digital channels.

Key Terms

Customer Segmentation

Customer segmentation in personalization groups users based on broad characteristics such as demographics, allowing targeted marketing efforts that address general preferences. Hyperpersonalization leverages real-time data and AI insights to tailor experiences and communications at an individual level, enhancing engagement by considering behavior, context, and predictive analytics. Explore how hyperpersonalization can transform customer segmentation and drive higher conversion rates.

Real-Time Data Analytics

Personalization customizes marketing efforts based on general user data, whereas hyperpersonalization leverages real-time data analytics to deliver highly tailored experiences at the individual level. Businesses utilizing hyperpersonalization can dynamically adjust content, offers, and recommendations by analyzing live user behavior, location, and interaction patterns. Explore how integrating advanced real-time data analytics can dramatically enhance customer engagement and conversion rates.

Predictive Modeling

Predictive modeling in personalization utilizes customer data to tailor experiences by anticipating individual preferences and behaviors. Hyperpersonalization advances this approach by integrating real-time data and AI-driven insights to deliver highly customized content and offers at an individual level. Explore how predictive modeling shapes personalized marketing strategies for deeper customer engagement.

Source and External Links

Personalization 101: What it is, importance, and examples - This guide explains personalization as tailoring customer experiences using known information about them, highlighting its importance in business and marketing.

What is Personalization and How to Get Started - This guide defines personalization as optimizing customer experience by delivering the right content to the right person at the right time, ensuring it feels natural and valuable.

What is personalization? - This article discusses personalization as a process of delivering unique digital experiences by leveraging customer data and real-time behavior analysis, enhancing user engagement and loyalty.

dowidth.com

dowidth.com