RegTech focuses on leveraging technology to enhance regulatory compliance and risk management within the banking sector, using advanced tools like AI and blockchain to ensure transparency and security. WealthTech, by contrast, centers on digital innovations that streamline investment management, financial planning, and personalized wealth advisory services for clients. Explore the key differences and benefits of RegTech and WealthTech in transforming modern banking.

Why it is important

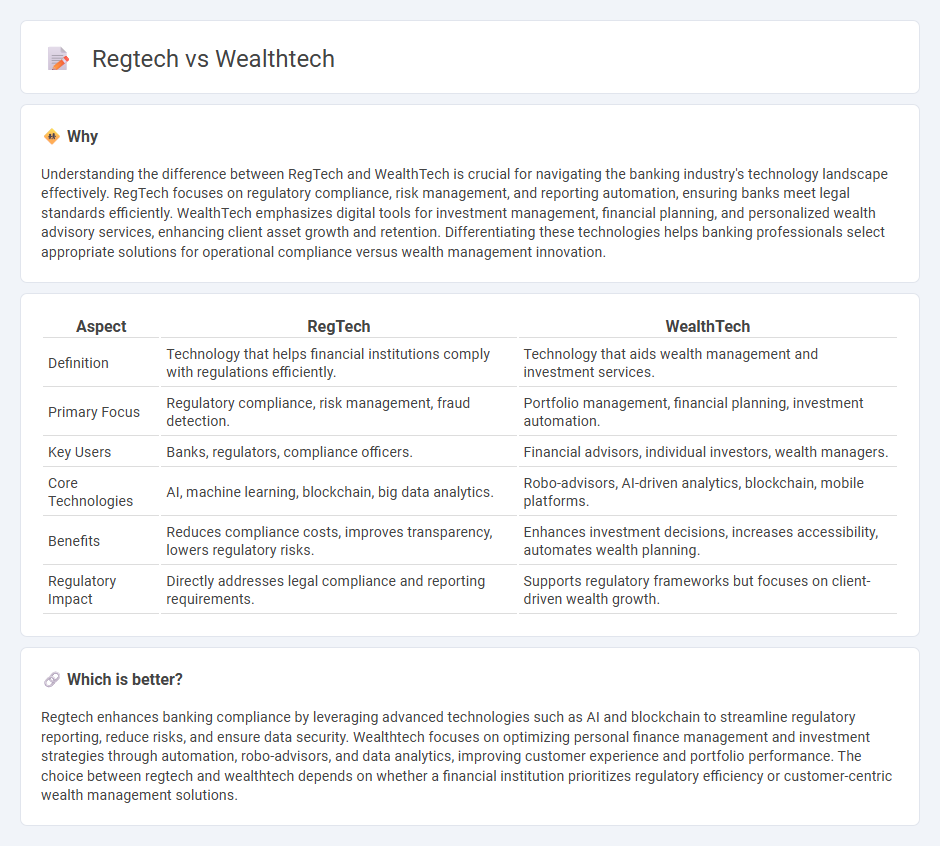

Understanding the difference between RegTech and WealthTech is crucial for navigating the banking industry's technology landscape effectively. RegTech focuses on regulatory compliance, risk management, and reporting automation, ensuring banks meet legal standards efficiently. WealthTech emphasizes digital tools for investment management, financial planning, and personalized wealth advisory services, enhancing client asset growth and retention. Differentiating these technologies helps banking professionals select appropriate solutions for operational compliance versus wealth management innovation.

Comparison Table

| Aspect | RegTech | WealthTech |

|---|---|---|

| Definition | Technology that helps financial institutions comply with regulations efficiently. | Technology that aids wealth management and investment services. |

| Primary Focus | Regulatory compliance, risk management, fraud detection. | Portfolio management, financial planning, investment automation. |

| Key Users | Banks, regulators, compliance officers. | Financial advisors, individual investors, wealth managers. |

| Core Technologies | AI, machine learning, blockchain, big data analytics. | Robo-advisors, AI-driven analytics, blockchain, mobile platforms. |

| Benefits | Reduces compliance costs, improves transparency, lowers regulatory risks. | Enhances investment decisions, increases accessibility, automates wealth planning. |

| Regulatory Impact | Directly addresses legal compliance and reporting requirements. | Supports regulatory frameworks but focuses on client-driven wealth growth. |

Which is better?

Regtech enhances banking compliance by leveraging advanced technologies such as AI and blockchain to streamline regulatory reporting, reduce risks, and ensure data security. Wealthtech focuses on optimizing personal finance management and investment strategies through automation, robo-advisors, and data analytics, improving customer experience and portfolio performance. The choice between regtech and wealthtech depends on whether a financial institution prioritizes regulatory efficiency or customer-centric wealth management solutions.

Connection

RegTech streamlines regulatory compliance through advanced data analytics and automated reporting, enabling WealthTech platforms to securely manage client assets while adhering to legal standards. Integration of RegTech solutions ensures WealthTech applications can efficiently monitor transactions, detect fraud, and maintain transparency, fostering trust and operational efficiency. These technologies collectively enhance financial services by combining regulatory oversight with personalized wealth management tools.

Key Terms

Digital Wealth Management

Wealthtech leverages advanced technologies like AI, big data, and robo-advisors to optimize digital wealth management by enhancing portfolio management, personalized investment strategies, and seamless client experiences. Regtech concentrates on compliance automation, risk management, and regulatory reporting to ensure digital wealth platforms adhere to evolving financial regulations efficiently. Explore how these technologies intersect to transform digital wealth management and drive innovation in financial services.

Compliance Automation

Wealthtech focuses on leveraging technology to enhance wealth management services, while regtech primarily targets regulatory compliance through automation tools. Compliance automation in regtech uses AI and machine learning to streamline risk management, reporting, and adherence to financial regulations. Explore in-depth how wealthtech and regtech drive innovation in compliance automation for financial institutions.

Robo-Advisory

Wealthtech leverages Robo-Advisory platforms to automate and personalize investment management, using AI-driven algorithms to optimize portfolio allocation and enhance user experience. Regtech employs automated compliance monitoring and reporting tools to ensure that Robo-Advisors adhere to regulatory standards, mitigating risks associated with data privacy and financial regulations. Explore how the synergy between wealthtech and regtech is transforming Robo-Advisory services for more efficient and compliant investment solutions.

Source and External Links

WealthTec - WealthTec offers a wealth planning platform for mass affluent to ultrahigh-net-worth individuals, serving various financial needs.

Wealthtech: A Union of Wealth Management and Technology - This blog discusses the wealthtech ecosystem, its market leaders like Betterment and Wealthfront, and the integration of AI in wealth management.

WealthTech100 2025 - The WealthTech100 list highlights 100 of the world's most innovative wealthtech companies, selected by industry experts and analysts.

dowidth.com

dowidth.com