Central bank digital currencies (CBDCs) offer a state-backed, secure means of digital transactions, contrasting with payment service providers that rely on private ledger balances dependent on institutional trust. CBDCs ensure direct claims on the central bank, enhancing financial stability, while payment service providers often expose users to counterparty risk and liquidity limitations. Explore the nuanced differences and impacts on your digital financial activities by learning more about both systems.

Why it is important

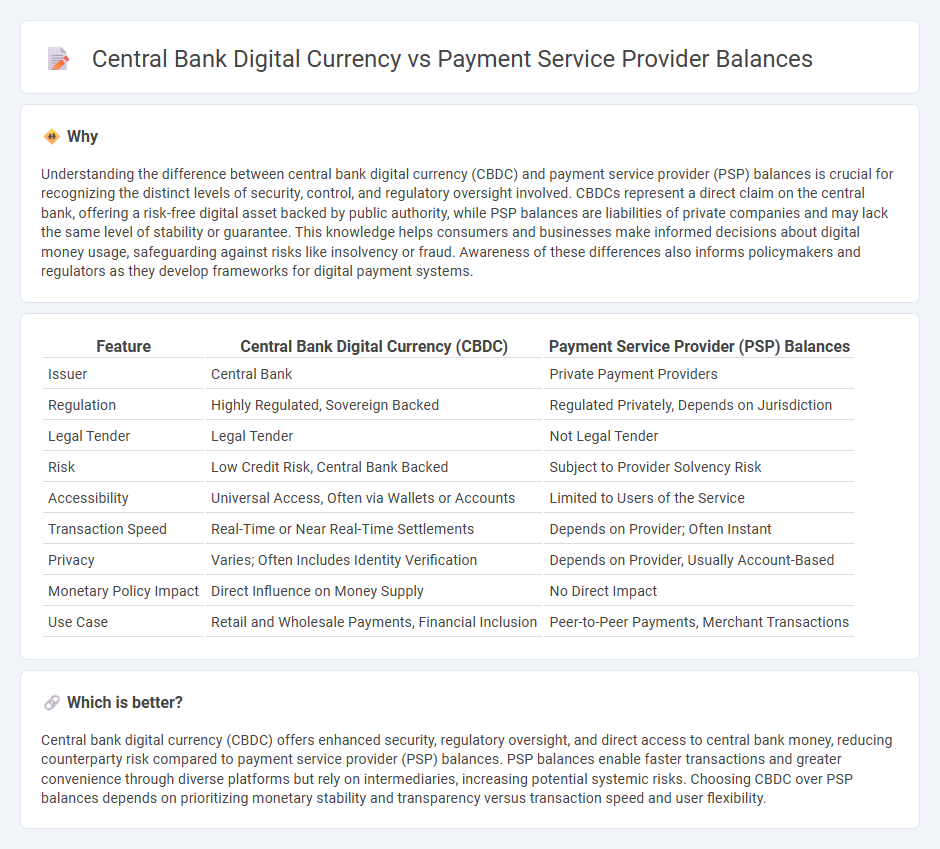

Understanding the difference between central bank digital currency (CBDC) and payment service provider (PSP) balances is crucial for recognizing the distinct levels of security, control, and regulatory oversight involved. CBDCs represent a direct claim on the central bank, offering a risk-free digital asset backed by public authority, while PSP balances are liabilities of private companies and may lack the same level of stability or guarantee. This knowledge helps consumers and businesses make informed decisions about digital money usage, safeguarding against risks like insolvency or fraud. Awareness of these differences also informs policymakers and regulators as they develop frameworks for digital payment systems.

Comparison Table

| Feature | Central Bank Digital Currency (CBDC) | Payment Service Provider (PSP) Balances |

|---|---|---|

| Issuer | Central Bank | Private Payment Providers |

| Regulation | Highly Regulated, Sovereign Backed | Regulated Privately, Depends on Jurisdiction |

| Legal Tender | Legal Tender | Not Legal Tender |

| Risk | Low Credit Risk, Central Bank Backed | Subject to Provider Solvency Risk |

| Accessibility | Universal Access, Often via Wallets or Accounts | Limited to Users of the Service |

| Transaction Speed | Real-Time or Near Real-Time Settlements | Depends on Provider; Often Instant |

| Privacy | Varies; Often Includes Identity Verification | Depends on Provider, Usually Account-Based |

| Monetary Policy Impact | Direct Influence on Money Supply | No Direct Impact |

| Use Case | Retail and Wholesale Payments, Financial Inclusion | Peer-to-Peer Payments, Merchant Transactions |

Which is better?

Central bank digital currency (CBDC) offers enhanced security, regulatory oversight, and direct access to central bank money, reducing counterparty risk compared to payment service provider (PSP) balances. PSP balances enable faster transactions and greater convenience through diverse platforms but rely on intermediaries, increasing potential systemic risks. Choosing CBDC over PSP balances depends on prioritizing monetary stability and transparency versus transaction speed and user flexibility.

Connection

Central bank digital currency (CBDC) and payment service provider balances are connected through real-time settlement systems that enable seamless fund transfers and liquidity management. CBDC operates as a digital form of central bank money, providing payment service providers with instant access to central bank reserves, enhancing transaction security and speed. This integration supports efficient payment ecosystems by reducing settlement risks and improving overall financial stability.

Key Terms

Settlement

Payment service provider balances represent private liabilities used for transaction settlement within closed networks, often limited by regulatory frameworks and interoperability challenges. Central bank digital currency (CBDC) offers a sovereign-backed, programmable, and universally accessible settlement medium, enhancing efficiency, security, and reducing counterparty risks in clearing and settlement processes. Explore the evolving dynamics between payment service providers and CBDCs to understand the future of digital payment settlement systems.

Interoperability

Payment service provider balances enable instant digital transactions across various platforms, but often lack unified interoperability compared to central bank digital currencies (CBDCs), which are designed to function seamlessly within broader financial infrastructures. CBDCs offer standardized protocols that ensure compatibility between multiple payment systems and financial institutions, reducing friction and enhancing transactional efficiency. Explore further to understand how interoperability between payment service provider balances and CBDCs can revolutionize digital payments.

Monetary sovereignty

Payment service provider balances offer convenience but lack the direct backing of central banks, potentially risking monetary sovereignty through reliance on private entities. Central bank digital currency (CBDC) ensures a state-controlled digital currency that preserves monetary sovereignty by maintaining regulatory oversight and preventing fragmentation in the payment ecosystem. Explore how CBDCs can strengthen national monetary autonomy and reshape digital payments.

Source and External Links

Understanding Connect account balances - Stripe accounts track both pending (unavailable) and available balances, with platforms and connected accounts each having their own, and payments moving between them based on transaction types.

How to Use the Account Balance Feature in Service Provider Pro - Clients can deposit money into their account balance, which they can use to pay for services directly or as a secondary payment method if funds are insufficient.

What is Load Balancing for Merchant Accounts? - Merchant account load balancing is the practice of distributing transactions across multiple processors to reduce risk and chargeback exposure, though it can carry significant risks if misused.

dowidth.com

dowidth.com