Account aggregation consolidates financial data from multiple institutions into a single platform, enhancing user convenience and financial management. Banking as a service (BaaS) enables third-party providers to offer banking services through APIs without owning a banking license, fostering innovation and expanded access. Discover how these technologies transform the financial ecosystem and reshape customer experiences.

Why it is important

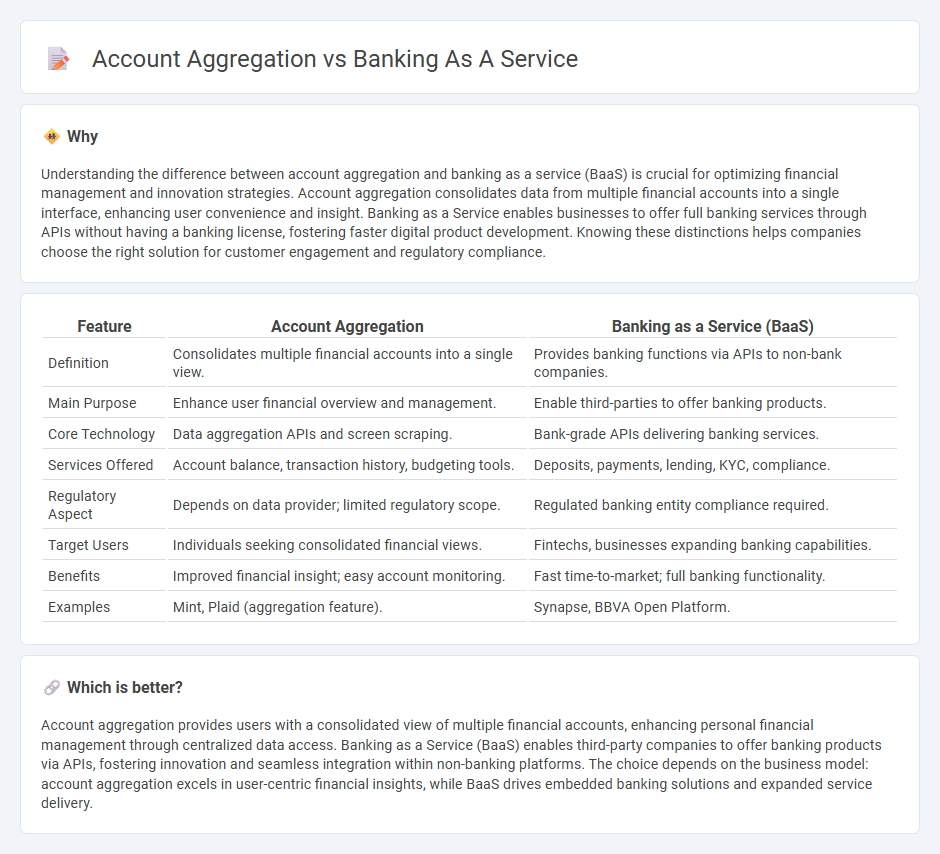

Understanding the difference between account aggregation and banking as a service (BaaS) is crucial for optimizing financial management and innovation strategies. Account aggregation consolidates data from multiple financial accounts into a single interface, enhancing user convenience and insight. Banking as a Service enables businesses to offer full banking services through APIs without having a banking license, fostering faster digital product development. Knowing these distinctions helps companies choose the right solution for customer engagement and regulatory compliance.

Comparison Table

| Feature | Account Aggregation | Banking as a Service (BaaS) |

|---|---|---|

| Definition | Consolidates multiple financial accounts into a single view. | Provides banking functions via APIs to non-bank companies. |

| Main Purpose | Enhance user financial overview and management. | Enable third-parties to offer banking products. |

| Core Technology | Data aggregation APIs and screen scraping. | Bank-grade APIs delivering banking services. |

| Services Offered | Account balance, transaction history, budgeting tools. | Deposits, payments, lending, KYC, compliance. |

| Regulatory Aspect | Depends on data provider; limited regulatory scope. | Regulated banking entity compliance required. |

| Target Users | Individuals seeking consolidated financial views. | Fintechs, businesses expanding banking capabilities. |

| Benefits | Improved financial insight; easy account monitoring. | Fast time-to-market; full banking functionality. |

| Examples | Mint, Plaid (aggregation feature). | Synapse, BBVA Open Platform. |

Which is better?

Account aggregation provides users with a consolidated view of multiple financial accounts, enhancing personal financial management through centralized data access. Banking as a Service (BaaS) enables third-party companies to offer banking products via APIs, fostering innovation and seamless integration within non-banking platforms. The choice depends on the business model: account aggregation excels in user-centric financial insights, while BaaS drives embedded banking solutions and expanded service delivery.

Connection

Account aggregation and Banking as a Service (BaaS) are interconnected through their roles in enhancing financial data accessibility and service integration. Account aggregation consolidates data from multiple bank accounts into a single interface, empowering BaaS platforms to offer seamless, personalized financial products and services. This integration supports improved customer experiences, enabling fintech companies and banks to deliver innovative solutions efficiently.

Key Terms

**Banking as a Service:**

Banking as a Service (BaaS) enables non-bank companies to offer full banking services by integrating licensed banking infrastructure via APIs, providing features like payments, lending, and account management without building banking systems from scratch. This approach drives innovation and expands financial service accessibility by embedding banking capabilities directly into digital platforms. Explore how BaaS transforms financial ecosystems and fuels seamless customer experiences.

API

Banking as a Service (BaaS) provides APIs allowing third-party developers to offer full banking products, including account opening, payments, and compliance management, embedded directly into their platforms. Account Aggregation APIs, on the other hand, enable users to consolidate financial data from multiple accounts into a single interface but do not offer transactional or banking infrastructure capabilities. Explore how these API-driven models transform fintech innovation and customer engagement.

White-label

Banking as a Service (BaaS) offers white-label financial solutions enabling businesses to provide fully branded banking products with embedded payment processing, compliance, and account management features. In contrast, account aggregation focuses on consolidating financial data from multiple sources into a single interface, enhancing customer insights without delivering full banking services. Explore how these white-label models transform fintech innovation and customer engagement by learning more about their unique applications.

Source and External Links

Banking as a Service (BaaS): What It Is + Examples - InnReg - Banking as a Service is a financial framework that enables non-banks to offer banking products by partnering with licensed banks via APIs, allowing fintechs and other companies to provide tailored financial services seamlessly under their own brand, thus transforming how financial services reach customers.

Top Banking as a Service Companies in 2025 - SDK.finance - BaaS providers allow non-banks to leverage traditional banking infrastructure through APIs to offer services like account creation, payment processing, and lending, enabling businesses to quickly launch financial products without holding a banking license.

Banking As a Service (BaaS) Explained & Industry Outlook 2023 - BaaS platforms open banking APIs to third parties for product development and white-label services, creating new revenue streams for banks and helping fintechs provide embedded banking, with the market driven by open banking regulations and technology adoption.

dowidth.com

dowidth.com