Sustainable finance integrates environmental, social, and governance (ESG) criteria into financial services to promote long-term economic growth while addressing global challenges. Climate finance specifically targets investments aimed at reducing carbon emissions and supporting adaptation to climate change impacts. Explore the key differences and opportunities within these growing financial sectors.

Why it is important

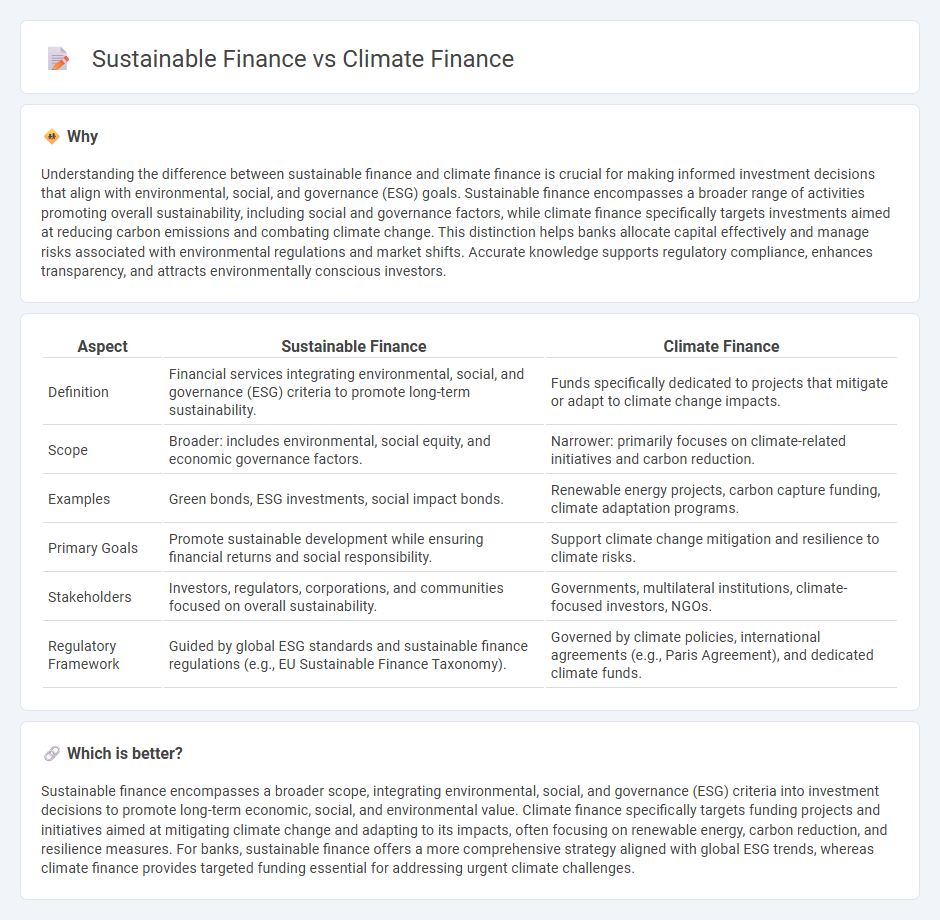

Understanding the difference between sustainable finance and climate finance is crucial for making informed investment decisions that align with environmental, social, and governance (ESG) goals. Sustainable finance encompasses a broader range of activities promoting overall sustainability, including social and governance factors, while climate finance specifically targets investments aimed at reducing carbon emissions and combating climate change. This distinction helps banks allocate capital effectively and manage risks associated with environmental regulations and market shifts. Accurate knowledge supports regulatory compliance, enhances transparency, and attracts environmentally conscious investors.

Comparison Table

| Aspect | Sustainable Finance | Climate Finance |

|---|---|---|

| Definition | Financial services integrating environmental, social, and governance (ESG) criteria to promote long-term sustainability. | Funds specifically dedicated to projects that mitigate or adapt to climate change impacts. |

| Scope | Broader: includes environmental, social equity, and economic governance factors. | Narrower: primarily focuses on climate-related initiatives and carbon reduction. |

| Examples | Green bonds, ESG investments, social impact bonds. | Renewable energy projects, carbon capture funding, climate adaptation programs. |

| Primary Goals | Promote sustainable development while ensuring financial returns and social responsibility. | Support climate change mitigation and resilience to climate risks. |

| Stakeholders | Investors, regulators, corporations, and communities focused on overall sustainability. | Governments, multilateral institutions, climate-focused investors, NGOs. |

| Regulatory Framework | Guided by global ESG standards and sustainable finance regulations (e.g., EU Sustainable Finance Taxonomy). | Governed by climate policies, international agreements (e.g., Paris Agreement), and dedicated climate funds. |

Which is better?

Sustainable finance encompasses a broader scope, integrating environmental, social, and governance (ESG) criteria into investment decisions to promote long-term economic, social, and environmental value. Climate finance specifically targets funding projects and initiatives aimed at mitigating climate change and adapting to its impacts, often focusing on renewable energy, carbon reduction, and resilience measures. For banks, sustainable finance offers a more comprehensive strategy aligned with global ESG trends, whereas climate finance provides targeted funding essential for addressing urgent climate challenges.

Connection

Sustainable finance and climate finance are interconnected through their shared goal of directing financial resources towards projects that mitigate environmental impacts and promote low-carbon development. Climate finance specifically targets investments that reduce greenhouse gas emissions and support climate adaptation, while sustainable finance encompasses a broader scope including social and governance factors alongside environmental considerations. Both frameworks drive the transition to a resilient, sustainable economy by mobilizing capital for renewable energy, sustainable agriculture, and green infrastructure initiatives.

Key Terms

**Climate finance:**

Climate finance refers to funding aimed at reducing greenhouse gas emissions and enhancing resilience to climate change impacts, primarily supporting mitigation and adaptation projects globally. This type of finance mobilizes both public and private capital to invest in renewable energy, energy efficiency, and climate-resilient infrastructure. Explore how climate finance drives global efforts to meet the Paris Agreement targets and transition to a low-carbon economy.

Carbon credits

Climate finance primarily targets funding projects that reduce greenhouse gas emissions, including carbon credits as a key mechanism for trading emission reductions. Sustainable finance encompasses a broader scope, integrating environmental, social, and governance (ESG) criteria into investment decisions, with carbon credits serving as one tool within its diverse portfolio for promoting eco-friendly initiatives. Explore the distinctions and applications of carbon credits in both finance spheres to deepen your understanding.

Green bonds

Green bonds are a key instrument in both climate finance and sustainable finance, primarily aimed at funding projects that mitigate climate change and promote environmental sustainability. Climate finance focuses specifically on financing initiatives that reduce greenhouse gas emissions and enhance climate resilience, whereas sustainable finance encompasses a broader scope, including social and governance factors alongside environmental goals. Explore the distinct roles of green bonds within these frameworks to understand their impact on global sustainability efforts.

Source and External Links

What is climate finance and why do we need more of it? - Climate finance includes financial resources and instruments like grants, green bonds, and concessional loans used to support climate action, crucial for the transition to a low-carbon economy and climate adaptation globally, with current flows needing to triple to meet Paris Agreement goals.

Climate finance - It is an umbrella term for loans, grants, and budget allocations aimed at climate mitigation and adaptation, sourced from public and private finance, with challenges including tracking flows and ensuring equitable support for developing countries.

Global Landscape of Climate Finance 2025 - CPI - Global climate finance reached a record USD 1.9 trillion in 2023, with private investments exceeding public ones for the first time, highlighting the growing importance of private capital in driving climate finance flows.

dowidth.com

dowidth.com