Account aggregation consolidates multiple financial accounts into a single platform, enabling users to view and manage finances efficiently. Third-party providers access banking data through APIs, offering tailored financial services while ensuring compliance with security standards like PSD2 and GDPR. Discover how these technologies transform personal finance management.

Why it is important

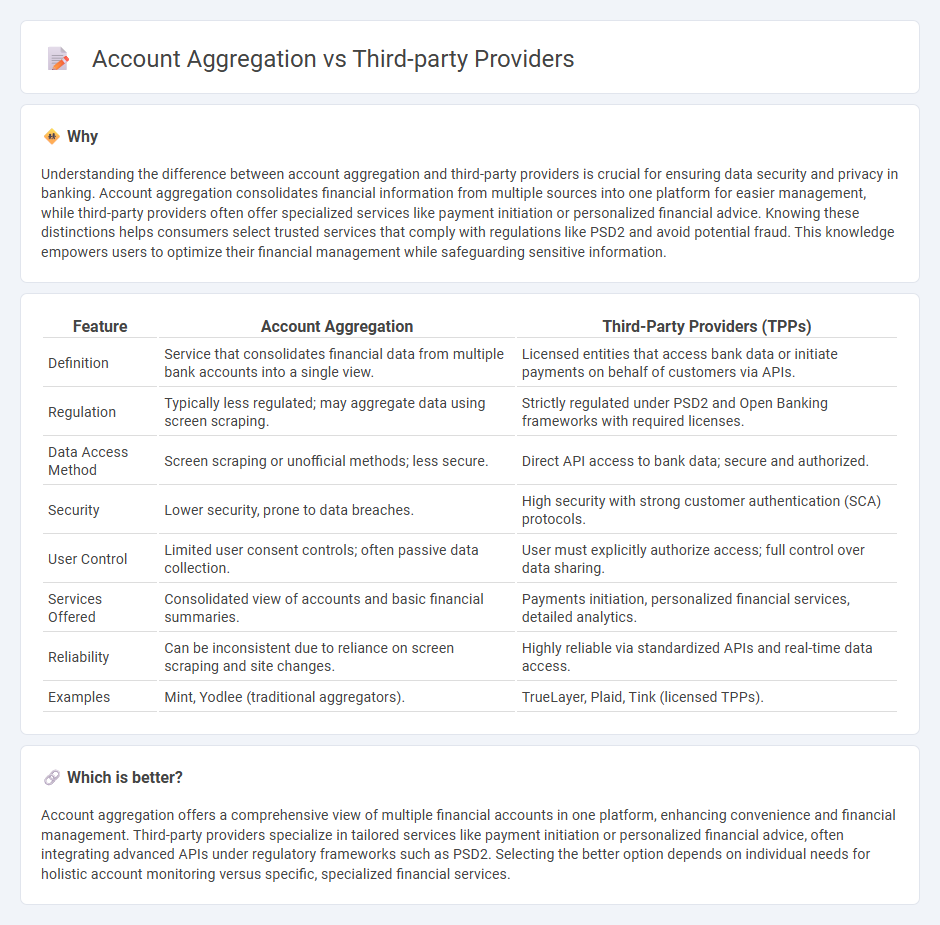

Understanding the difference between account aggregation and third-party providers is crucial for ensuring data security and privacy in banking. Account aggregation consolidates financial information from multiple sources into one platform for easier management, while third-party providers often offer specialized services like payment initiation or personalized financial advice. Knowing these distinctions helps consumers select trusted services that comply with regulations like PSD2 and avoid potential fraud. This knowledge empowers users to optimize their financial management while safeguarding sensitive information.

Comparison Table

| Feature | Account Aggregation | Third-Party Providers (TPPs) |

|---|---|---|

| Definition | Service that consolidates financial data from multiple bank accounts into a single view. | Licensed entities that access bank data or initiate payments on behalf of customers via APIs. |

| Regulation | Typically less regulated; may aggregate data using screen scraping. | Strictly regulated under PSD2 and Open Banking frameworks with required licenses. |

| Data Access Method | Screen scraping or unofficial methods; less secure. | Direct API access to bank data; secure and authorized. |

| Security | Lower security, prone to data breaches. | High security with strong customer authentication (SCA) protocols. |

| User Control | Limited user consent controls; often passive data collection. | User must explicitly authorize access; full control over data sharing. |

| Services Offered | Consolidated view of accounts and basic financial summaries. | Payments initiation, personalized financial services, detailed analytics. |

| Reliability | Can be inconsistent due to reliance on screen scraping and site changes. | Highly reliable via standardized APIs and real-time data access. |

| Examples | Mint, Yodlee (traditional aggregators). | TrueLayer, Plaid, Tink (licensed TPPs). |

Which is better?

Account aggregation offers a comprehensive view of multiple financial accounts in one platform, enhancing convenience and financial management. Third-party providers specialize in tailored services like payment initiation or personalized financial advice, often integrating advanced APIs under regulatory frameworks such as PSD2. Selecting the better option depends on individual needs for holistic account monitoring versus specific, specialized financial services.

Connection

Account aggregation enables third-party providers to securely access multiple bank accounts through APIs, facilitating a comprehensive financial overview for users. These providers use aggregated data to offer personalized services such as budgeting tools, investment advice, and credit monitoring. This integration drives the open banking ecosystem, enhancing customer experience and promoting financial transparency.

Key Terms

Open Banking

Third-party providers (TPPs) leverage Open Banking APIs to securely access customer financial data with consent, enabling innovative services like payment initiation and personalized financial management. Account aggregation consolidates multiple banking accounts into a single interface, streamlining financial overview and decision-making for users by utilizing TPP capabilities under regulatory frameworks like PSD2. Explore deeper insights into how Open Banking transforms financial ecosystems and empowers consumers.

API (Application Programming Interface)

Third-party providers leverage APIs to securely access user financial data across multiple institutions, enabling innovative fintech services like personal finance management and payment initiation. Account aggregation platforms use APIs to consolidate account information from various banks into a single dashboard, improving user visibility and financial decision-making. Explore deeper insights into how APIs drive the evolution of third-party providers and account aggregation solutions.

Data Consent

Third-party providers enable direct access to user financial data with explicit consent, ensuring compliance with data protection regulations such as GDPR and PSD2. Account aggregation services consolidate information from multiple accounts, requiring explicit user permission to aggregate and share data securely. Explore how data consent frameworks shape user control and privacy in financial data sharing platforms.

Source and External Links

What is a Third-Party Service Provider? - A third-party service provider is an external person or company that delivers services or technology to another organization, commonly in forms such as Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), or Infrastructure-as-a-Service (IaaS), including providers like Google Suite, AWS, and Microsoft Azure.

What Is a Third-Party Service Provider? - Third-party service providers are external entities offering services such as IT support, cloud computing, and payment processing (e.g., PayPal, AWS), enabling companies to focus on core competencies while also posing data privacy risks that require careful management and contractual oversight.

Third-Party Service Provider - Termly's Legal Dictionary - Defined as unaffiliated persons or companies performing services for another company without equity stake, typical examples include web hosting, marketing agencies, software services, contractors, and consultants.

dowidth.com

dowidth.com