Wealthtech platforms leverage advanced algorithms and data analytics to optimize investment strategies and personalized financial advice, catering primarily to high-net-worth individuals seeking efficient wealth management. Cryptobanks operate on blockchain technology, offering decentralized financial services such as crypto asset custody, trading, and lending, targeting users interested in digital currencies and decentralized finance. Explore the detailed differences between wealthtech and cryptobanks to understand which financial innovation suits your investment goals best.

Why it is important

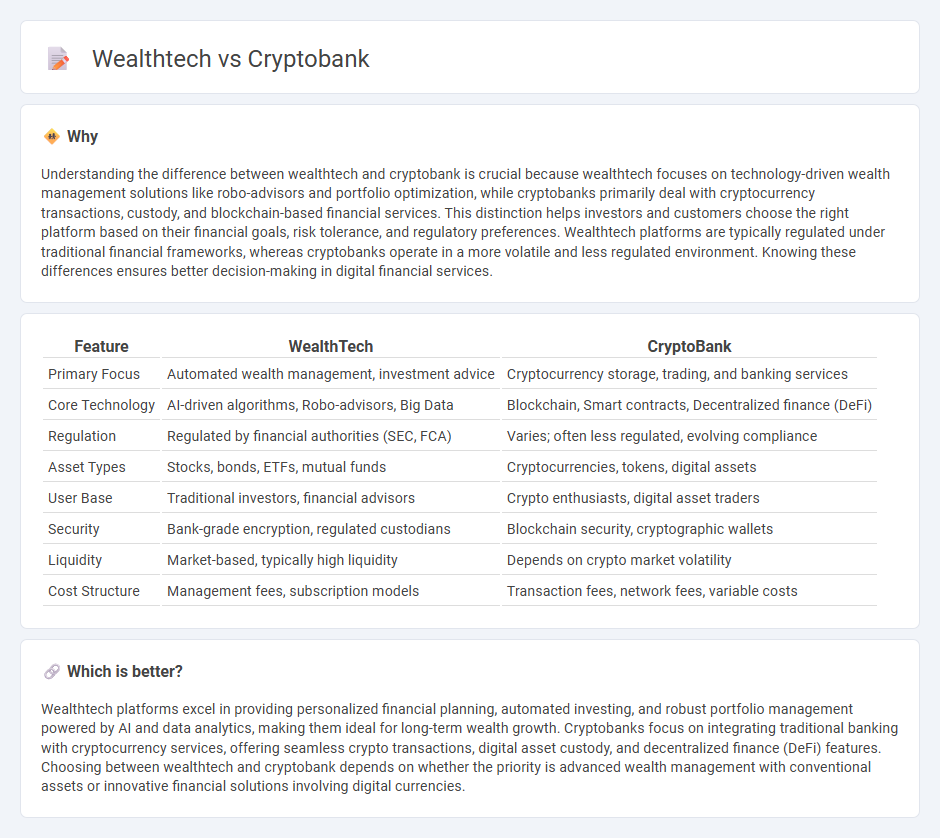

Understanding the difference between wealthtech and cryptobank is crucial because wealthtech focuses on technology-driven wealth management solutions like robo-advisors and portfolio optimization, while cryptobanks primarily deal with cryptocurrency transactions, custody, and blockchain-based financial services. This distinction helps investors and customers choose the right platform based on their financial goals, risk tolerance, and regulatory preferences. Wealthtech platforms are typically regulated under traditional financial frameworks, whereas cryptobanks operate in a more volatile and less regulated environment. Knowing these differences ensures better decision-making in digital financial services.

Comparison Table

| Feature | WealthTech | CryptoBank |

|---|---|---|

| Primary Focus | Automated wealth management, investment advice | Cryptocurrency storage, trading, and banking services |

| Core Technology | AI-driven algorithms, Robo-advisors, Big Data | Blockchain, Smart contracts, Decentralized finance (DeFi) |

| Regulation | Regulated by financial authorities (SEC, FCA) | Varies; often less regulated, evolving compliance |

| Asset Types | Stocks, bonds, ETFs, mutual funds | Cryptocurrencies, tokens, digital assets |

| User Base | Traditional investors, financial advisors | Crypto enthusiasts, digital asset traders |

| Security | Bank-grade encryption, regulated custodians | Blockchain security, cryptographic wallets |

| Liquidity | Market-based, typically high liquidity | Depends on crypto market volatility |

| Cost Structure | Management fees, subscription models | Transaction fees, network fees, variable costs |

Which is better?

Wealthtech platforms excel in providing personalized financial planning, automated investing, and robust portfolio management powered by AI and data analytics, making them ideal for long-term wealth growth. Cryptobanks focus on integrating traditional banking with cryptocurrency services, offering seamless crypto transactions, digital asset custody, and decentralized finance (DeFi) features. Choosing between wealthtech and cryptobank depends on whether the priority is advanced wealth management with conventional assets or innovative financial solutions involving digital currencies.

Connection

Wealthtech platforms integrate advanced digital tools to optimize investment management, while cryptobanks leverage blockchain technology to provide decentralized financial services, creating a seamless interface for digital asset transactions. Both sectors enhance banking innovation by combining algorithm-driven wealth management with secure, transparent cryptocurrency operations. This convergence drives the evolution of financial services, fostering greater accessibility and efficiency in managing diverse asset portfolios.

Key Terms

Digital Assets

Cryptobanks specialize in managing and securing digital assets such as cryptocurrencies and tokenized securities, offering services including wallets, custody, and seamless blockchain transactions. Wealthtech platforms leverage technology to optimize traditional investments and portfolio management but are increasingly integrating digital asset options for diversification and enhanced returns. Explore how the evolving landscape of digital asset management is reshaping financial services and investment strategies.

Robo-advisory

Cryptobanks leverage blockchain technology to offer secure, decentralized financial services with integrated robo-advisory for cryptocurrency portfolios, providing automated asset management tailored to digital assets. Wealthtech platforms utilize advanced algorithms and AI-driven robo-advisors to optimize traditional investment strategies, offering personalized financial planning and portfolio rebalancing for broader asset classes. Explore the evolving landscape of robo-advisory in cryptobank and wealthtech sectors to understand their impact on investment management.

Smart Contracts

Cryptobanks leverage smart contracts to automate secure, transparent financial transactions and decentralized asset management, enabling users to access blockchain-based banking services without intermediaries. Wealthtech platforms integrate smart contracts to streamline investment processes, enhance portfolio management, and facilitate automated compliance and reporting. Explore how smart contracts redefine financial services by bridging cryptobank functionalities with wealthtech innovations.

Source and External Links

What Is a Crypto Bank, and How Does It Work? - B2BinPay - Crypto banks are financial institutions that combine traditional banking functions with decentralized finance, providing services such as transactions, lending, and investments for both fiat and cryptocurrencies, bridging centralized and decentralized economies.

Sygnum Bank | Regulated Digital Asset Banking - Sygnum is a regulated digital asset bank offering secure crypto services like trading, custody, staking, lending, and tokenization, supporting institutional-grade crypto banking and compliance.

Anchorage Digital: Crypto Bank for Institutions - Anchorage Digital is the only federally chartered crypto bank in the US, providing institutional clients with integrated crypto services including custody, trading, staking, and on-chain settlement with strong regulatory compliance.

dowidth.com

dowidth.com