Account aggregation consolidates financial information from various accounts into a single, unified view, enhancing overview and control of finances. Personal financial management tools analyze this aggregated data to provide tailored budgeting, spending insights, and financial planning advice. Explore more to understand how combining these technologies can optimize your financial health.

Why it is important

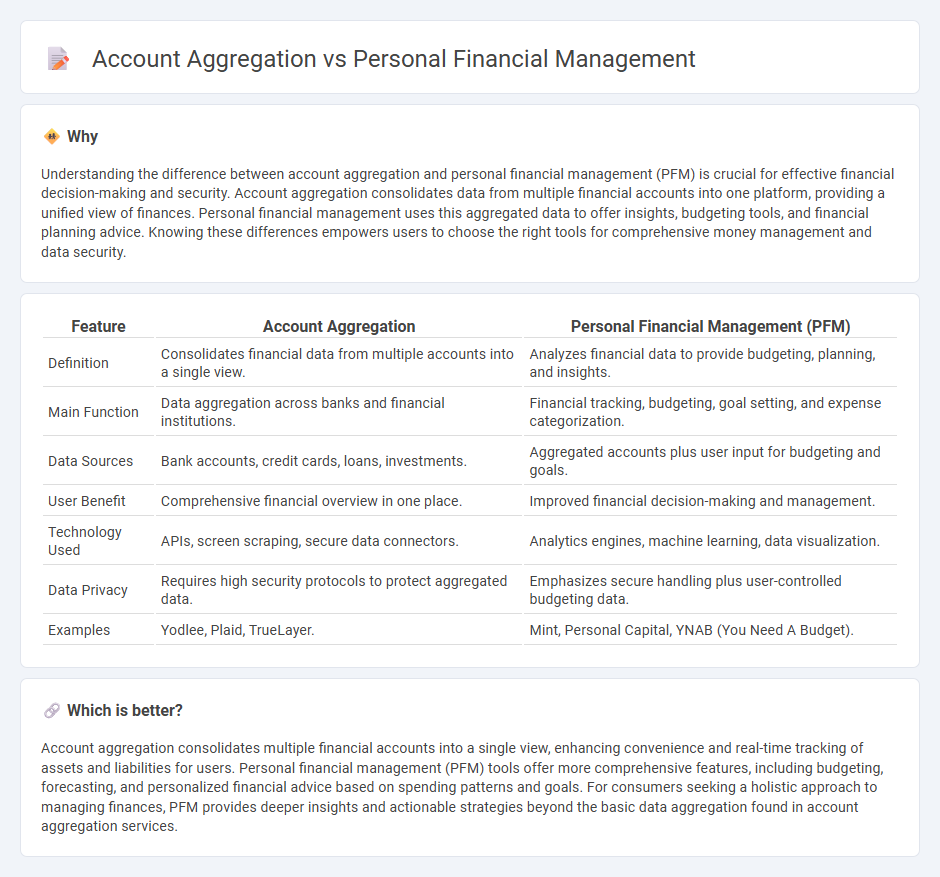

Understanding the difference between account aggregation and personal financial management (PFM) is crucial for effective financial decision-making and security. Account aggregation consolidates data from multiple financial accounts into one platform, providing a unified view of finances. Personal financial management uses this aggregated data to offer insights, budgeting tools, and financial planning advice. Knowing these differences empowers users to choose the right tools for comprehensive money management and data security.

Comparison Table

| Feature | Account Aggregation | Personal Financial Management (PFM) |

|---|---|---|

| Definition | Consolidates financial data from multiple accounts into a single view. | Analyzes financial data to provide budgeting, planning, and insights. |

| Main Function | Data aggregation across banks and financial institutions. | Financial tracking, budgeting, goal setting, and expense categorization. |

| Data Sources | Bank accounts, credit cards, loans, investments. | Aggregated accounts plus user input for budgeting and goals. |

| User Benefit | Comprehensive financial overview in one place. | Improved financial decision-making and management. |

| Technology Used | APIs, screen scraping, secure data connectors. | Analytics engines, machine learning, data visualization. |

| Data Privacy | Requires high security protocols to protect aggregated data. | Emphasizes secure handling plus user-controlled budgeting data. |

| Examples | Yodlee, Plaid, TrueLayer. | Mint, Personal Capital, YNAB (You Need A Budget). |

Which is better?

Account aggregation consolidates multiple financial accounts into a single view, enhancing convenience and real-time tracking of assets and liabilities for users. Personal financial management (PFM) tools offer more comprehensive features, including budgeting, forecasting, and personalized financial advice based on spending patterns and goals. For consumers seeking a holistic approach to managing finances, PFM provides deeper insights and actionable strategies beyond the basic data aggregation found in account aggregation services.

Connection

Account aggregation consolidates financial data from multiple accounts into a single platform, enabling comprehensive analysis and real-time tracking. Personal financial management (PFM) tools utilize this aggregated data to provide users with insights, budgeting assistance, and spending recommendations. The integration of account aggregation enhances the accuracy and effectiveness of PFM solutions in helping users achieve financial goals.

Key Terms

**Personal Financial Management**

Personal Financial Management (PFM) tools enable users to track income, expenses, budgeting, and financial goals through an integrated interface that emphasizes actionable insights and long-term planning. Unlike account aggregation, which primarily consolidates financial data from multiple sources for comprehensive visibility, PFM platforms leverage this data to provide personalized advice, spending analysis, and goal-setting features. Explore more about how PFM solutions can empower smarter financial decisions and enhance your financial well-being.

Budgeting

Personal financial management (PFM) tools and account aggregation services both enhance budgeting by providing users with comprehensive insights into their finances. PFM platforms offer detailed budgeting features such as expense tracking, goal setting, and customized spending reports, while account aggregation consolidates multiple financial accounts for a unified view without deep analytical tools. Explore our in-depth comparison to understand which solution best supports your budgeting needs.

Expense Tracking

Personal financial management focuses on providing users with tools to monitor, categorize, and analyze their expenses to improve budgeting and savings. Account aggregation consolidates financial data from multiple accounts into a single view, enhancing expense tracking by delivering a comprehensive snapshot of spending patterns. Explore how combining these approaches can optimize your expense tracking experience.

Source and External Links

Why is Personal Finance Important? - This resource offers practical tips for managing personal finances, including setting financial goals, creating a budget, and reducing debt.

Personal Finance - It provides a comprehensive guide to personal finance by outlining key areas such as income, spending, saving, investing, and protection.

What is Personal Finance & Why is it Important? - This article explains personal finance as the process of planning and managing individual or household finances to achieve financial goals.

dowidth.com

dowidth.com