Social trading enables investors to replicate the strategies of experienced traders through online platforms, providing real-time insights and collaborative opportunities. Wealth management offers personalized financial planning and asset allocation tailored to an individual's long-term goals and risk tolerance. Explore the distinct advantages of social trading and wealth management to determine the best fit for your financial growth.

Why it is important

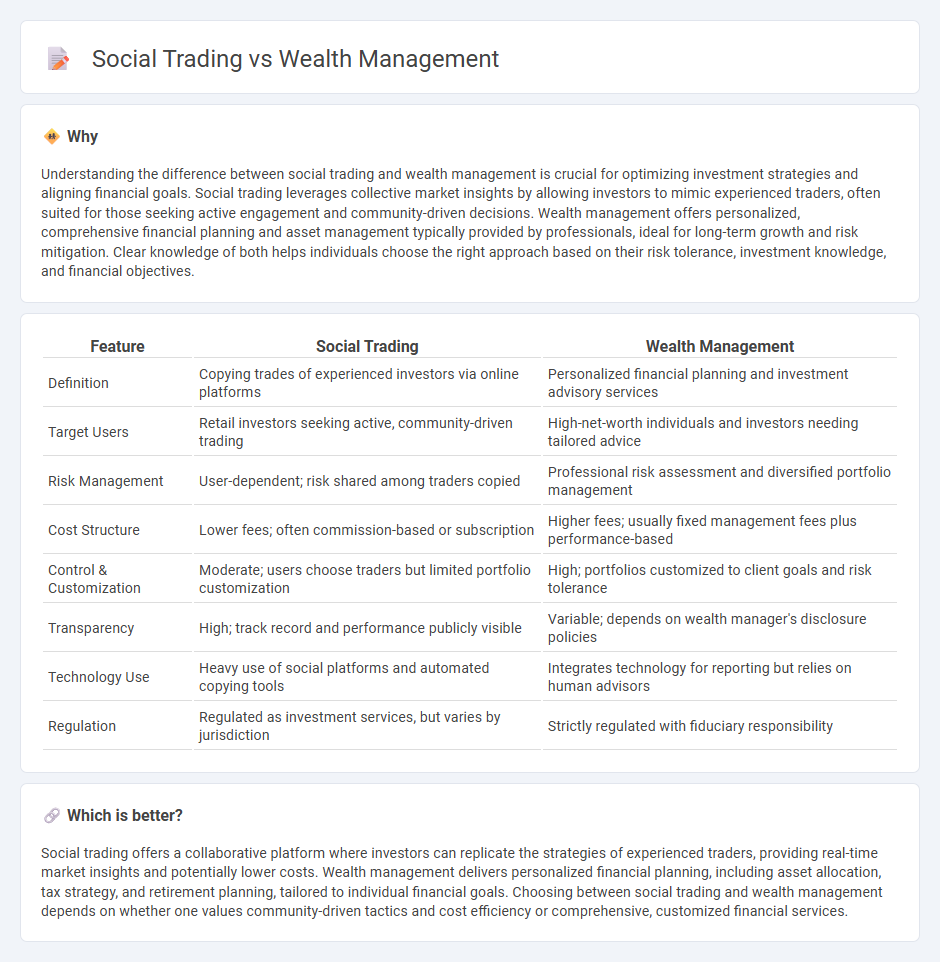

Understanding the difference between social trading and wealth management is crucial for optimizing investment strategies and aligning financial goals. Social trading leverages collective market insights by allowing investors to mimic experienced traders, often suited for those seeking active engagement and community-driven decisions. Wealth management offers personalized, comprehensive financial planning and asset management typically provided by professionals, ideal for long-term growth and risk mitigation. Clear knowledge of both helps individuals choose the right approach based on their risk tolerance, investment knowledge, and financial objectives.

Comparison Table

| Feature | Social Trading | Wealth Management |

|---|---|---|

| Definition | Copying trades of experienced investors via online platforms | Personalized financial planning and investment advisory services |

| Target Users | Retail investors seeking active, community-driven trading | High-net-worth individuals and investors needing tailored advice |

| Risk Management | User-dependent; risk shared among traders copied | Professional risk assessment and diversified portfolio management |

| Cost Structure | Lower fees; often commission-based or subscription | Higher fees; usually fixed management fees plus performance-based |

| Control & Customization | Moderate; users choose traders but limited portfolio customization | High; portfolios customized to client goals and risk tolerance |

| Transparency | High; track record and performance publicly visible | Variable; depends on wealth manager's disclosure policies |

| Technology Use | Heavy use of social platforms and automated copying tools | Integrates technology for reporting but relies on human advisors |

| Regulation | Regulated as investment services, but varies by jurisdiction | Strictly regulated with fiduciary responsibility |

Which is better?

Social trading offers a collaborative platform where investors can replicate the strategies of experienced traders, providing real-time market insights and potentially lower costs. Wealth management delivers personalized financial planning, including asset allocation, tax strategy, and retirement planning, tailored to individual financial goals. Choosing between social trading and wealth management depends on whether one values community-driven tactics and cost efficiency or comprehensive, customized financial services.

Connection

Social trading platforms integrate with wealth management strategies by enabling investors to observe and replicate the trades of seasoned professionals, enhancing portfolio diversification and risk management. By leveraging collective intelligence and real-time data analytics, social trading provides actionable insights that complement traditional wealth management advisory services. This synergy helps clients optimize investment outcomes through informed decision-making and personalized financial planning.

Key Terms

Wealth Management:

Wealth management encompasses personalized financial planning, investment portfolio diversification, tax optimization, and estate planning tailored to high-net-worth individuals seeking long-term financial growth and security. It involves professional advisory services that integrate risk management, retirement strategies, and asset allocation to build and preserve wealth effectively. Discover how comprehensive wealth management can safeguard and enhance your financial future.

Portfolio Diversification

Wealth management offers personalized portfolio diversification strategies tailored to long-term financial goals, leveraging professional expertise and risk assessment to balance asset classes effectively. Social trading emphasizes diversification through collective insights, enabling investors to replicate varied portfolios from top traders in real-time for higher adaptive potential. Explore further to understand which approach aligns best with your investment objectives and risk tolerance.

Asset Allocation

Wealth management emphasizes personalized asset allocation strategies tailored to individual risk tolerance and financial goals, leveraging a diversified portfolio across equities, bonds, and alternative investments to optimize long-term returns. Social trading focuses on the collective wisdom by allowing investors to replicate or follow successful traders' positions, often involving higher risk and more dynamic asset allocation based on market sentiment and real-time data. Explore how these distinct approaches manage asset allocation to align with your investment objectives.

Source and External Links

Fidelity Wealth Management - Offers personalized wealth planning with a focus on growing and protecting wealth through customized investment strategies.

Wealth Management - A discipline that involves structuring and planning wealth to assist in growing, preserving, and protecting wealth.

RBC Wealth Management - Provides tailored wealth strategies focusing on personal and family goals, including wealth transfer and legacy planning.

dowidth.com

dowidth.com