Invisible payments utilize seamless technology to enable transactions without physical interaction, relying on advanced sensors and AI for automatic billing. Wallet payments involve digital wallets that store payment information securely, allowing users to complete transactions via smartphones or wearable devices. Explore the differences and benefits of these payment methods to enhance your banking experience.

Why it is important

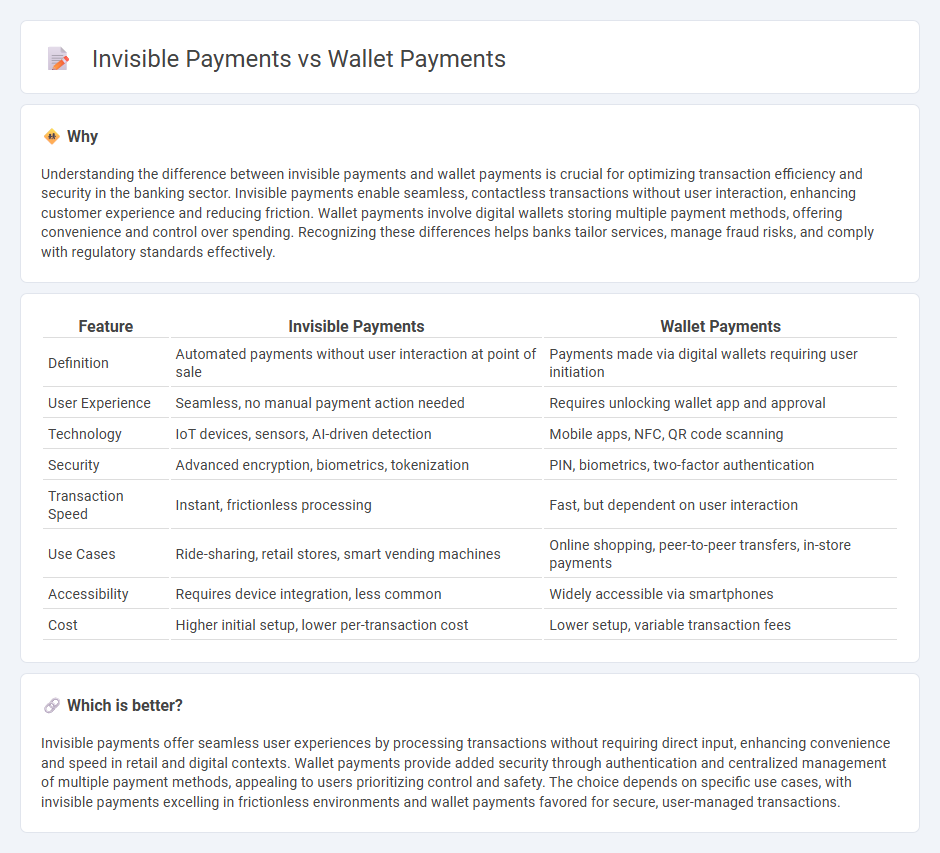

Understanding the difference between invisible payments and wallet payments is crucial for optimizing transaction efficiency and security in the banking sector. Invisible payments enable seamless, contactless transactions without user interaction, enhancing customer experience and reducing friction. Wallet payments involve digital wallets storing multiple payment methods, offering convenience and control over spending. Recognizing these differences helps banks tailor services, manage fraud risks, and comply with regulatory standards effectively.

Comparison Table

| Feature | Invisible Payments | Wallet Payments |

|---|---|---|

| Definition | Automated payments without user interaction at point of sale | Payments made via digital wallets requiring user initiation |

| User Experience | Seamless, no manual payment action needed | Requires unlocking wallet app and approval |

| Technology | IoT devices, sensors, AI-driven detection | Mobile apps, NFC, QR code scanning |

| Security | Advanced encryption, biometrics, tokenization | PIN, biometrics, two-factor authentication |

| Transaction Speed | Instant, frictionless processing | Fast, but dependent on user interaction |

| Use Cases | Ride-sharing, retail stores, smart vending machines | Online shopping, peer-to-peer transfers, in-store payments |

| Accessibility | Requires device integration, less common | Widely accessible via smartphones |

| Cost | Higher initial setup, lower per-transaction cost | Lower setup, variable transaction fees |

Which is better?

Invisible payments offer seamless user experiences by processing transactions without requiring direct input, enhancing convenience and speed in retail and digital contexts. Wallet payments provide added security through authentication and centralized management of multiple payment methods, appealing to users prioritizing control and safety. The choice depends on specific use cases, with invisible payments excelling in frictionless environments and wallet payments favored for secure, user-managed transactions.

Connection

Invisible payments leverage digital wallets by enabling seamless, contactless transactions without requiring user interaction at checkout. Wallet payments store encrypted payment information securely, allowing invisible payment systems to authenticate and process purchases in real-time. The integration of digital wallets with invisible payment technology enhances transaction speed, security, and convenience in modern banking ecosystems.

Key Terms

Digital Wallets

Digital wallets enable secure and convenient payments by storing users' payment information for quick transactions, while invisible payments operate seamlessly in the background without user interaction, offering a frictionless experience. Wallet payments require user initiation through apps like Apple Pay or Google Wallet, whereas invisible payments leverage technologies such as RFID or NFC to complete purchases automatically. Explore how digital wallets are evolving to integrate both methods for enhanced consumer convenience and security.

Tokenization

Wallet payments utilize tokenization to replace sensitive card details with unique tokens, enhancing security during transactions. Invisible payments extend tokenization by processing transactions seamlessly in the background without user interaction, increasing convenience and reducing fraud risk. Discover how tokenization transforms payment security and user experience by exploring detailed comparisons.

Seamless Authentication

Wallet payments leverage digital wallets like Apple Pay and Google Pay, enabling fast transactions through biometric or PIN-based verification for enhanced security. Invisible payments rely on seamless authentication technologies such as facial recognition or device tokenization, allowing frictionless transactions without user interaction. Explore how these advanced authentication methods redefine payment experiences for greater convenience and security.

Source and External Links

How digital wallets work and how to accept a digital wallet - Digital wallets store payment methods like cards and use NFC, MST, or QR codes for fast wireless payments in-store or online after user authentication.

Tap to pay with your phone - Google Wallet Help - Google Wallet allows contactless payments using NFC technology on phones at terminals showing Google Pay or contactless symbols, requiring a secure setup with payment methods added.

Guide to digital wallets - Wells Fargo - Digital wallets enable secure payments without sharing card numbers, supporting biometric authentication and available on platforms like Apple Pay, Google Pay, Samsung Pay, and PayPal.

dowidth.com

dowidth.com