Wealthtech integrates advanced technology like AI, big data, and robo-advisors to optimize investment management and personalized financial planning, distinguishing itself from traditional wealth management through automation and scalability. Digital platforms in wealthtech offer real-time analytics and seamless portfolio adjustments, improving client engagement and cost efficiency compared to conventional financial advisory services. Explore the evolving landscape of wealthtech innovations to understand how they reshape the banking and investment sectors.

Why it is important

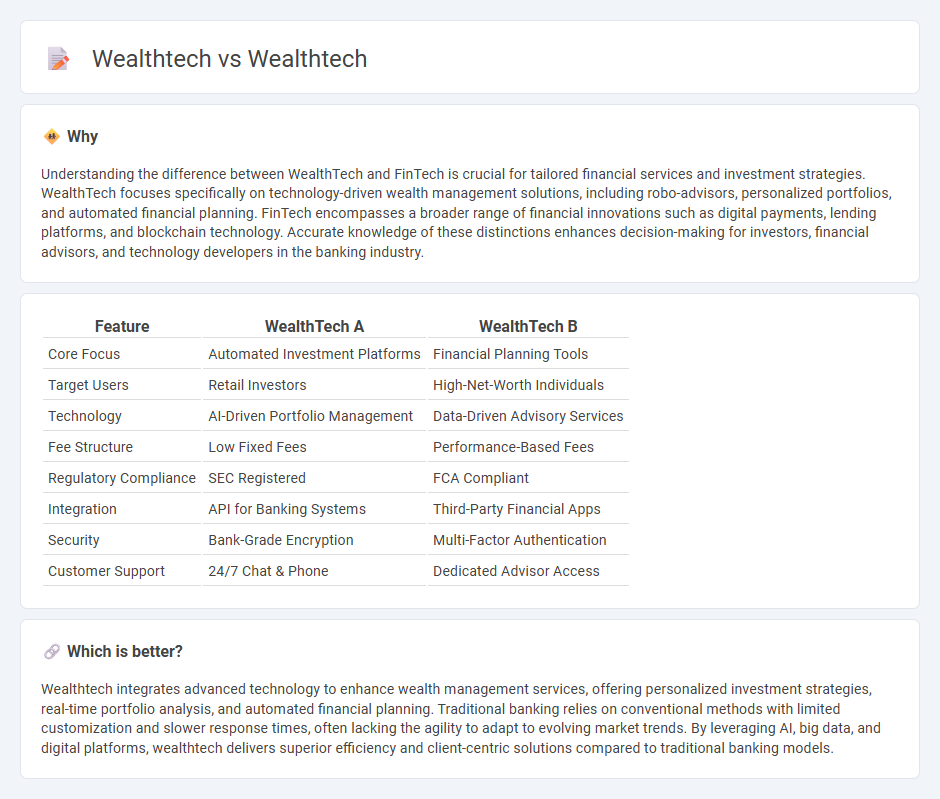

Understanding the difference between WealthTech and FinTech is crucial for tailored financial services and investment strategies. WealthTech focuses specifically on technology-driven wealth management solutions, including robo-advisors, personalized portfolios, and automated financial planning. FinTech encompasses a broader range of financial innovations such as digital payments, lending platforms, and blockchain technology. Accurate knowledge of these distinctions enhances decision-making for investors, financial advisors, and technology developers in the banking industry.

Comparison Table

| Feature | WealthTech A | WealthTech B |

|---|---|---|

| Core Focus | Automated Investment Platforms | Financial Planning Tools |

| Target Users | Retail Investors | High-Net-Worth Individuals |

| Technology | AI-Driven Portfolio Management | Data-Driven Advisory Services |

| Fee Structure | Low Fixed Fees | Performance-Based Fees |

| Regulatory Compliance | SEC Registered | FCA Compliant |

| Integration | API for Banking Systems | Third-Party Financial Apps |

| Security | Bank-Grade Encryption | Multi-Factor Authentication |

| Customer Support | 24/7 Chat & Phone | Dedicated Advisor Access |

Which is better?

Wealthtech integrates advanced technology to enhance wealth management services, offering personalized investment strategies, real-time portfolio analysis, and automated financial planning. Traditional banking relies on conventional methods with limited customization and slower response times, often lacking the agility to adapt to evolving market trends. By leveraging AI, big data, and digital platforms, wealthtech delivers superior efficiency and client-centric solutions compared to traditional banking models.

Connection

Wealthtech integrates technology-driven solutions to enhance wealth management, leveraging AI, big data, and automation to optimize investment strategies. Banking institutions adopt wealthtech platforms to provide personalized financial advisory, streamline asset management, and improve customer experience through seamless digital interfaces. This convergence enables banks to expand their service offerings, increase operational efficiency, and foster client loyalty in a competitive financial landscape.

Key Terms

Robo-advisors

Wealthtech innovations have reshaped investment management with robo-advisors offering algorithm-driven portfolio management, personalized asset allocation, and cost-effective financial advisory services. Leading platforms like Betterment, Wealthfront, and Schwab Intelligent Portfolios utilize AI and machine learning to optimize investment strategies and enhance user experience. Explore how robo-advisors are transforming wealth management and their impact on investor outcomes.

Digital asset management

Wealthtech solutions for digital asset management leverage AI-driven algorithms and blockchain integration to offer enhanced portfolio diversification and real-time transaction transparency. These platforms prioritize security through multi-layer encryption and provide users with seamless access to cryptocurrencies alongside traditional investments. Explore comprehensive comparisons to understand how different wealthtech providers innovate digital asset management and optimize client wealth growth.

Automated portfolio allocation

Automated portfolio allocation in wealthtech leverages advanced algorithms and AI to optimize investment strategies, reducing human error and enhancing personalization. Leading platforms integrate real-time market data and risk assessment models to continuously rebalance portfolios according to individual goals and market conditions. Explore how cutting-edge wealthtech solutions transform portfolio management for smarter, data-driven investing.

Source and External Links

Top Wealthtech Companies to Watch in 2025 - Wealthtech is a technology-driven approach to wealth management, using tools like AI and analytics to automate investing, budgeting, and financial planning for clients, making the process faster and more efficient.

WealthTec(r) - Technology Solutions For Financial & Estate Planning - WealthTec Suite is a wealth planning platform designed for mass affluent to ultra-high-net-worth individuals, providing integrated solutions for financial and estate planning.

WealthTech100 2025 - The WealthTech100 is an annual ranking of the 100 most innovative wealthtech companies globally, selected by industry experts to help financial leaders identify impactful digital wealth management and advisory solutions.

dowidth.com

dowidth.com