Credit builder cards help establish or improve credit scores by reporting payment history and typically feature lower limits to encourage responsible spending. Charge cards require full payment each month, often with no preset spending limit, catering to users with strong credit profiles and disciplined financial habits. Explore the key differences and benefits to find the ideal option for your financial goals.

Why it is important

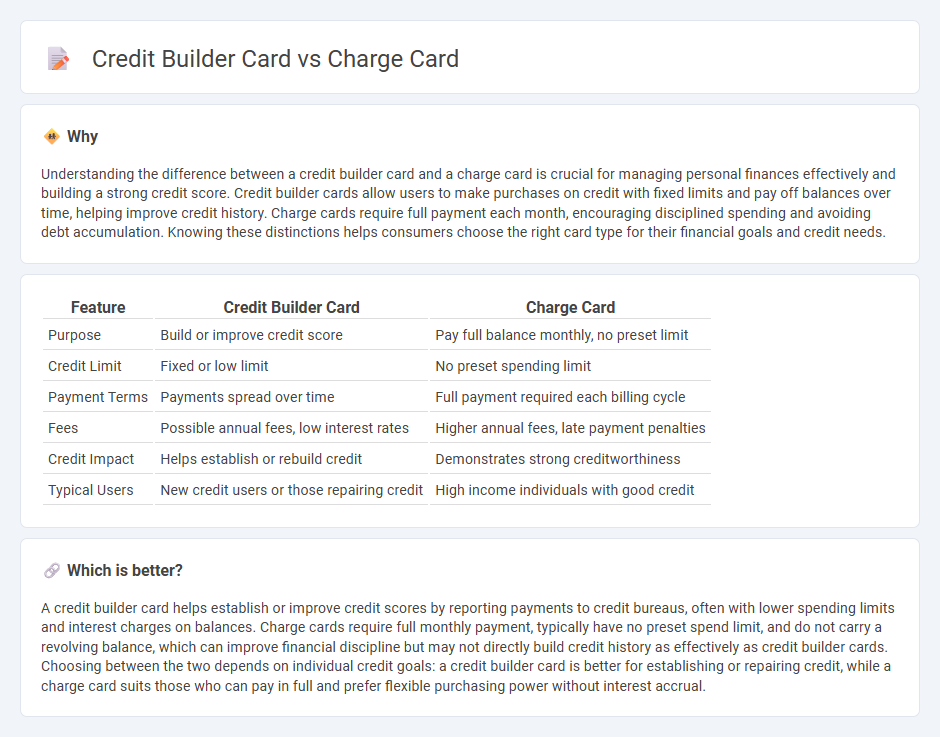

Understanding the difference between a credit builder card and a charge card is crucial for managing personal finances effectively and building a strong credit score. Credit builder cards allow users to make purchases on credit with fixed limits and pay off balances over time, helping improve credit history. Charge cards require full payment each month, encouraging disciplined spending and avoiding debt accumulation. Knowing these distinctions helps consumers choose the right card type for their financial goals and credit needs.

Comparison Table

| Feature | Credit Builder Card | Charge Card |

|---|---|---|

| Purpose | Build or improve credit score | Pay full balance monthly, no preset limit |

| Credit Limit | Fixed or low limit | No preset spending limit |

| Payment Terms | Payments spread over time | Full payment required each billing cycle |

| Fees | Possible annual fees, low interest rates | Higher annual fees, late payment penalties |

| Credit Impact | Helps establish or rebuild credit | Demonstrates strong creditworthiness |

| Typical Users | New credit users or those repairing credit | High income individuals with good credit |

Which is better?

A credit builder card helps establish or improve credit scores by reporting payments to credit bureaus, often with lower spending limits and interest charges on balances. Charge cards require full monthly payment, typically have no preset spend limit, and do not carry a revolving balance, which can improve financial discipline but may not directly build credit history as effectively as credit builder cards. Choosing between the two depends on individual credit goals: a credit builder card is better for establishing or repairing credit, while a charge card suits those who can pay in full and prefer flexible purchasing power without interest accrual.

Connection

Credit builder cards and charge cards are connected through their role in establishing and managing credit history, both requiring regular payments to maintain account health. Credit builder cards allow users to build or rebuild credit scores by reporting timely payments to credit bureaus, while charge cards require full monthly payment, helping cultivate disciplined financial habits. Both types of cards influence credit utilization and payment history, key factors in credit scoring models used by lenders.

Key Terms

Revolving Credit (Charge Card)

Charge cards require the full balance to be paid each month, promoting disciplined spending and avoiding revolving debt, while credit builder cards offer small credit limits and allow partial payments to establish or rebuild credit history. Revolving credit inherent in credit builder cards involves carrying a balance with interest, helping users demonstrate responsible credit management over time. Explore the features and benefits of both options to determine the best fit for your financial goals.

Credit Limit (Credit Builder Card)

Credit builder cards typically offer lower credit limits compared to charge cards, as they are designed to help individuals establish or improve their credit history with manageable spending boundaries. These credit limits are often set based on the cardholder's income and credit profile, ensuring responsible usage and gradual credit score improvement. Explore more about how credit limits impact your financial growth with credit builder cards.

Interest-Free Period (Charge Card)

Charge cards typically offer an interest-free period where the full balance must be paid monthly to avoid interest charges, unlike credit builder cards which often carry ongoing interest on balances. The interest-free period on charge cards can help users manage cash flow without accumulating debt if payments are made in full and on time. Explore detailed comparisons to better understand how interest-free periods impact your spending strategy.

Source and External Links

What Is a Charge Card? | Capital One - A charge card allows purchases without a preset spending limit but requires payment in full each month, typically with no interest but often high annual or late fees.

What Is A Charge Card? | American Express Australia - Charge cards offer flexible spending power with no pre-set limit and must be paid in full every month, eliminating interest charges but potentially incurring late fees.

Charge card - Wikipedia - Charge cards operate by requiring users to pay their balance monthly without interest, generating revenue mainly through merchant fees, and sometimes offering options to pay certain purchases over time.

dowidth.com

dowidth.com