RegTech focuses on leveraging advanced technologies like AI and blockchain to streamline regulatory compliance and risk management for financial institutions. BankTech encompasses a broader range of innovations, including digital banking, payment solutions, and customer experience enhancements within banks. Explore the nuances and impact of RegTech versus BankTech to understand the future of financial technology.

Why it is important

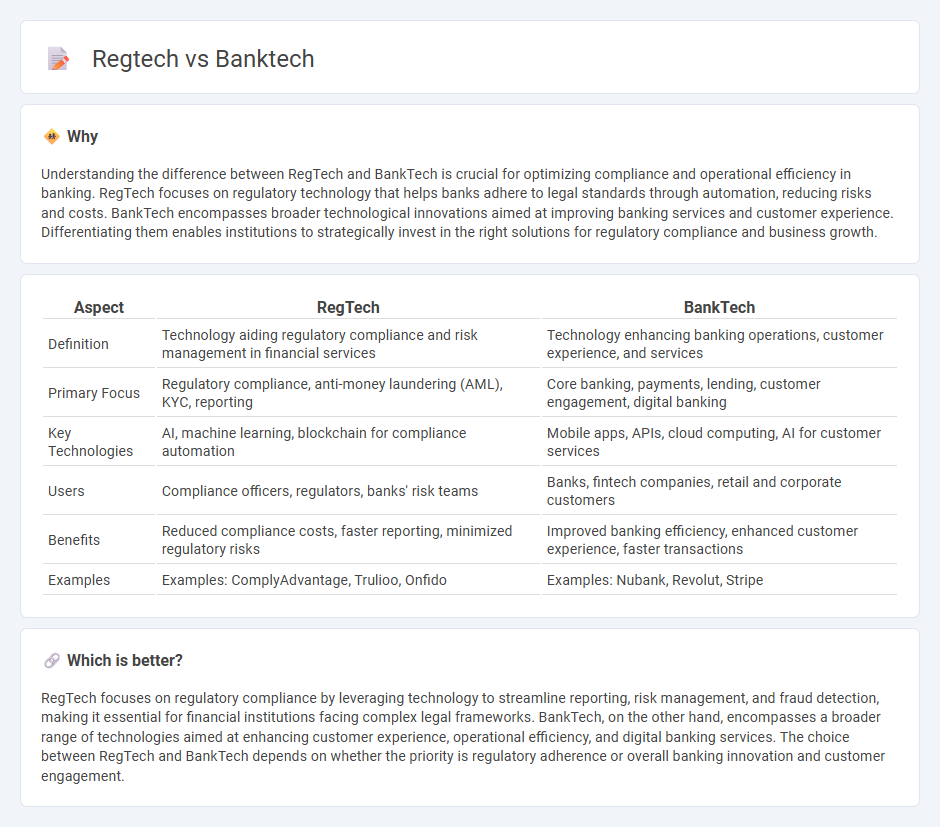

Understanding the difference between RegTech and BankTech is crucial for optimizing compliance and operational efficiency in banking. RegTech focuses on regulatory technology that helps banks adhere to legal standards through automation, reducing risks and costs. BankTech encompasses broader technological innovations aimed at improving banking services and customer experience. Differentiating them enables institutions to strategically invest in the right solutions for regulatory compliance and business growth.

Comparison Table

| Aspect | RegTech | BankTech |

|---|---|---|

| Definition | Technology aiding regulatory compliance and risk management in financial services | Technology enhancing banking operations, customer experience, and services |

| Primary Focus | Regulatory compliance, anti-money laundering (AML), KYC, reporting | Core banking, payments, lending, customer engagement, digital banking |

| Key Technologies | AI, machine learning, blockchain for compliance automation | Mobile apps, APIs, cloud computing, AI for customer services |

| Users | Compliance officers, regulators, banks' risk teams | Banks, fintech companies, retail and corporate customers |

| Benefits | Reduced compliance costs, faster reporting, minimized regulatory risks | Improved banking efficiency, enhanced customer experience, faster transactions |

| Examples | Examples: ComplyAdvantage, Trulioo, Onfido | Examples: Nubank, Revolut, Stripe |

Which is better?

RegTech focuses on regulatory compliance by leveraging technology to streamline reporting, risk management, and fraud detection, making it essential for financial institutions facing complex legal frameworks. BankTech, on the other hand, encompasses a broader range of technologies aimed at enhancing customer experience, operational efficiency, and digital banking services. The choice between RegTech and BankTech depends on whether the priority is regulatory adherence or overall banking innovation and customer engagement.

Connection

Regtech and banktech are interconnected through their shared goal of enhancing the banking industry's efficiency, security, and compliance. Regtech leverages advanced technologies like AI, machine learning, and big data analytics to automate regulatory compliance and risk management, directly supporting banktech solutions focused on improving banking operations and customer experience. Together, these technologies enable banks to streamline regulatory processes, reduce operational costs, and maintain robust security standards in a highly regulated financial environment.

Key Terms

Automation

Banktech emphasizes automation in core banking processes such as transaction processing and customer onboarding to enhance efficiency and reduce human errors. Regtech focuses on automating regulatory compliance tasks, including reporting, risk management, and anti-money laundering checks, to ensure adherence to complex legal frameworks. Explore detailed comparisons to understand how these technologies transform financial institutions.

Compliance

Banktech solutions streamline banking operations with technologies enhancing transaction security, data management, and customer experience, while regtech specifically targets regulatory compliance challenges through automated monitoring, reporting, and risk assessment tools. Focusing on compliance, regtech employs AI-driven analytics and machine learning to ensure adherence to evolving financial regulations, reducing the risk of penalties and operational inefficiencies in banks. Discover how integrating regtech tools can optimize your compliance processes and mitigate regulatory risks effectively.

Digital Transformation

Banktech leverages advanced technologies such as AI, blockchain, and cloud computing to enhance banking operations, improve customer experience, and drive digital transformation across financial services. Regtech focuses on automating regulatory compliance through real-time monitoring, risk management, and reporting, significantly reducing costs and mitigating compliance risks for financial institutions. Discover how digital transformation is reshaping the future of finance and compliance by learning more about the synergy between banktech and regtech.

Source and External Links

Bank Systems & Technology - A platform connecting the banking IT community with news on channels, payments, security, and compliance.

Banktech Software Services - Offers end-to-end implementation services for Temenos Products, focusing on agile digital transformation for banks.

BankTech - Provides banking technologies for business growth, including debit order collections and real-time verification services.

dowidth.com

dowidth.com