Hyperpersonalization leverages advanced data analytics and AI to tailor banking experiences uniquely to individual customer behaviors and preferences, enhancing engagement and satisfaction. Automated financial advice employs algorithms and machine learning to provide scalable, efficient, and consistent investment or financial planning recommendations across a broad user base. Discover how integrating these approaches can transform your banking strategy and client relationships.

Why it is important

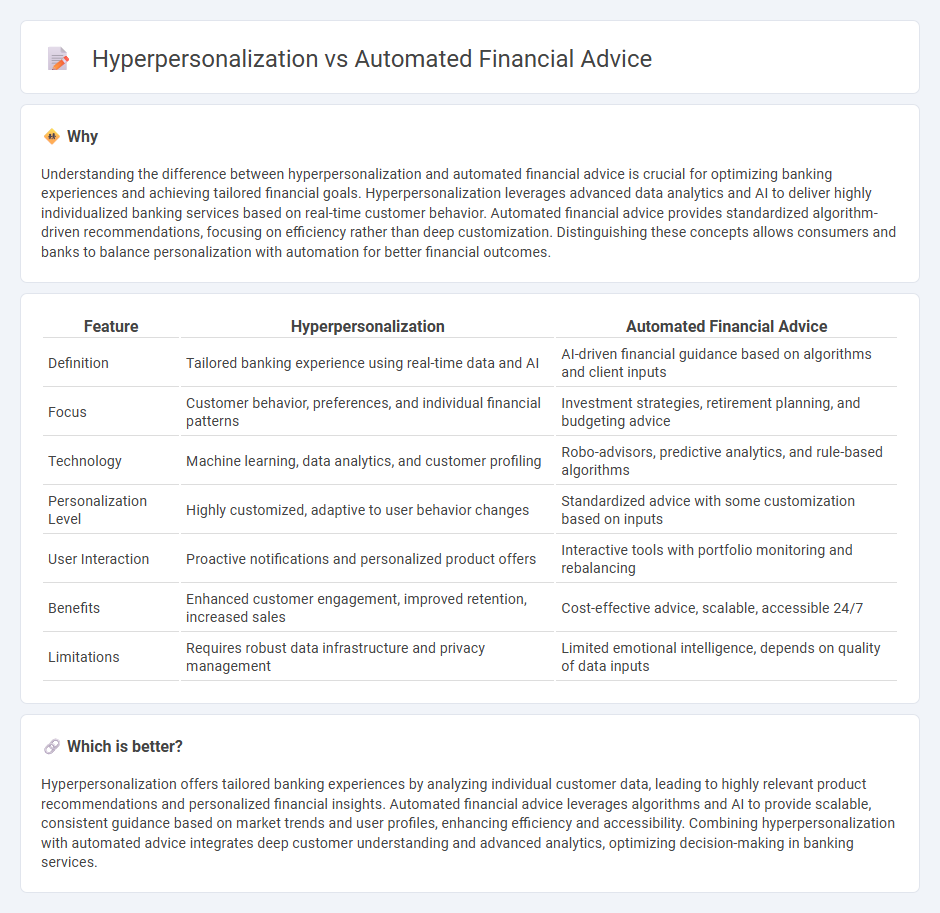

Understanding the difference between hyperpersonalization and automated financial advice is crucial for optimizing banking experiences and achieving tailored financial goals. Hyperpersonalization leverages advanced data analytics and AI to deliver highly individualized banking services based on real-time customer behavior. Automated financial advice provides standardized algorithm-driven recommendations, focusing on efficiency rather than deep customization. Distinguishing these concepts allows consumers and banks to balance personalization with automation for better financial outcomes.

Comparison Table

| Feature | Hyperpersonalization | Automated Financial Advice |

|---|---|---|

| Definition | Tailored banking experience using real-time data and AI | AI-driven financial guidance based on algorithms and client inputs |

| Focus | Customer behavior, preferences, and individual financial patterns | Investment strategies, retirement planning, and budgeting advice |

| Technology | Machine learning, data analytics, and customer profiling | Robo-advisors, predictive analytics, and rule-based algorithms |

| Personalization Level | Highly customized, adaptive to user behavior changes | Standardized advice with some customization based on inputs |

| User Interaction | Proactive notifications and personalized product offers | Interactive tools with portfolio monitoring and rebalancing |

| Benefits | Enhanced customer engagement, improved retention, increased sales | Cost-effective advice, scalable, accessible 24/7 |

| Limitations | Requires robust data infrastructure and privacy management | Limited emotional intelligence, depends on quality of data inputs |

Which is better?

Hyperpersonalization offers tailored banking experiences by analyzing individual customer data, leading to highly relevant product recommendations and personalized financial insights. Automated financial advice leverages algorithms and AI to provide scalable, consistent guidance based on market trends and user profiles, enhancing efficiency and accessibility. Combining hyperpersonalization with automated advice integrates deep customer understanding and advanced analytics, optimizing decision-making in banking services.

Connection

Hyperpersonalization in banking leverages customer data and artificial intelligence to deliver tailored financial products and services, enhancing client engagement and satisfaction. Automated financial advice uses algorithms and machine learning to provide real-time, personalized investment recommendations and financial planning aligned with individual goals. Together, these technologies create a seamless, data-driven customer experience that optimizes financial decision-making and loyalty.

Key Terms

Robo-advisors

Robo-advisors leverage automated financial advice algorithms to deliver efficient portfolio management based on clients' risk tolerance and investment goals. Hyperpersonalization enhances this approach by integrating real-time data, behavioral insights, and individual preferences to tailor financial strategies uniquely for each user. Explore how cutting-edge robo-advisor platforms are revolutionizing investment personalization.

AI-driven analytics

AI-driven analytics enhance automated financial advice by delivering data-backed investment strategies through machine learning algorithms and real-time market analysis. Hyperpersonalization leverages AI to tailor financial recommendations based on individual behavior, preferences, and risk profiles, creating highly customized customer experiences. Discover how integrating these technologies can revolutionize your financial planning approach.

Customer segmentation

Automated financial advice leverages algorithm-driven customer segmentation to deliver scalable investment recommendations, using basic demographic and behavioral data to create broad client profiles. Hyperpersonalization advances this approach by integrating real-time data, AI, and machine learning to tailor financial advice at an individual level, capturing nuanced preferences and life events for precise targeting. Explore how these innovations reshape customer segmentation strategies and enhance financial service personalization.

Source and External Links

What is a robo advisor? - Robo advisors are digital financial services that use technology to automate investing based on an individual's goals and preferences, offering a cost-effective alternative to traditional investment management.

Best Robo-Advisors - Robo-advisors automate investment management using algorithms to build and maintain portfolios suited to one's goals and risk tolerance, often with lower fees and minimal human interaction.

Robo-Advisor - Vanguard's robo-advisor service uses algorithms to provide automated investment management, offering features like portfolio rebalancing and access to high-quality investments through Vanguard ETFs.

dowidth.com

dowidth.com