Neo brokerage platforms offer low-cost, digital-first trading services focused on individual investors seeking intuitive interfaces and real-time market access. Wealth management provides comprehensive financial planning, investment advisory, and personalized portfolio strategies tailored for high-net-worth clients prioritizing long-term growth and risk management. Explore the key differences to determine which financial service aligns best with your investment goals.

Why it is important

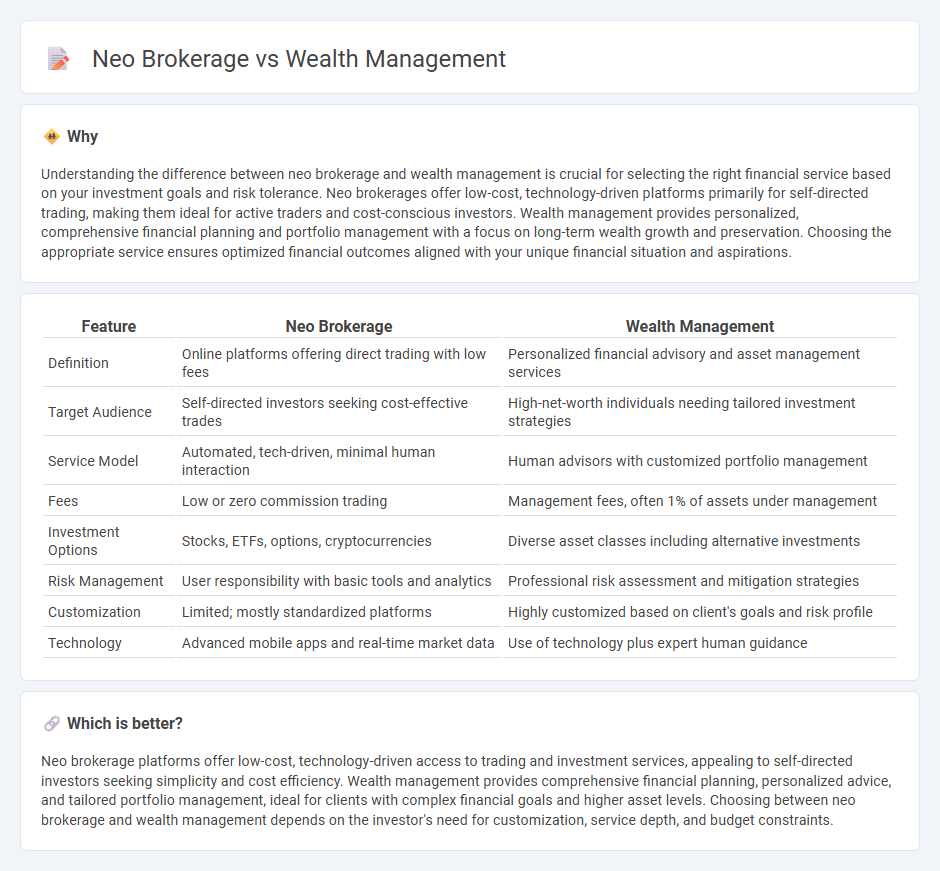

Understanding the difference between neo brokerage and wealth management is crucial for selecting the right financial service based on your investment goals and risk tolerance. Neo brokerages offer low-cost, technology-driven platforms primarily for self-directed trading, making them ideal for active traders and cost-conscious investors. Wealth management provides personalized, comprehensive financial planning and portfolio management with a focus on long-term wealth growth and preservation. Choosing the appropriate service ensures optimized financial outcomes aligned with your unique financial situation and aspirations.

Comparison Table

| Feature | Neo Brokerage | Wealth Management |

|---|---|---|

| Definition | Online platforms offering direct trading with low fees | Personalized financial advisory and asset management services |

| Target Audience | Self-directed investors seeking cost-effective trades | High-net-worth individuals needing tailored investment strategies |

| Service Model | Automated, tech-driven, minimal human interaction | Human advisors with customized portfolio management |

| Fees | Low or zero commission trading | Management fees, often 1% of assets under management |

| Investment Options | Stocks, ETFs, options, cryptocurrencies | Diverse asset classes including alternative investments |

| Risk Management | User responsibility with basic tools and analytics | Professional risk assessment and mitigation strategies |

| Customization | Limited; mostly standardized platforms | Highly customized based on client's goals and risk profile |

| Technology | Advanced mobile apps and real-time market data | Use of technology plus expert human guidance |

Which is better?

Neo brokerage platforms offer low-cost, technology-driven access to trading and investment services, appealing to self-directed investors seeking simplicity and cost efficiency. Wealth management provides comprehensive financial planning, personalized advice, and tailored portfolio management, ideal for clients with complex financial goals and higher asset levels. Choosing between neo brokerage and wealth management depends on the investor's need for customization, service depth, and budget constraints.

Connection

Neo brokerage platforms leverage advanced technology and low-cost trading options to attract a broader client base, which seamlessly integrates with wealth management services focused on personalized financial planning and asset allocation. This synergy allows users to execute trades effortlessly while benefiting from tailored investment strategies managed through unified digital interfaces. The combination enhances client engagement by providing comprehensive financial solutions encompassing both self-directed trading and professional wealth management.

Key Terms

**Wealth Management:**

Wealth management offers personalized financial planning, investment advisory, and holistic asset management tailored to high-net-worth individuals, emphasizing long-term wealth preservation and growth. Services include tax optimization, estate planning, retirement strategies, and access to exclusive investment opportunities, leveraging expert financial advisors. Discover how wealth management can strategically enhance your financial future with comprehensive support and customized solutions.

Asset Allocation

Wealth management offers personalized asset allocation strategies tailored to high-net-worth individuals, emphasizing diversification across equities, fixed income, real estate, and alternative investments. Neo brokerages provide user-friendly platforms with algorithm-driven asset allocation, catering to retail investors seeking low-cost, automated portfolio management. Explore the distinct advantages of each approach to optimize your investment strategy.

Financial Planning

Wealth management emphasizes comprehensive financial planning, including investment strategies, retirement planning, tax optimization, and estate planning tailored to high-net-worth individuals. Neo brokerages offer streamlined, tech-driven platforms focusing primarily on execution and lower-cost trading but typically lack personalized financial planning services. Explore our detailed comparison to understand which option aligns best with your financial goals.

Source and External Links

Wealth management - Wikipedia - Wealth management involves structuring and planning wealth to grow, preserve, and protect assets, often catering to high-net-worth clients with services like estate planning, tax strategies, and business succession planning.

Wealth Management | Personalized Wealth Planning | Fidelity - Fidelity offers personalized wealth planning and investment management through dedicated advisors, focusing on comprehensive financial goals like retirement, estate, tax, and healthcare cost management.

RBC Wealth Management - RBC provides tailored wealth management strategies that help clients grow, protect, and transfer wealth, focusing on family legacy, philanthropy, and financial goals for today and the future.

dowidth.com

dowidth.com