Synthetic identity fraud involves creating fictitious identities using real and fabricated information to defraud financial institutions, while friendly fraud occurs when legitimate customers dispute legitimate transactions, causing losses to banks. Both types of fraud pose significant risks to banking security, with synthetic fraud often harder to detect due to its fabricated nature and friendly fraud impacting customer trust and transaction integrity. Explore comprehensive strategies to combat synthetic and friendly fraud in banking systems.

Why it is important

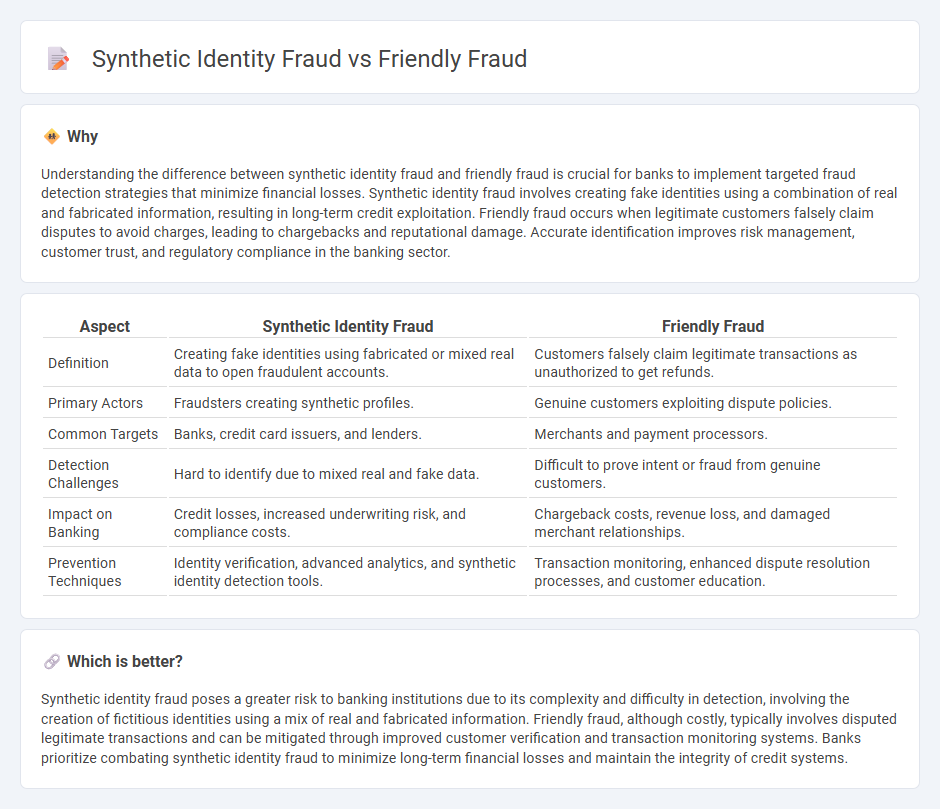

Understanding the difference between synthetic identity fraud and friendly fraud is crucial for banks to implement targeted fraud detection strategies that minimize financial losses. Synthetic identity fraud involves creating fake identities using a combination of real and fabricated information, resulting in long-term credit exploitation. Friendly fraud occurs when legitimate customers falsely claim disputes to avoid charges, leading to chargebacks and reputational damage. Accurate identification improves risk management, customer trust, and regulatory compliance in the banking sector.

Comparison Table

| Aspect | Synthetic Identity Fraud | Friendly Fraud |

|---|---|---|

| Definition | Creating fake identities using fabricated or mixed real data to open fraudulent accounts. | Customers falsely claim legitimate transactions as unauthorized to get refunds. |

| Primary Actors | Fraudsters creating synthetic profiles. | Genuine customers exploiting dispute policies. |

| Common Targets | Banks, credit card issuers, and lenders. | Merchants and payment processors. |

| Detection Challenges | Hard to identify due to mixed real and fake data. | Difficult to prove intent or fraud from genuine customers. |

| Impact on Banking | Credit losses, increased underwriting risk, and compliance costs. | Chargeback costs, revenue loss, and damaged merchant relationships. |

| Prevention Techniques | Identity verification, advanced analytics, and synthetic identity detection tools. | Transaction monitoring, enhanced dispute resolution processes, and customer education. |

Which is better?

Synthetic identity fraud poses a greater risk to banking institutions due to its complexity and difficulty in detection, involving the creation of fictitious identities using a mix of real and fabricated information. Friendly fraud, although costly, typically involves disputed legitimate transactions and can be mitigated through improved customer verification and transaction monitoring systems. Banks prioritize combating synthetic identity fraud to minimize long-term financial losses and maintain the integrity of credit systems.

Connection

Synthetic identity fraud and friendly fraud both exploit banking systems by manipulating identity verification and transaction legitimacy. Synthetic identity fraud creates artificial identities using real and fake data to open accounts and conduct fraudulent activities, while friendly fraud involves legitimate account holders disputing authorized transactions to receive unauthorized refunds. Both fraud types undermine bank security measures, increase financial losses, and complicate fraud detection efforts.

Key Terms

Chargeback

Chargeback disputes in friendly fraud arise when customers falsely claim unauthorized transactions to avoid payment, causing losses for merchants. In synthetic identity fraud, fraudsters use fabricated identities to make fraudulent purchases, leading to chargebacks that result in significant financial damage and increased risk for credit issuers. Explore deeper insights into chargeback prevention strategies for both fraud types to protect revenue and reduce fraud liability.

Account Takeover

Account Takeover (ATO) is a critical aspect where friendly fraud and synthetic identity fraud diverge significantly; friendly fraud involves legitimate users mistakenly or intentionally disputing charges, whereas synthetic identity fraud leverages fabricated identities to hijack accounts and commit financial crimes. In synthetic identity fraud, fraudsters exploit stolen personal information combined with fictitious data to bypass security measures, making ATO detection complex for financial institutions. Explore more about how these fraud types impact cybersecurity strategies and fraud prevention techniques.

Identity Fabrication

Friendly fraud occurs when legitimate customers dispute valid transactions, exploiting chargeback policies to falsely claim non-receipt or dissatisfaction. Synthetic identity fraud involves assembling fake identities using a combination of real and fabricated personal information to create new, nonexistent personas for financial crimes. Explore further to understand the nuances and prevention techniques of identity fabrication in fraud schemes.

Source and External Links

What is friendly fraud? - Mastercard - Friendly fraud, also called chargeback fraud, happens when a cardholder disputes a legitimate purchase as fraudulent, often due to transaction confusion or unauthorized use within their household, and accounts for up to 70% of credit card fraud costing over $132 billion annually.

What is friendly fraud? Chargeback fraud explained - Stripe - Friendly fraud occurs when a customer disputes an authentic charge, often caused by forgetfulness, misunderstandings, unauthorized use, or buyer's remorse, making it distinct from traditional third-party fraud.

Friendly Fraud Definition - FraudNet - Friendly fraud typically involves customers unintentionally disputing legitimate transactions due to misunderstandings or forgotten purchases, resulting in chargebacks that impose financial and operational strains on merchants.

dowidth.com

dowidth.com