Hyperpersonalization in banking leverages advanced data analytics and AI to tailor financial products and services to individual customer preferences and behaviors, enhancing customer engagement and satisfaction. Mass customization, by contrast, offers adaptable but generalized solutions designed to meet the needs of broader customer segments more efficiently. Discover how these strategies revolutionize customer experience and drive growth in the banking sector.

Why it is important

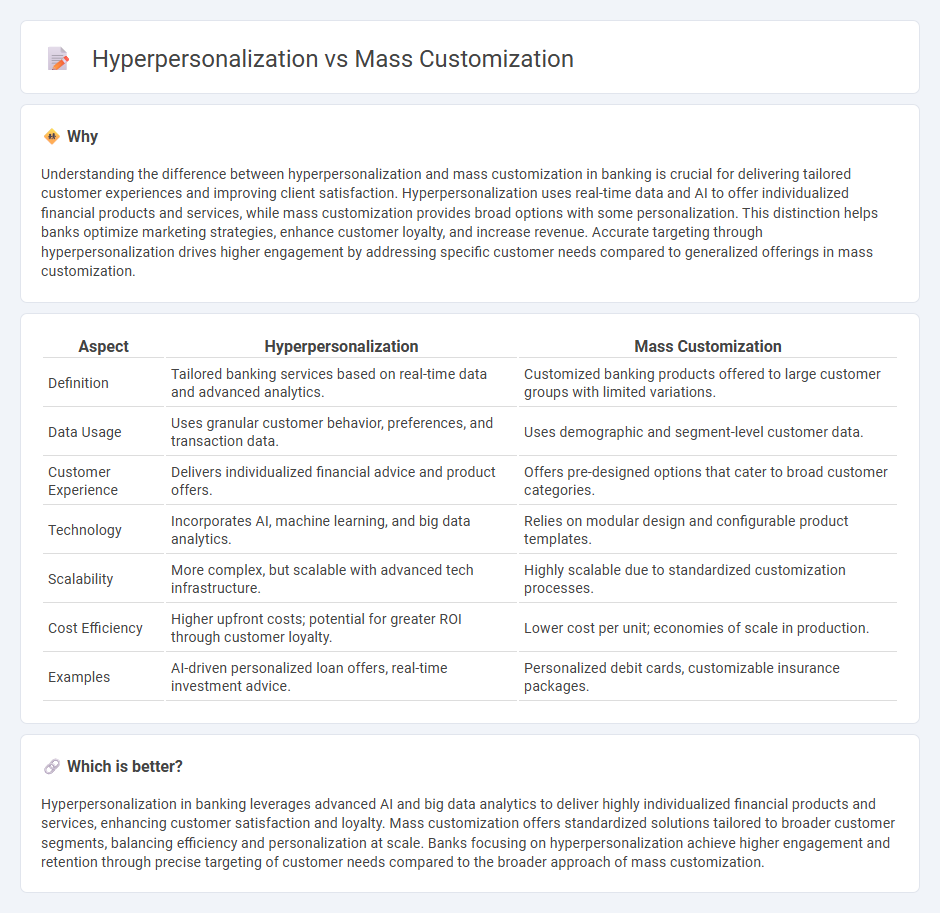

Understanding the difference between hyperpersonalization and mass customization in banking is crucial for delivering tailored customer experiences and improving client satisfaction. Hyperpersonalization uses real-time data and AI to offer individualized financial products and services, while mass customization provides broad options with some personalization. This distinction helps banks optimize marketing strategies, enhance customer loyalty, and increase revenue. Accurate targeting through hyperpersonalization drives higher engagement by addressing specific customer needs compared to generalized offerings in mass customization.

Comparison Table

| Aspect | Hyperpersonalization | Mass Customization |

|---|---|---|

| Definition | Tailored banking services based on real-time data and advanced analytics. | Customized banking products offered to large customer groups with limited variations. |

| Data Usage | Uses granular customer behavior, preferences, and transaction data. | Uses demographic and segment-level customer data. |

| Customer Experience | Delivers individualized financial advice and product offers. | Offers pre-designed options that cater to broad customer categories. |

| Technology | Incorporates AI, machine learning, and big data analytics. | Relies on modular design and configurable product templates. |

| Scalability | More complex, but scalable with advanced tech infrastructure. | Highly scalable due to standardized customization processes. |

| Cost Efficiency | Higher upfront costs; potential for greater ROI through customer loyalty. | Lower cost per unit; economies of scale in production. |

| Examples | AI-driven personalized loan offers, real-time investment advice. | Personalized debit cards, customizable insurance packages. |

Which is better?

Hyperpersonalization in banking leverages advanced AI and big data analytics to deliver highly individualized financial products and services, enhancing customer satisfaction and loyalty. Mass customization offers standardized solutions tailored to broader customer segments, balancing efficiency and personalization at scale. Banks focusing on hyperpersonalization achieve higher engagement and retention through precise targeting of customer needs compared to the broader approach of mass customization.

Connection

Hyperpersonalization in banking uses advanced data analytics and AI to deliver individually tailored financial products and services, enhancing customer engagement and satisfaction. Mass customization leverages technological platforms to efficiently produce personalized banking solutions at scale, blending the benefits of personalization with economies of scale. Together, they enable banks to meet diverse customer needs with precision while optimizing operational efficiency and competitive advantage.

Key Terms

Customer Segmentation

Mass customization tailors products to broad customer segments by combining standard components with flexible options, optimizing economies of scale while addressing varied preferences. Hyperpersonalization leverages real-time data analytics and AI to deliver individualized experiences and offers based on unique customer behavior, preferences, and context. Discover how these approaches transform customer segmentation strategies for enhanced engagement and loyalty.

Data Analytics

Mass customization leverages customer segmentation and predictive analytics to tailor products for broad market segments, balancing personalization with scalability. Hyperpersonalization employs real-time data analytics, machine learning, and behavioral insights to deliver highly individualized experiences and product recommendations on a one-to-one basis. Explore how advanced data analytics transform these strategies for optimized customer engagement and business growth.

Real-time Personalization

Mass customization tailors products to large customer segments using predefined options, while hyperpersonalization leverages real-time data and AI to deliver individualized experiences at the moment of engagement. Real-time personalization dynamically adjusts content, offers, and recommendations based on current user behavior, location, and preferences, enhancing relevance and conversion rates. Explore how real-time personalization can transform your customer interactions and drive business growth.

Source and External Links

Mass Customization: A Complete Guide - This guide details strategies for implementing mass customization, including setting clear goals, understanding customer needs, and leveraging technology for scalability and automation.

Guide to Mass Customization - This guide explores the concept of mass customization through types such as collaborative and adaptive customization, illustrating how businesses can balance personalization with mass production efficiency.

Mass Customization - This Wikipedia entry provides an overview of mass customization as a business strategy combining the cost-effectiveness of mass production with the flexibility of individual customization, using computer-aided systems for a wide range of industries.

dowidth.com

dowidth.com