Cloud migration in banking involves transferring legacy systems to cloud infrastructure to enhance scalability, reduce costs, and improve data security. Banking-as-a-Service (BaaS) enables third-party providers to embed fully licensed banking capabilities via APIs, accelerating innovation and customer experience. Discover more about how these transformative approaches are reshaping the financial landscape.

Why it is important

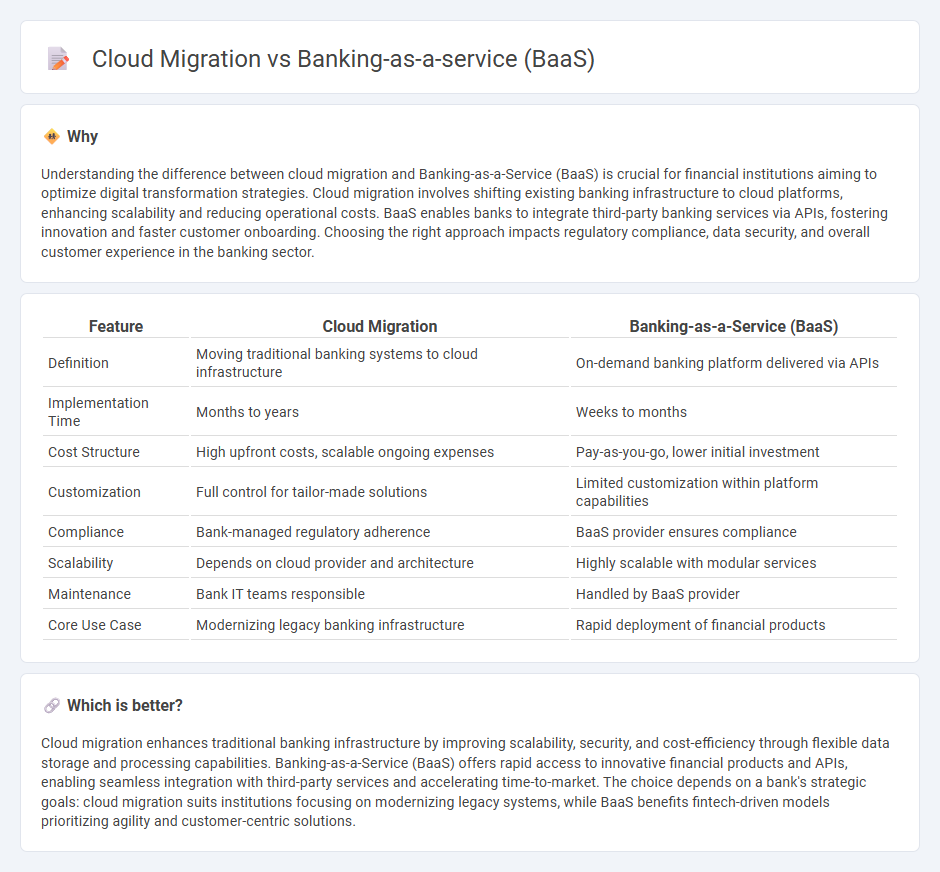

Understanding the difference between cloud migration and Banking-as-a-Service (BaaS) is crucial for financial institutions aiming to optimize digital transformation strategies. Cloud migration involves shifting existing banking infrastructure to cloud platforms, enhancing scalability and reducing operational costs. BaaS enables banks to integrate third-party banking services via APIs, fostering innovation and faster customer onboarding. Choosing the right approach impacts regulatory compliance, data security, and overall customer experience in the banking sector.

Comparison Table

| Feature | Cloud Migration | Banking-as-a-Service (BaaS) |

|---|---|---|

| Definition | Moving traditional banking systems to cloud infrastructure | On-demand banking platform delivered via APIs |

| Implementation Time | Months to years | Weeks to months |

| Cost Structure | High upfront costs, scalable ongoing expenses | Pay-as-you-go, lower initial investment |

| Customization | Full control for tailor-made solutions | Limited customization within platform capabilities |

| Compliance | Bank-managed regulatory adherence | BaaS provider ensures compliance |

| Scalability | Depends on cloud provider and architecture | Highly scalable with modular services |

| Maintenance | Bank IT teams responsible | Handled by BaaS provider |

| Core Use Case | Modernizing legacy banking infrastructure | Rapid deployment of financial products |

Which is better?

Cloud migration enhances traditional banking infrastructure by improving scalability, security, and cost-efficiency through flexible data storage and processing capabilities. Banking-as-a-Service (BaaS) offers rapid access to innovative financial products and APIs, enabling seamless integration with third-party services and accelerating time-to-market. The choice depends on a bank's strategic goals: cloud migration suits institutions focusing on modernizing legacy systems, while BaaS benefits fintech-driven models prioritizing agility and customer-centric solutions.

Connection

Cloud migration enables banks to shift their core operations and data to scalable, secure cloud platforms, enhancing agility and cost efficiency. Banking-as-a-Service (BaaS) leverages this cloud infrastructure to offer modular financial services through APIs, allowing non-bank businesses to embed banking functionalities seamlessly. The integration of cloud migration and BaaS accelerates innovation, improves customer experience, and supports rapid deployment of personalized financial products.

Key Terms

API integration

Banking-as-a-Service (BaaS) leverages API integration to enable fintech companies and third-party developers to embed financial services directly into their platforms, streamlining access to banking products. Cloud migration involves transferring legacy banking infrastructure to cloud environments, enhancing scalability, security, and operational efficiency through API-driven microservices. Explore deeper insights on how API integration transforms financial services by bridging BaaS and cloud migration strategies.

Core banking systems

Core banking systems benefit significantly from Banking-as-a-Service (BaaS) by enabling seamless integration of third-party financial services through APIs, accelerating digital innovation and reducing time-to-market. Cloud migration of core banking shifts traditional systems to scalable, secure cloud environments, enhancing operational resilience and agility. Explore how combining BaaS with cloud strategies can future-proof core banking infrastructure and drive competitive advantage.

Data residency

Banking-as-a-Service (BaaS) platforms often prioritize compliance with strict data residency requirements by leveraging localized data centers to ensure sensitive financial data remains within specific jurisdictions. In contrast, cloud migration strategies may face challenges balancing scalability and flexibility with regulatory mandates on data residency, requiring robust data governance frameworks and encryption techniques. Explore how these approaches impact your institution's compliance and operational efficiency in-depth.

Source and External Links

Banking as a Service (BaaS) Examples and FAQs - This article provides an in-depth look at how BaaS allows non-bank entities to embed financial services into their offerings via API integrations with licensed banks.

A Primer on Banking-as-a-Service - This primer explains BaaS as a model where licensed banks and FinTech firms deliver banking infrastructure and services to third-party businesses through APIs, enabling them to offer financial services without a banking license.

Tech Translated: Banking as a Service (BaaS) - This resource details how BaaS providers act as the backend for non-banking companies, managing regulatory compliance and security, allowing these companies to offer financial services under their own brand.

dowidth.com

dowidth.com