Sustainable investing prioritizes environmental, social, and governance (ESG) criteria to generate long-term financial returns while supporting ethical business practices. Mission-related investing aligns capital deployment directly with an organization's core values and social or environmental goals, often involving targeted impact objectives. Discover the key distinctions and benefits of each approach to optimize your investment strategy.

Why it is important

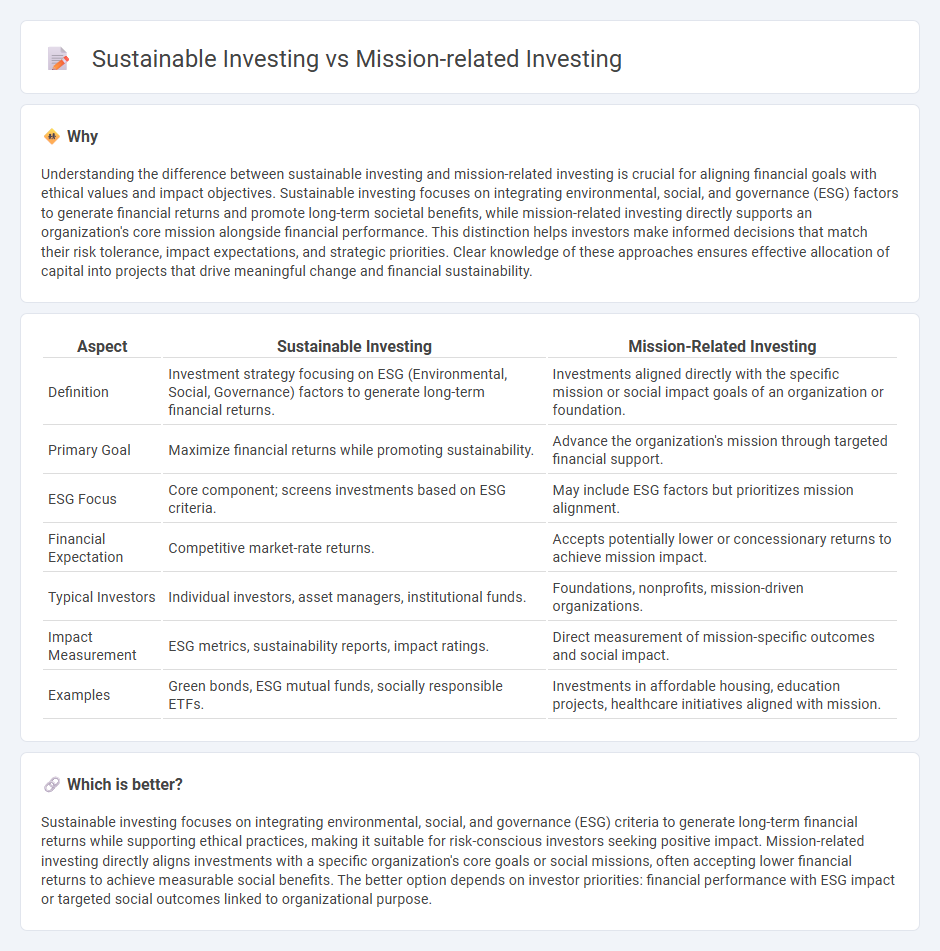

Understanding the difference between sustainable investing and mission-related investing is crucial for aligning financial goals with ethical values and impact objectives. Sustainable investing focuses on integrating environmental, social, and governance (ESG) factors to generate financial returns and promote long-term societal benefits, while mission-related investing directly supports an organization's core mission alongside financial performance. This distinction helps investors make informed decisions that match their risk tolerance, impact expectations, and strategic priorities. Clear knowledge of these approaches ensures effective allocation of capital into projects that drive meaningful change and financial sustainability.

Comparison Table

| Aspect | Sustainable Investing | Mission-Related Investing |

|---|---|---|

| Definition | Investment strategy focusing on ESG (Environmental, Social, Governance) factors to generate long-term financial returns. | Investments aligned directly with the specific mission or social impact goals of an organization or foundation. |

| Primary Goal | Maximize financial returns while promoting sustainability. | Advance the organization's mission through targeted financial support. |

| ESG Focus | Core component; screens investments based on ESG criteria. | May include ESG factors but prioritizes mission alignment. |

| Financial Expectation | Competitive market-rate returns. | Accepts potentially lower or concessionary returns to achieve mission impact. |

| Typical Investors | Individual investors, asset managers, institutional funds. | Foundations, nonprofits, mission-driven organizations. |

| Impact Measurement | ESG metrics, sustainability reports, impact ratings. | Direct measurement of mission-specific outcomes and social impact. |

| Examples | Green bonds, ESG mutual funds, socially responsible ETFs. | Investments in affordable housing, education projects, healthcare initiatives aligned with mission. |

Which is better?

Sustainable investing focuses on integrating environmental, social, and governance (ESG) criteria to generate long-term financial returns while supporting ethical practices, making it suitable for risk-conscious investors seeking positive impact. Mission-related investing directly aligns investments with a specific organization's core goals or social missions, often accepting lower financial returns to achieve measurable social benefits. The better option depends on investor priorities: financial performance with ESG impact or targeted social outcomes linked to organizational purpose.

Connection

Sustainable investing and mission-related investing both prioritize environmental, social, and governance (ESG) criteria to generate positive societal impact alongside financial returns. Banks increasingly integrate these approaches by funding projects that align with sustainability goals and their core mission, ensuring investments support long-term ethical practices. This synergy drives responsible banking strategies that foster economic growth while addressing global challenges like climate change and social inequality.

Key Terms

Impact Measurement

Mission-related investing prioritizes financial returns while aligning investments with the organization's core mission, emphasizing measurable social and environmental outcomes through specific impact metrics. Sustainable investing integrates environmental, social, and governance (ESG) criteria to manage risks and generate long-term value, often using broad sustainability benchmarks for impact measurement. Explore further to understand how tailored impact assessment frameworks differentiate these approaches and drive effective investment strategies.

Environmental, Social, and Governance (ESG) Criteria

Mission-related investing (MRI) integrates specific organizational missions with investment goals, often targeting social impact alongside financial returns, while sustainable investing broadly emphasizes Environmental, Social, and Governance (ESG) criteria to minimize risk and promote corporate responsibility. MRI typically aligns investments with a nonprofit's core values or community objectives, whereas sustainable investing uses ESG factors as benchmarks to evaluate companies' long-term sustainability and ethical practices. Explore the detailed distinctions and benefits of each approach to optimize your investment strategy.

Fiduciary Duty

Mission-related investing integrates social and environmental goals directly into fiduciary duty, emphasizing measurable impact alongside financial returns. Sustainable investing prioritizes long-term value by incorporating environmental, social, and governance (ESG) factors to mitigate risks and enhance profitability. Explore how aligning fiduciary duties with ethical investing strategies reshapes portfolio management and stewardship principles.

Source and External Links

New Frontiers in Mission-Related Investing - The F.B. Heron Foundation focuses on mission-related investing to align investments with philanthropic goals, aiming to increase social and community benefits while managing risks.

Mission Investing * The David and Lucile Packard Foundation - This foundation uses mission investing to maximize social and environmental impact through loans and equity investments, complementing their grantmaking efforts with a dedicated endowment.

The Rockefeller Foundation Mission-Related Investing - The Rockefeller Foundation pioneers impact investing, using its endowment to support both profit and social or environmental impact, evolving its strategies to align with its mission.

dowidth.com

dowidth.com