Virtual cards offer enhanced security with unique, temporary card numbers ideal for online purchases, reducing fraud risk compared to traditional debit cards linked directly to your bank account. Debit cards provide widespread acceptance for in-person and ATM transactions, allowing instant access to funds and real-time balance tracking. Discover more about how virtual and debit cards can optimize your banking experience.

Why it is important

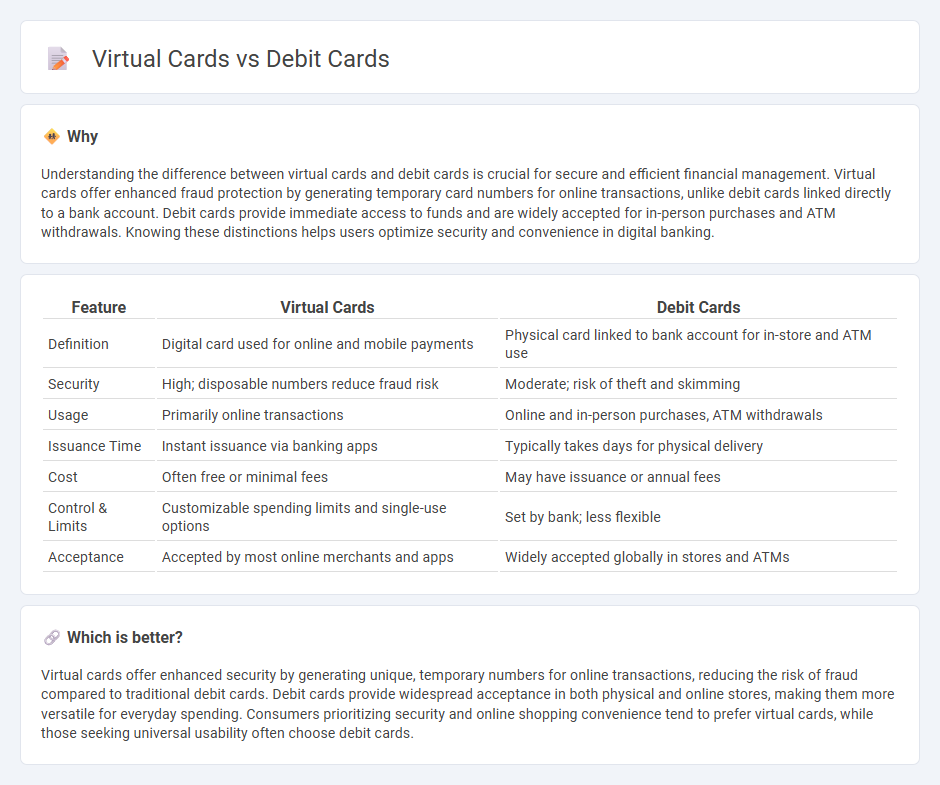

Understanding the difference between virtual cards and debit cards is crucial for secure and efficient financial management. Virtual cards offer enhanced fraud protection by generating temporary card numbers for online transactions, unlike debit cards linked directly to a bank account. Debit cards provide immediate access to funds and are widely accepted for in-person purchases and ATM withdrawals. Knowing these distinctions helps users optimize security and convenience in digital banking.

Comparison Table

| Feature | Virtual Cards | Debit Cards |

|---|---|---|

| Definition | Digital card used for online and mobile payments | Physical card linked to bank account for in-store and ATM use |

| Security | High; disposable numbers reduce fraud risk | Moderate; risk of theft and skimming |

| Usage | Primarily online transactions | Online and in-person purchases, ATM withdrawals |

| Issuance Time | Instant issuance via banking apps | Typically takes days for physical delivery |

| Cost | Often free or minimal fees | May have issuance or annual fees |

| Control & Limits | Customizable spending limits and single-use options | Set by bank; less flexible |

| Acceptance | Accepted by most online merchants and apps | Widely accepted globally in stores and ATMs |

Which is better?

Virtual cards offer enhanced security by generating unique, temporary numbers for online transactions, reducing the risk of fraud compared to traditional debit cards. Debit cards provide widespread acceptance in both physical and online stores, making them more versatile for everyday spending. Consumers prioritizing security and online shopping convenience tend to prefer virtual cards, while those seeking universal usability often choose debit cards.

Connection

Virtual cards and debit cards share a direct connection through their linkage to the same underlying bank account, allowing users to manage funds seamlessly across both platforms. Virtual cards provide a secure, digital alternative for online transactions by generating temporary card numbers tied to the debit card's actual account, minimizing fraud risk. This integration enhances financial control, enabling real-time spending monitoring and instant transaction alerts linked to the debit card's balance.

Key Terms

Physical Card

Physical debit cards provide tangible access to funds with features like EMV chips for secure transactions and widespread acceptance at ATMs, retailers, and online platforms. They offer real-world usability, including contactless payments and cash withdrawals, which virtual cards cannot perform. Explore the full advantages and differences between debit and virtual cards to determine the best choice for your financial needs.

Digital Wallet

Debit cards linked to digital wallets enable seamless, secure payments by storing card information electronically, reducing the need for physical cards during transactions. Virtual cards, created through digital wallets, provide enhanced security by generating unique card numbers for each transaction, minimizing fraud risks. Explore the benefits and smart uses of digital wallets integrating both debit and virtual cards to optimize your payment experience.

Security Features

Debit cards offer security features such as PIN protection, EMV chip technology, and fraud monitoring services to safeguard transactions and minimize unauthorized access. Virtual cards enhance security by generating temporary card numbers linked to your primary account, reducing the risk of exposing actual card details during online purchases and providing easy control over spending limits. Discover more about how these security features impact your financial safety and which option suits your needs.

Source and External Links

Using Debit Cards - A debit card lets you pay directly with money in your checking account without borrowing, unlike credit cards, and can be used for purchases, getting cash back, and ATM withdrawals.

Debit card - Debit cards are payment cards processed via systems like EFTPOS, offline debit, or electronic purse, often dual-branded and accepted worldwide through networks like Visa and Mastercard.

Debit cards - better than cash | Apply online - Debit cards provide easy access to your checking account funds for everyday and online purchases, require a PIN or signature for transactions, and include security features like CVV codes.

dowidth.com

dowidth.com