Hyperpersonalization in banking uses advanced data analytics and AI to deliver customized financial products and services tailored to individual customer behaviors and preferences. Contextual banking focuses on providing relevant banking interactions based on the customer's current situation, location, or activity to enhance convenience and engagement. Explore how these innovative approaches transform customer experiences and drive better financial outcomes.

Why it is important

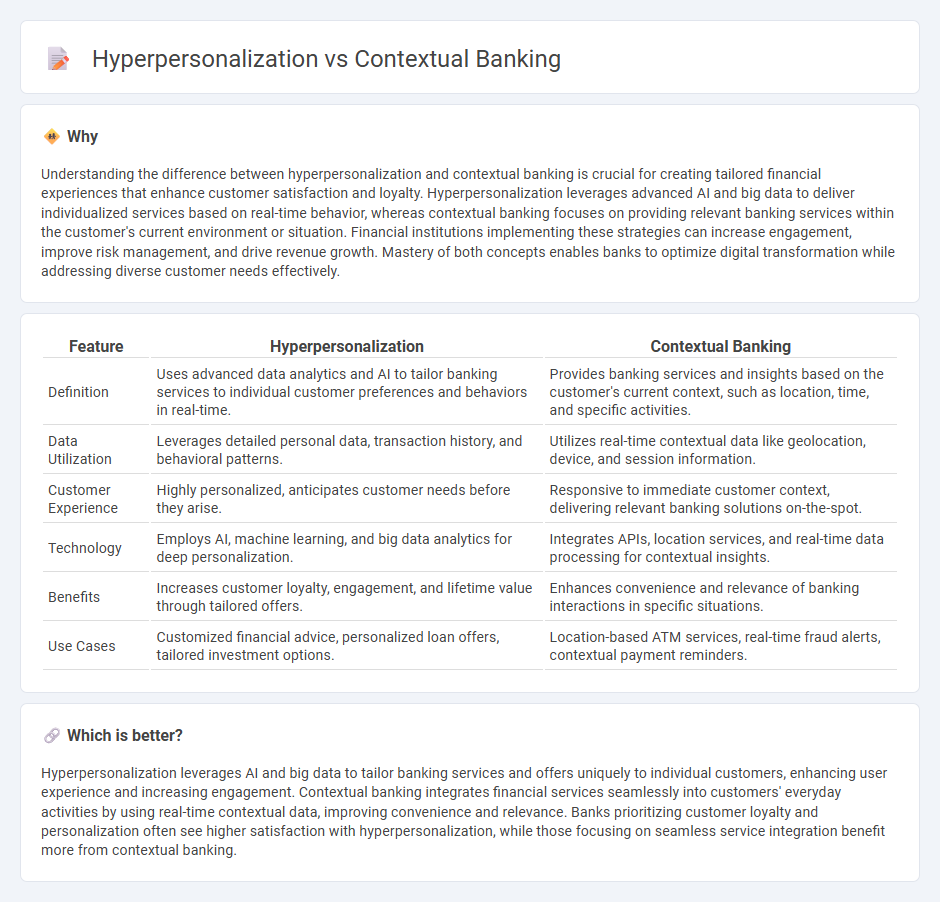

Understanding the difference between hyperpersonalization and contextual banking is crucial for creating tailored financial experiences that enhance customer satisfaction and loyalty. Hyperpersonalization leverages advanced AI and big data to deliver individualized services based on real-time behavior, whereas contextual banking focuses on providing relevant banking services within the customer's current environment or situation. Financial institutions implementing these strategies can increase engagement, improve risk management, and drive revenue growth. Mastery of both concepts enables banks to optimize digital transformation while addressing diverse customer needs effectively.

Comparison Table

| Feature | Hyperpersonalization | Contextual Banking |

|---|---|---|

| Definition | Uses advanced data analytics and AI to tailor banking services to individual customer preferences and behaviors in real-time. | Provides banking services and insights based on the customer's current context, such as location, time, and specific activities. |

| Data Utilization | Leverages detailed personal data, transaction history, and behavioral patterns. | Utilizes real-time contextual data like geolocation, device, and session information. |

| Customer Experience | Highly personalized, anticipates customer needs before they arise. | Responsive to immediate customer context, delivering relevant banking solutions on-the-spot. |

| Technology | Employs AI, machine learning, and big data analytics for deep personalization. | Integrates APIs, location services, and real-time data processing for contextual insights. |

| Benefits | Increases customer loyalty, engagement, and lifetime value through tailored offers. | Enhances convenience and relevance of banking interactions in specific situations. |

| Use Cases | Customized financial advice, personalized loan offers, tailored investment options. | Location-based ATM services, real-time fraud alerts, contextual payment reminders. |

Which is better?

Hyperpersonalization leverages AI and big data to tailor banking services and offers uniquely to individual customers, enhancing user experience and increasing engagement. Contextual banking integrates financial services seamlessly into customers' everyday activities by using real-time contextual data, improving convenience and relevance. Banks prioritizing customer loyalty and personalization often see higher satisfaction with hyperpersonalization, while those focusing on seamless service integration benefit more from contextual banking.

Connection

Hyperpersonalization in banking leverages AI and data analytics to tailor financial products and services to individual customer behaviors and preferences, enhancing user experience and loyalty. Contextual banking integrates real-time data from multiple sources, such as transaction history, location, and device usage, enabling banks to deliver relevant and timely offers or advice. Together, these strategies create a seamless, personalized financial journey that anticipates customer needs and drives engagement.

Key Terms

Customer Journey Mapping

Contextual banking integrates real-time customer data and environmental factors to deliver relevant financial services, while hyperpersonalization uses AI-driven insights to tailor experiences at an individual level throughout the customer journey. Customer Journey Mapping in contextual banking emphasizes understanding situational triggers, whereas hyperpersonalization focuses on micro-moments and predictive analytics for precision targeting. Explore how combining these strategies transforms customer engagement and optimizes banking relationships.

Real-time Data Analytics

Real-time data analytics empowers contextual banking by enabling financial institutions to deliver timely, relevant services based on a customer's current financial situation and behavior. Hyperpersonalization leverages these insights to tailor banking experiences at an individual level, enhancing customer satisfaction and loyalty through predictive modeling and dynamic offer adjustments. Explore how integrating advanced data analytics transforms customer engagement and operational efficiency in modern banking.

Personalized Product Offers

Contextual banking leverages real-time data and situational awareness to tailor financial services, enhancing relevance and customer satisfaction. Hyperpersonalization uses advanced AI and machine learning to analyze individual behaviors and preferences, delivering highly customized product offers that anticipate customer needs. Explore how these strategies transform personalized product offerings and drive customer engagement.

Source and External Links

The future of banking: embedded finance and contextual banking - Offers financial services at the exact time and in the context of the customer's needs, delivering personalized and data-driven solutions like Buy Now Pay Later and tailored loan offers based on real-time analytics.

What is Contextual Banking? | Code & Pepper - Uses advanced analytics to seamlessly integrate financial services into customers' daily experiences, anticipating and fulfilling customer needs in real time for greater satisfaction and loyalty.

Contextual banking: When talking to a bank finally makes sense - Leverages modern technology to enhance the customer experience by providing personalized, relevant, and timely financial information, such as real-time property affordability checks during home searches.

dowidth.com

dowidth.com