Banking institutions generate income through various streams, including interest from loans and fees from financial services, along with foreign exchange income derived from currency trading and cross-border transactions. Foreign exchange income is influenced by market volatility, exchange rate fluctuations, and international trade volumes, making it a dynamic revenue source. Explore the nuances of income streaming and foreign exchange income to better understand their impact on banking profitability.

Why it is important

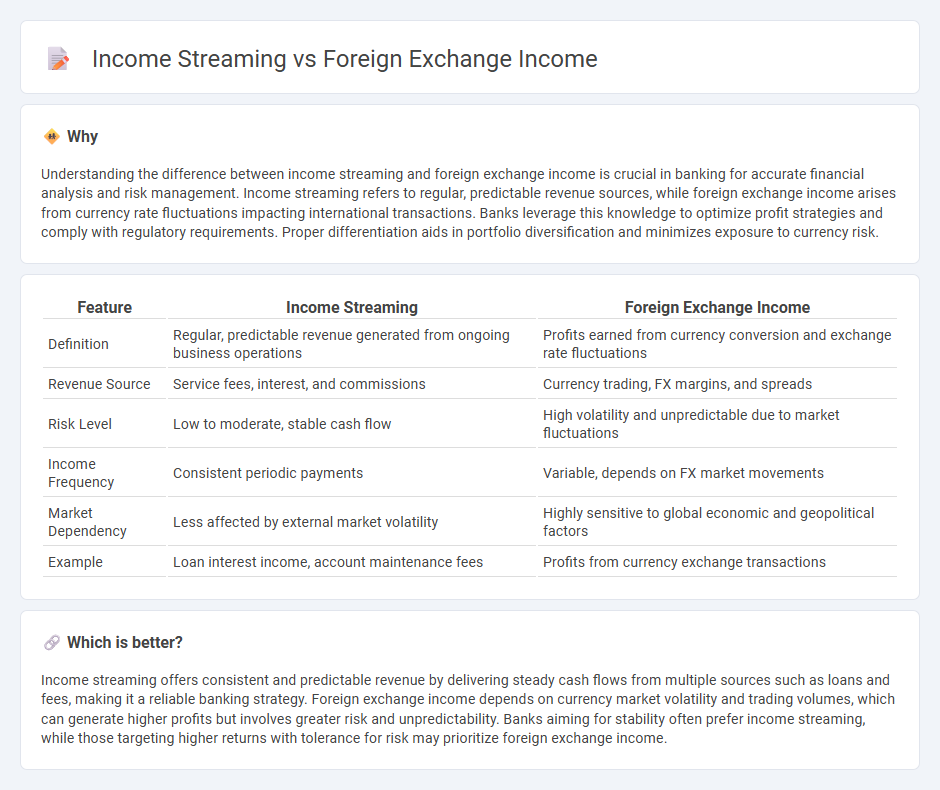

Understanding the difference between income streaming and foreign exchange income is crucial in banking for accurate financial analysis and risk management. Income streaming refers to regular, predictable revenue sources, while foreign exchange income arises from currency rate fluctuations impacting international transactions. Banks leverage this knowledge to optimize profit strategies and comply with regulatory requirements. Proper differentiation aids in portfolio diversification and minimizes exposure to currency risk.

Comparison Table

| Feature | Income Streaming | Foreign Exchange Income |

|---|---|---|

| Definition | Regular, predictable revenue generated from ongoing business operations | Profits earned from currency conversion and exchange rate fluctuations |

| Revenue Source | Service fees, interest, and commissions | Currency trading, FX margins, and spreads |

| Risk Level | Low to moderate, stable cash flow | High volatility and unpredictable due to market fluctuations |

| Income Frequency | Consistent periodic payments | Variable, depends on FX market movements |

| Market Dependency | Less affected by external market volatility | Highly sensitive to global economic and geopolitical factors |

| Example | Loan interest income, account maintenance fees | Profits from currency exchange transactions |

Which is better?

Income streaming offers consistent and predictable revenue by delivering steady cash flows from multiple sources such as loans and fees, making it a reliable banking strategy. Foreign exchange income depends on currency market volatility and trading volumes, which can generate higher profits but involves greater risk and unpredictability. Banks aiming for stability often prefer income streaming, while those targeting higher returns with tolerance for risk may prioritize foreign exchange income.

Connection

Income streaming in banking involves generating consistent revenue through diverse financial products and services, which often include foreign exchange income derived from currency trading and international transactions. Foreign exchange income contributes significantly to banks' profitability by capitalizing on currency fluctuations and exchange rate spreads. This interconnected revenue stream enhances financial stability and supports the expansion of global banking operations.

Key Terms

Exchange Rate

Foreign exchange income fluctuates with currency exchange rate variations, impacting multinational corporations and investors relying on cross-border transactions. Income streaming strategies mitigate exchange rate risk by diversifying revenue sources across multiple currencies and markets. Explore effective techniques to optimize income streams against exchange rate volatility.

Remittance

Foreign exchange income from remittances significantly impacts national economies by inflating foreign currency reserves and stabilizing exchange rates. Income streaming in remittance sectors ensures consistent cash flow through digital platforms, enhancing transaction efficiency and accessibility for cross-border money transfers. Discover how optimizing remittance channels can boost both income generation and economic resilience.

Diversification

Foreign exchange income offers diversification by generating revenue through currency fluctuations, reducing reliance on a single economic market. Income streaming diversifies cash flow by combining multiple revenue sources such as dividends, interest, and royalties, enhancing financial stability. Explore more to understand how these strategies can optimize your investment portfolio's diversification.

Source and External Links

Foreign Exchange Gain/Loss - Overview, Recording, Example - This webpage explains how foreign exchange gains and losses occur, especially in cross-border transactions involving changing exchange rates.

Tax Treatment of Foreign Exchange Gains or Losses - This document discusses the tax implications of foreign exchange gains and losses under the Mauritius Income Tax Act.

Foreign Exchange Earnings - This page defines foreign exchange earnings as proceeds from exports and returns on foreign investments denominated in convertible currencies.

dowidth.com

dowidth.com