Personal financial management tools focus on budgeting, expense tracking, and saving strategies tailored to individual needs, while wealth management tools emphasize investment planning, asset allocation, and tax optimization for high-net-worth clients. Both types of tools use data analytics and financial algorithms to enhance decision-making and maximize financial outcomes. Explore how these distinct tools can empower your financial goals by learning more about their unique benefits and features.

Why it is important

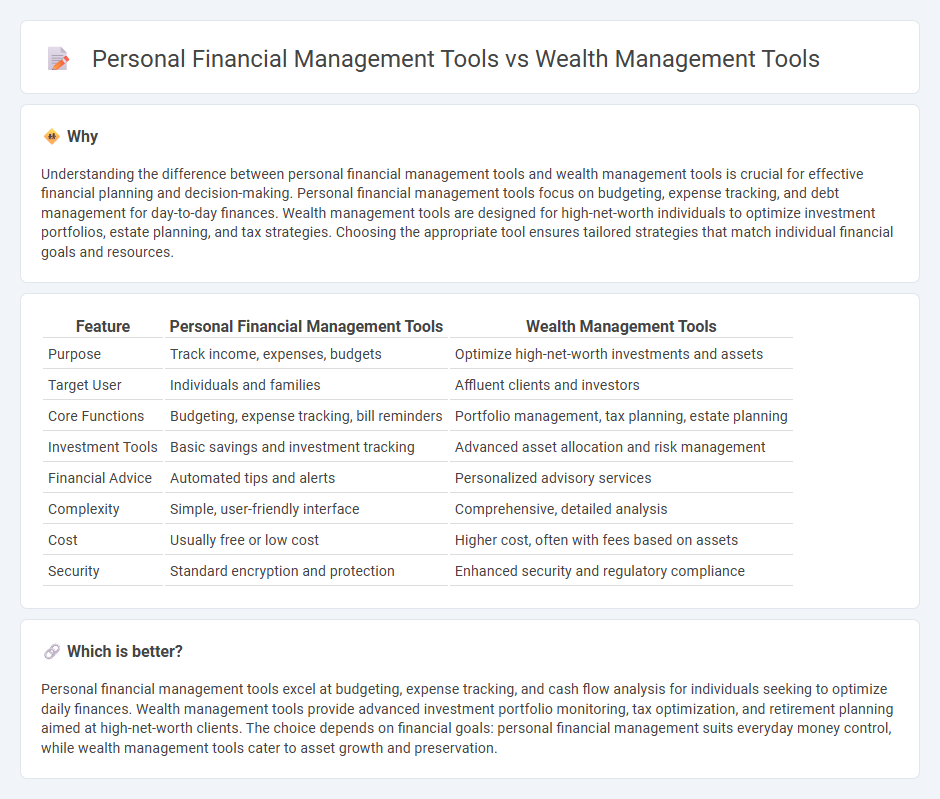

Understanding the difference between personal financial management tools and wealth management tools is crucial for effective financial planning and decision-making. Personal financial management tools focus on budgeting, expense tracking, and debt management for day-to-day finances. Wealth management tools are designed for high-net-worth individuals to optimize investment portfolios, estate planning, and tax strategies. Choosing the appropriate tool ensures tailored strategies that match individual financial goals and resources.

Comparison Table

| Feature | Personal Financial Management Tools | Wealth Management Tools |

|---|---|---|

| Purpose | Track income, expenses, budgets | Optimize high-net-worth investments and assets |

| Target User | Individuals and families | Affluent clients and investors |

| Core Functions | Budgeting, expense tracking, bill reminders | Portfolio management, tax planning, estate planning |

| Investment Tools | Basic savings and investment tracking | Advanced asset allocation and risk management |

| Financial Advice | Automated tips and alerts | Personalized advisory services |

| Complexity | Simple, user-friendly interface | Comprehensive, detailed analysis |

| Cost | Usually free or low cost | Higher cost, often with fees based on assets |

| Security | Standard encryption and protection | Enhanced security and regulatory compliance |

Which is better?

Personal financial management tools excel at budgeting, expense tracking, and cash flow analysis for individuals seeking to optimize daily finances. Wealth management tools provide advanced investment portfolio monitoring, tax optimization, and retirement planning aimed at high-net-worth clients. The choice depends on financial goals: personal financial management suits everyday money control, while wealth management tools cater to asset growth and preservation.

Connection

Personal financial management (PFM) tools and wealth management tools are interconnected through their shared goal of optimizing an individual's financial health by tracking expenses, budgeting, and investment portfolios. PFM tools provide real-time insights into cash flow and spending habits, which inform wealth management strategies such as asset allocation and retirement planning. Integration of these tools enables a holistic approach to financial decision-making, enhancing personalized advice and long-term wealth growth.

Key Terms

Wealth Management Tools:

Wealth management tools offer comprehensive solutions designed to optimize high-net-worth portfolios through advanced investment analysis, tax optimization, and estate planning features. These platforms integrate real-time market data and personalized advisory services to maximize asset growth and risk management effectively. Explore how wealth management tools can elevate your financial strategy and safeguard your legacy.

Portfolio Diversification

Wealth management tools emphasize portfolio diversification by offering advanced asset allocation strategies across multiple investment classes such as stocks, bonds, real estate, and alternative investments to optimize risk-adjusted returns. Personal financial management tools primarily focus on budgeting and expense tracking but increasingly integrate basic diversification features to help users balance savings and investments. Explore how specialized wealth management solutions can enhance your portfolio diversification for long-term financial growth.

Asset Allocation

Wealth management tools prioritize sophisticated asset allocation strategies that optimize investment portfolios based on risk tolerance, financial goals, and market conditions, offering tailored diversification across asset classes. Personal financial management tools mainly focus on budgeting, expense tracking, and basic asset overview without advanced portfolio rebalancing or strategic allocation features. Explore more on how these tools differ in enhancing your financial planning and investment outcomes.

Source and External Links

Top 5 Financial Advisor Apps for Wealth Management in 2025 - Offers comprehensive wealth management apps like Wealthfront for automated investing, financial planning, and retirement goal tracking with features such as portfolio management, tax-efficient strategies, and account linking.

The Best Wealth Management Software in 2025 - Masttro - Reviews top wealth management platforms including SS&C Black Diamond, known for portfolio management, data aggregation, and financial advisor-centric reporting and integration capabilities.

Free Financial Planning Tools | Investor.gov - Provides free calculators and tools for retirement planning, savings goals, compound interest, required minimum distribution, and mutual fund fee analysis to aid individual financial decisions.

dowidth.com

dowidth.com