Neobanking revolutionizes financial services by offering fully digital banking experiences without traditional physical branches, while open banking enhances customer empowerment by securely sharing financial data with third-party providers through APIs. Both approaches drive innovation, improve accessibility, and foster personalized financial management for users. Discover how neobanking and open banking transform the future of finance and customer experience.

Why it is important

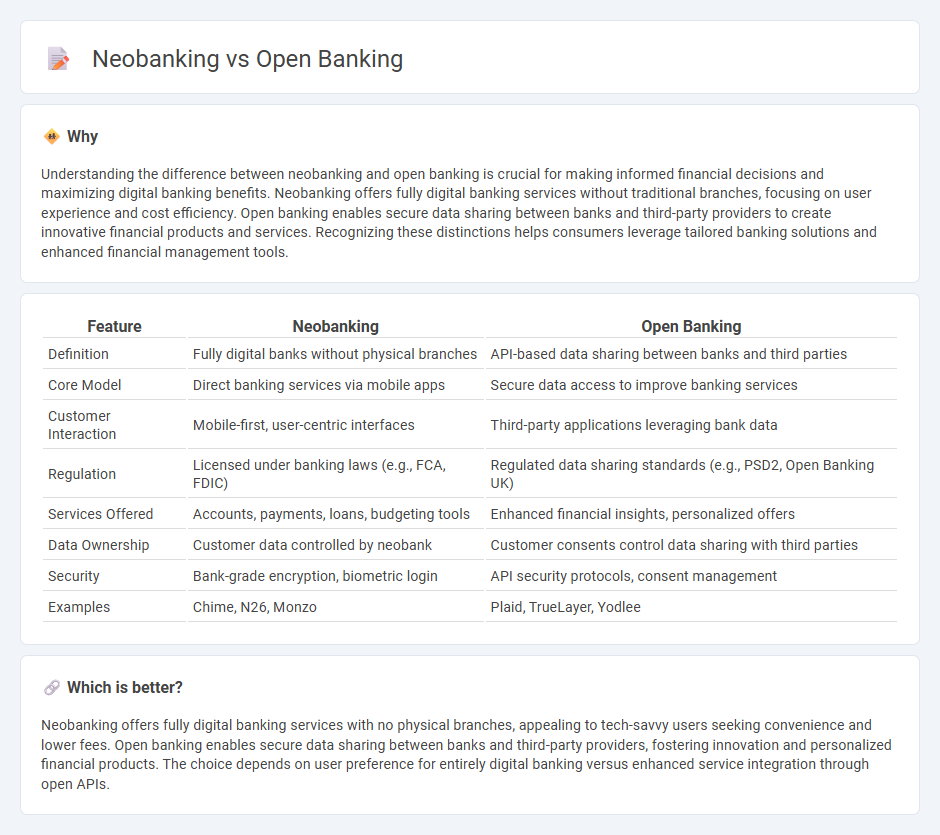

Understanding the difference between neobanking and open banking is crucial for making informed financial decisions and maximizing digital banking benefits. Neobanking offers fully digital banking services without traditional branches, focusing on user experience and cost efficiency. Open banking enables secure data sharing between banks and third-party providers to create innovative financial products and services. Recognizing these distinctions helps consumers leverage tailored banking solutions and enhanced financial management tools.

Comparison Table

| Feature | Neobanking | Open Banking |

|---|---|---|

| Definition | Fully digital banks without physical branches | API-based data sharing between banks and third parties |

| Core Model | Direct banking services via mobile apps | Secure data access to improve banking services |

| Customer Interaction | Mobile-first, user-centric interfaces | Third-party applications leveraging bank data |

| Regulation | Licensed under banking laws (e.g., FCA, FDIC) | Regulated data sharing standards (e.g., PSD2, Open Banking UK) |

| Services Offered | Accounts, payments, loans, budgeting tools | Enhanced financial insights, personalized offers |

| Data Ownership | Customer data controlled by neobank | Customer consents control data sharing with third parties |

| Security | Bank-grade encryption, biometric login | API security protocols, consent management |

| Examples | Chime, N26, Monzo | Plaid, TrueLayer, Yodlee |

Which is better?

Neobanking offers fully digital banking services with no physical branches, appealing to tech-savvy users seeking convenience and lower fees. Open banking enables secure data sharing between banks and third-party providers, fostering innovation and personalized financial products. The choice depends on user preference for entirely digital banking versus enhanced service integration through open APIs.

Connection

Neobanking leverages open banking APIs to access customer financial data securely and offer personalized digital financial services without traditional branch infrastructure. Open banking enables neobanks to integrate with multiple banking systems, facilitating real-time data sharing and streamlined payments. This synergy enhances user experience by promoting transparency, innovation, and competition within the financial ecosystem.

Key Terms

API Integration

API integration serves as the technological backbone for both open banking and neobanking, enabling seamless data exchange and service interoperability within financial ecosystems. Open banking leverages APIs to provide third-party developers with secure access to customer banking data, fostering innovation and personalized financial services. Explore how API-driven platforms transform traditional banking models by enhancing connectivity and expanding digital financial offerings.

Digital-Only Operations

Open banking enables secure sharing of financial data through APIs, facilitating services from multiple providers within a traditional banking framework, while neobanking operates as digital-only banks offering streamlined, user-friendly interfaces without physical branches. Digital-only operations in neobanks emphasize innovation in customer experience, real-time transactions, and cost efficiency due to the absence of legacy infrastructure. Explore the evolving landscape of digital finance to understand how these models reshape banking priorities and customer engagement.

Third-Party Access

Open banking enables third-party providers to access consumer financial data securely via APIs, facilitating innovative services like personalized financial management and payment initiation. Neobanking operates as digital-only banks, offering seamless user experiences but often relies on open banking APIs to integrate third-party services and enhance functionality. Explore how third-party access shapes the future of financial services by learning more about the synergy between open banking and neobanking.

Source and External Links

What is open banking? A guide to the future of finance - Plaid - Open banking is a system that allows consumers to securely share their banking, transaction, and financial data with third-party providers through standardized APIs, enhancing financial transparency, access, and innovation across the industry.

Open banking - Wikipedia - Open banking permits customers to share their financial information securely and electronically with other banks or authorized financial organizations to enable improved financial services and innovation.

What is open banking? Your essential guide - Mastercard - Open banking allows consumers and small businesses to securely share their financial data with third parties, enabling innovative financial experiences that put users in control of how their data is used and benefit from more choices in managing money, payments, and credit.

dowidth.com

dowidth.com