Hyperpersonalization in banking leverages advanced data analytics and AI to tailor financial products and services to individual customer preferences and behaviors, enhancing engagement and satisfaction. Real-time offers deliver timely promotions and financial opportunities based on immediate transaction data and customer context, driving quick decision-making and increased conversion rates. Explore how these cutting-edge strategies transform customer experience and profitability in modern banking.

Why it is important

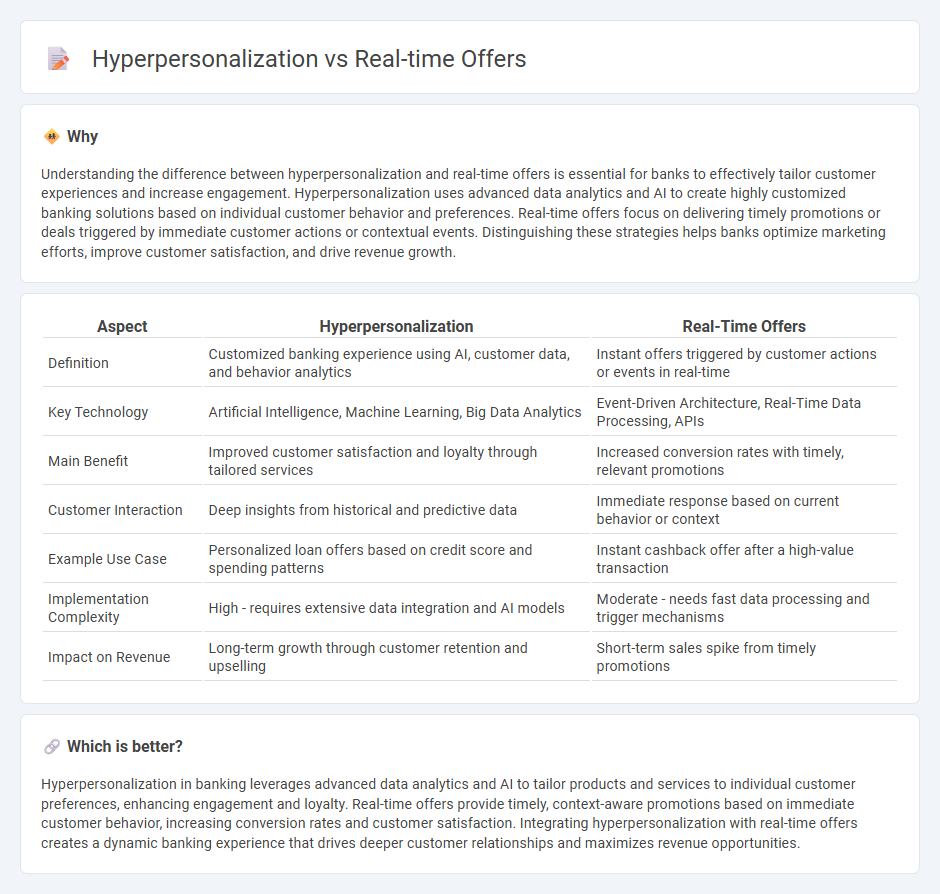

Understanding the difference between hyperpersonalization and real-time offers is essential for banks to effectively tailor customer experiences and increase engagement. Hyperpersonalization uses advanced data analytics and AI to create highly customized banking solutions based on individual customer behavior and preferences. Real-time offers focus on delivering timely promotions or deals triggered by immediate customer actions or contextual events. Distinguishing these strategies helps banks optimize marketing efforts, improve customer satisfaction, and drive revenue growth.

Comparison Table

| Aspect | Hyperpersonalization | Real-Time Offers |

|---|---|---|

| Definition | Customized banking experience using AI, customer data, and behavior analytics | Instant offers triggered by customer actions or events in real-time |

| Key Technology | Artificial Intelligence, Machine Learning, Big Data Analytics | Event-Driven Architecture, Real-Time Data Processing, APIs |

| Main Benefit | Improved customer satisfaction and loyalty through tailored services | Increased conversion rates with timely, relevant promotions |

| Customer Interaction | Deep insights from historical and predictive data | Immediate response based on current behavior or context |

| Example Use Case | Personalized loan offers based on credit score and spending patterns | Instant cashback offer after a high-value transaction |

| Implementation Complexity | High - requires extensive data integration and AI models | Moderate - needs fast data processing and trigger mechanisms |

| Impact on Revenue | Long-term growth through customer retention and upselling | Short-term sales spike from timely promotions |

Which is better?

Hyperpersonalization in banking leverages advanced data analytics and AI to tailor products and services to individual customer preferences, enhancing engagement and loyalty. Real-time offers provide timely, context-aware promotions based on immediate customer behavior, increasing conversion rates and customer satisfaction. Integrating hyperpersonalization with real-time offers creates a dynamic banking experience that drives deeper customer relationships and maximizes revenue opportunities.

Connection

Hyperpersonalization in banking leverages AI-driven data analytics to analyze individual customer behaviors, preferences, and transaction histories, enabling the delivery of real-time offers that are highly relevant and timely. Real-time offer systems rely on hyperpersonalized insights to present targeted promotions, lending options, and financial products that match each customer's immediate needs and financial goals. This seamless integration increases customer engagement, conversion rates, and overall satisfaction by creating a customized banking experience.

Key Terms

Customer Data Platform (CDP)

Real-time offers leverage Customer Data Platforms (CDPs) to deliver timely, context-aware promotions by analyzing customer actions as they happen, enhancing engagement and conversion rates. Hyperpersonalization uses CDP-driven insights to tailor experiences at an individual level, integrating behavioral, transactional, and demographic data for deeper relevance. Discover how CDPs power these strategies to transform customer interactions and boost business outcomes.

Artificial Intelligence (AI)

Real-time offers leverage Artificial Intelligence (AI) to deliver dynamic promotions based on immediate customer behavior and contextual data, enhancing responsiveness and engagement. Hyperpersonalization uses advanced AI algorithms to analyze vast datasets, including past interactions and preferences, creating tailored experiences that predict individual needs with high precision. Explore how AI-driven strategies transform marketing by balancing real-time responsiveness and deep personalization to boost customer satisfaction and conversion rates.

Next-Best-Action (NBA)

Next-Best-Action (NBA) leverages real-time offers by analyzing customer behavior and preferences instantly to deliver tailored product recommendations and promotions. Hyperpersonalization enhances NBA by integrating AI-driven data from multiple touchpoints, improving customer engagement with highly relevant and timely interactions. Explore how combining real-time offers with hyperpersonalization can revolutionize your customer experience strategy.

Source and External Links

Breaking the addiction to sitewide offers: Three techniques - Real-time offers are targeted discounts triggered by AI based on a visitor's in-session behavior, aiming to nudge only "on-the-fence" shoppers toward purchase, rather than offering blanket deals to everyone.

Real-Time Offers - Real-time offers use immediate data from customer interactions to present personalized recommendations, upsells, or discounts at the optimal moment, increasing the likelihood of conversion during active engagement.

What Are Real-Time Rewards? Uses, Benefits & Setup - Real-time rewards provide instant incentives--such as discounts, cashback, or digital gift cards--immediately after a customer action, enhancing satisfaction and engagement compared to traditional delayed loyalty programs.

dowidth.com

dowidth.com