Core banking modernization integrates advanced technology within traditional banking systems to enhance efficiency, security, and customer experience, whereas Open Banking fosters innovation by enabling third-party access to financial data through APIs, promoting transparency and personalized services. Both approaches aim to transform banking operations but differ in scope and implementation, with modernization focusing on internal upgrades and Open Banking on external collaboration. Explore the advantages and strategic impacts of these banking evolutions to understand their influence on the financial industry.

Why it is important

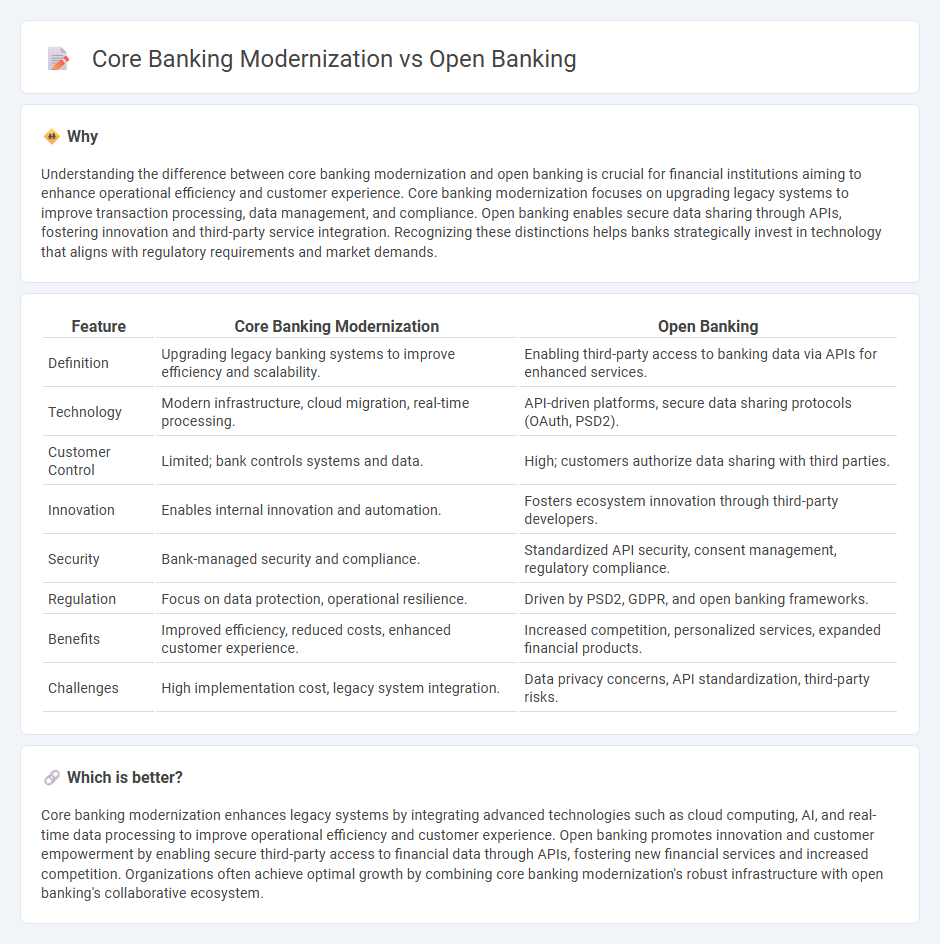

Understanding the difference between core banking modernization and open banking is crucial for financial institutions aiming to enhance operational efficiency and customer experience. Core banking modernization focuses on upgrading legacy systems to improve transaction processing, data management, and compliance. Open banking enables secure data sharing through APIs, fostering innovation and third-party service integration. Recognizing these distinctions helps banks strategically invest in technology that aligns with regulatory requirements and market demands.

Comparison Table

| Feature | Core Banking Modernization | Open Banking |

|---|---|---|

| Definition | Upgrading legacy banking systems to improve efficiency and scalability. | Enabling third-party access to banking data via APIs for enhanced services. |

| Technology | Modern infrastructure, cloud migration, real-time processing. | API-driven platforms, secure data sharing protocols (OAuth, PSD2). |

| Customer Control | Limited; bank controls systems and data. | High; customers authorize data sharing with third parties. |

| Innovation | Enables internal innovation and automation. | Fosters ecosystem innovation through third-party developers. |

| Security | Bank-managed security and compliance. | Standardized API security, consent management, regulatory compliance. |

| Regulation | Focus on data protection, operational resilience. | Driven by PSD2, GDPR, and open banking frameworks. |

| Benefits | Improved efficiency, reduced costs, enhanced customer experience. | Increased competition, personalized services, expanded financial products. |

| Challenges | High implementation cost, legacy system integration. | Data privacy concerns, API standardization, third-party risks. |

Which is better?

Core banking modernization enhances legacy systems by integrating advanced technologies such as cloud computing, AI, and real-time data processing to improve operational efficiency and customer experience. Open banking promotes innovation and customer empowerment by enabling secure third-party access to financial data through APIs, fostering new financial services and increased competition. Organizations often achieve optimal growth by combining core banking modernization's robust infrastructure with open banking's collaborative ecosystem.

Connection

Core banking modernization enhances legacy systems with cloud-based infrastructure and APIs, enabling seamless integration with Open Banking platforms. Open Banking relies on these modernized core systems to securely share customer data and facilitate innovative financial services through third-party providers. This synergy drives improved customer experience, real-time transaction processing, and expanded financial ecosystems.

Key Terms

APIs

Open banking leverages APIs to enable seamless third-party integrations and real-time data sharing, enhancing customer experience and fostering innovation. Core banking modernization emphasizes updating legacy systems to support API-driven architectures, improving scalability, security, and operational efficiency. Explore how API strategies differ in open banking and core banking to transform financial services effectively.

Legacy Systems

Legacy systems in core banking often hinder rapid innovation due to outdated architecture and limited integration capabilities, restricting the implementation of open banking APIs and real-time data exchange. Open banking requires a modernized core infrastructure that supports seamless connectivity, enhanced security protocols, and scalable platforms to enable secure data sharing with third-party providers. Discover how upgrading legacy systems can unlock the full potential of open banking to enhance customer experience and operational efficiency.

Data Interoperability

Open banking enables seamless data exchange between financial institutions and third-party providers through standardized APIs, enhancing customer experience and innovation. Core banking modernization focuses on updating legacy systems to support real-time processing, scalability, and improved data integration across internal channels. Explore how businesses leverage data interoperability to optimize both open banking and core banking modernization strategies.

Source and External Links

Open banking - Open banking allows customers to securely share their financial information electronically with other banks or authorized financial organizations to improve financial services and innovation.

What is open banking? A guide to the future of finance - Plaid - Open banking is a system letting consumers securely share banking and financial data with third-party providers through standardized APIs, enabling real-time data exchange that fosters financial transparency, control, and innovation.

What is open banking? Your essential guide - Mastercard - Open banking empowers consumers and small businesses to securely share their financial account data with third-party providers, enabling innovative financial experiences and greater control over how their data is used.

dowidth.com

dowidth.com