Neo banking offers fully digital financial services with seamless mobile access and innovative features, catering to tech-savvy customers seeking convenience and low fees. Cooperative banks focus on community-driven banking, emphasizing customer ownership and local economic support through personalized service and member participation. Explore the distinctive benefits and functionalities of neo banks and cooperative banks to find the best fit for your financial needs.

Why it is important

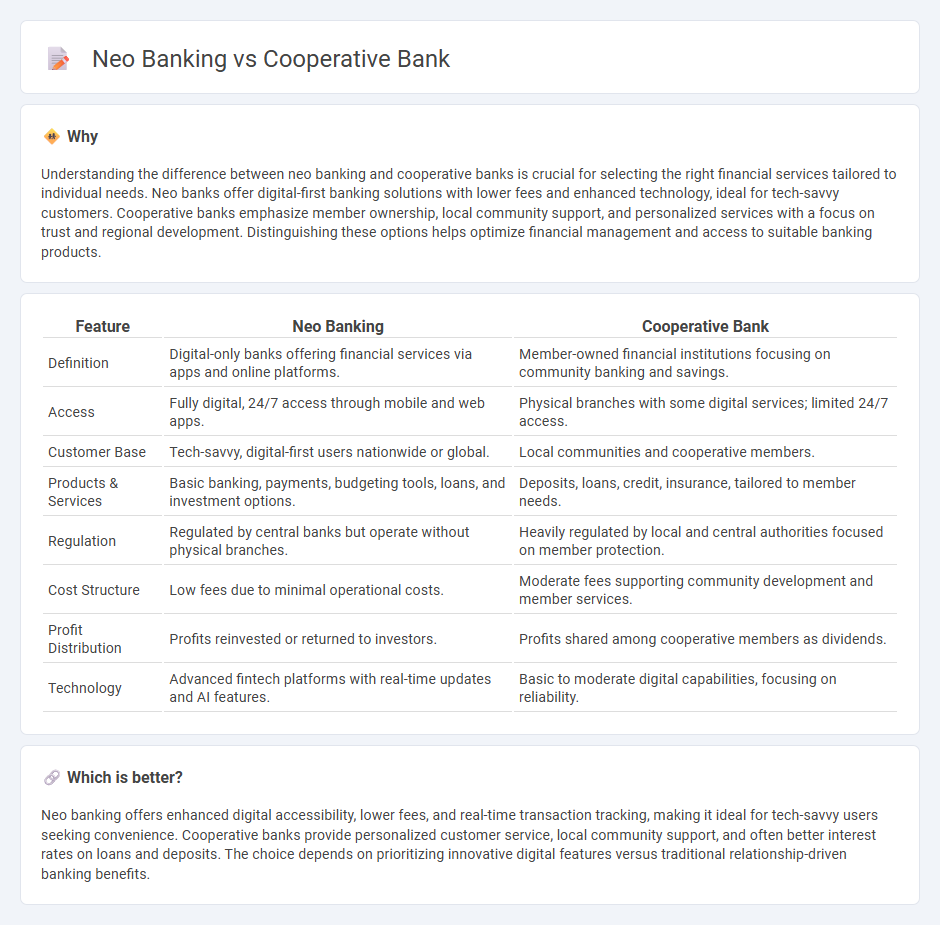

Understanding the difference between neo banking and cooperative banks is crucial for selecting the right financial services tailored to individual needs. Neo banks offer digital-first banking solutions with lower fees and enhanced technology, ideal for tech-savvy customers. Cooperative banks emphasize member ownership, local community support, and personalized services with a focus on trust and regional development. Distinguishing these options helps optimize financial management and access to suitable banking products.

Comparison Table

| Feature | Neo Banking | Cooperative Bank |

|---|---|---|

| Definition | Digital-only banks offering financial services via apps and online platforms. | Member-owned financial institutions focusing on community banking and savings. |

| Access | Fully digital, 24/7 access through mobile and web apps. | Physical branches with some digital services; limited 24/7 access. |

| Customer Base | Tech-savvy, digital-first users nationwide or global. | Local communities and cooperative members. |

| Products & Services | Basic banking, payments, budgeting tools, loans, and investment options. | Deposits, loans, credit, insurance, tailored to member needs. |

| Regulation | Regulated by central banks but operate without physical branches. | Heavily regulated by local and central authorities focused on member protection. |

| Cost Structure | Low fees due to minimal operational costs. | Moderate fees supporting community development and member services. |

| Profit Distribution | Profits reinvested or returned to investors. | Profits shared among cooperative members as dividends. |

| Technology | Advanced fintech platforms with real-time updates and AI features. | Basic to moderate digital capabilities, focusing on reliability. |

Which is better?

Neo banking offers enhanced digital accessibility, lower fees, and real-time transaction tracking, making it ideal for tech-savvy users seeking convenience. Cooperative banks provide personalized customer service, local community support, and often better interest rates on loans and deposits. The choice depends on prioritizing innovative digital features versus traditional relationship-driven banking benefits.

Connection

Neo banking leverages digital platforms to offer seamless, low-cost financial services, while cooperative banks provide community-focused, member-owned banking solutions. Both models emphasize customer-centric approaches and financial inclusion but differ in structure; neo banks operate entirely online without physical branches, whereas cooperative banks maintain localized governance and regulatory compliance. Integration between neo banking technology and cooperative banks' community reach enhances accessibility, broadens financial services, and supports underserved populations.

Key Terms

Ownership Structure

Cooperative banks are member-owned financial institutions where customers typically hold voting rights and influence decision-making, fostering a community-centric ownership model. Neo banks operate under a corporate ownership structure, often backed by venture capital or large fintech firms, emphasizing technology-driven services without physical branches. Explore deeper distinctions in governance and customer impact between these banking models to understand which aligns with your financial needs.

Digital Infrastructure

Cooperative banks utilize traditional digital infrastructure that integrates core banking systems with online and mobile platforms to serve member-driven financial needs, emphasizing security and local community focus. Neo banks operate entirely on cloud-based digital infrastructure, leveraging APIs and advanced fintech innovations to provide seamless, real-time banking services with enhanced user experience and lower operational costs. Discover how these distinctive digital frameworks shape the future of banking services.

Regulatory Framework

Cooperative banks operate under stringent regulatory frameworks established by the Reserve Bank of India (RBI) and state cooperative authorities, ensuring consumer protection and financial stability through detailed compliance requirements. Neo banks function primarily as digital-only entities, often partnering with traditional banks to meet regulatory standards, resulting in a more flexible but evolving regulatory landscape governed by the RBI and financial technology guidelines. Explore the distinct regulatory nuances and compliance strategies shaping the future of cooperative banks and neo banking ecosystems.

Source and External Links

Cooperative banking - Wikipedia - Cooperative banks are retail and commercial banking institutions owned by their customers that operate on cooperative principles such as one person, one vote, providing financial services like savings and loans primarily to members but sometimes also to non-members.

What is a Cooperative Bank? - Cooperative banks are community-focused financial institutions founded to serve local residents' financial needs, offering deposits, loans, and fair interest rates, governed by elected representatives who are depositors themselves.

National Cooperative Bank. Working Together. Building Community. - The National Cooperative Bank is the sole US bank dedicated to serving cooperatives nationwide, offering specialized banking products and demonstrating a strong commitment to community investment.

dowidth.com

dowidth.com