Income streaming generates revenue by directing interest and fees from financial products, enhancing a bank's profitability beyond standard service charges. Custody fees involve charges for safeguarding clients' assets, offering a steady income stream tied to asset under management values. Explore the distinctions between income streaming and custody fees to optimize your bank's financial strategies.

Why it is important

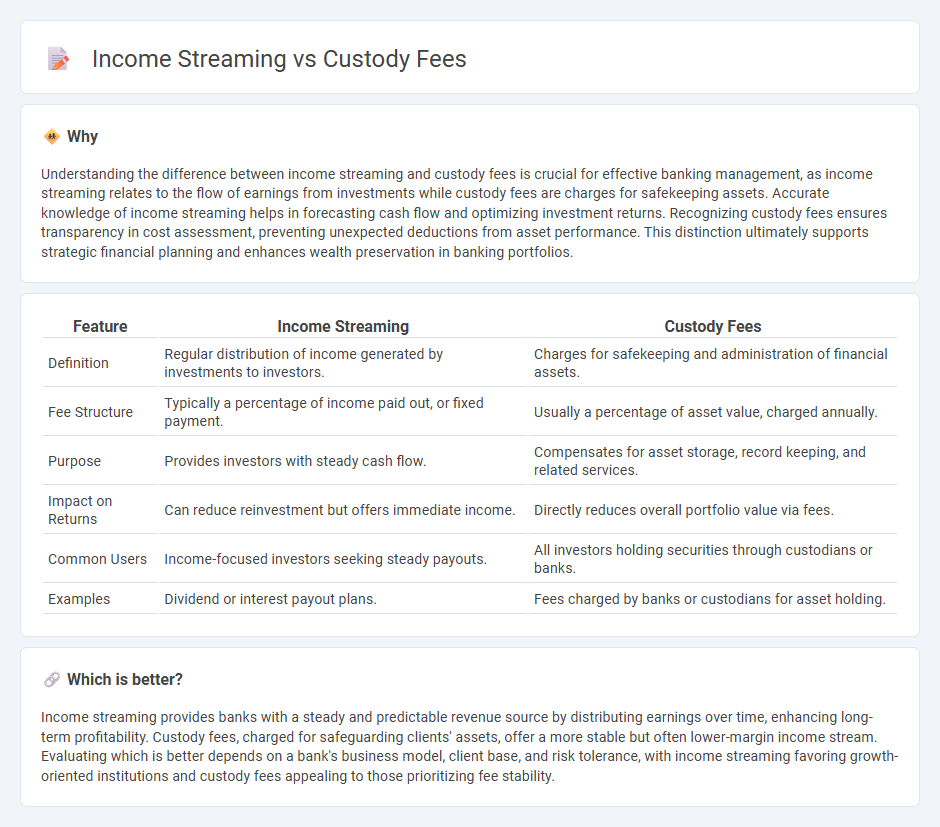

Understanding the difference between income streaming and custody fees is crucial for effective banking management, as income streaming relates to the flow of earnings from investments while custody fees are charges for safekeeping assets. Accurate knowledge of income streaming helps in forecasting cash flow and optimizing investment returns. Recognizing custody fees ensures transparency in cost assessment, preventing unexpected deductions from asset performance. This distinction ultimately supports strategic financial planning and enhances wealth preservation in banking portfolios.

Comparison Table

| Feature | Income Streaming | Custody Fees |

|---|---|---|

| Definition | Regular distribution of income generated by investments to investors. | Charges for safekeeping and administration of financial assets. |

| Fee Structure | Typically a percentage of income paid out, or fixed payment. | Usually a percentage of asset value, charged annually. |

| Purpose | Provides investors with steady cash flow. | Compensates for asset storage, record keeping, and related services. |

| Impact on Returns | Can reduce reinvestment but offers immediate income. | Directly reduces overall portfolio value via fees. |

| Common Users | Income-focused investors seeking steady payouts. | All investors holding securities through custodians or banks. |

| Examples | Dividend or interest payout plans. | Fees charged by banks or custodians for asset holding. |

Which is better?

Income streaming provides banks with a steady and predictable revenue source by distributing earnings over time, enhancing long-term profitability. Custody fees, charged for safeguarding clients' assets, offer a more stable but often lower-margin income stream. Evaluating which is better depends on a bank's business model, client base, and risk tolerance, with income streaming favoring growth-oriented institutions and custody fees appealing to those prioritizing fee stability.

Connection

Income streaming through financial instruments like dividend-paying stocks or bond interest generates consistent revenue within investment portfolios. Custody fees are charged by financial institutions to safeguard these assets, directly impacting the net income realized by investors. The interplay between income streaming and custody fees affects overall returns, making fee assessment critical for effective portfolio management in banking.

Key Terms

Asset Safekeeping

Custody fees are charges imposed by financial institutions for the safekeeping and administration of assets, directly impacting net portfolio returns. Income streaming refers to the systematic distribution of investment income, offering predictable cash flows while potentially influencing tax efficiency. Explore how strategic asset safekeeping balances custody costs and income streaming benefits to optimize your investment outcomes.

Dividend Distribution

Custody fees can significantly impact net returns on dividend distributions by reducing the overall income an investor receives, especially in accounts with frequent trades or smaller dividends. Income streaming allows investors to allocate different types of income, such as dividends, interest, or capital gains, in a tax-efficient manner tailored to individual needs, potentially minimizing tax liability. Explore strategies to optimize dividend income while managing custody fees for better portfolio performance.

Fee Structure

Custody fees typically involve a fixed percentage of assets under management, often ranging between 0.05% to 0.25% annually, directly impacting investment returns over time. Income streaming fees can vary widely depending on the service provider, sometimes including setup charges and periodic management fees tied to the income generated. Explore how these fee structures influence your overall financial strategy and asset growth potential by learning more.

Source and External Links

Custody Fees | DBS Treasures - Custody fees are charged monthly based on assets' market value, with fees accumulated biannually and charged if the portfolio falls below a certain balance, typically calculated in SGD and subject to GST.

Custody Fees Explained: A Comprehensive Guide - Veri Global - Custody fees are charges for safekeeping investment assets, commonly structured as flat fees, asset-based percentages, or transaction fees, impacting the net returns of investment portfolios.

How are custody fees for stocks, ETFs, ETCs and bonds calculated? - Custody fees are calculated daily based on the value of held positions, summed monthly and charged in the instrument or account currency, with no minimum fee and no relation to trading activities.

dowidth.com

dowidth.com