Green financing focuses on funding environmentally sustainable projects and renewable energy initiatives, aiming to reduce carbon footprints and promote ecological balance. Corporate financing involves raising capital for business operations, expansion, and investment opportunities, prioritizing profitability and growth. Discover how these distinct financial approaches impact global economic and environmental strategies.

Why it is important

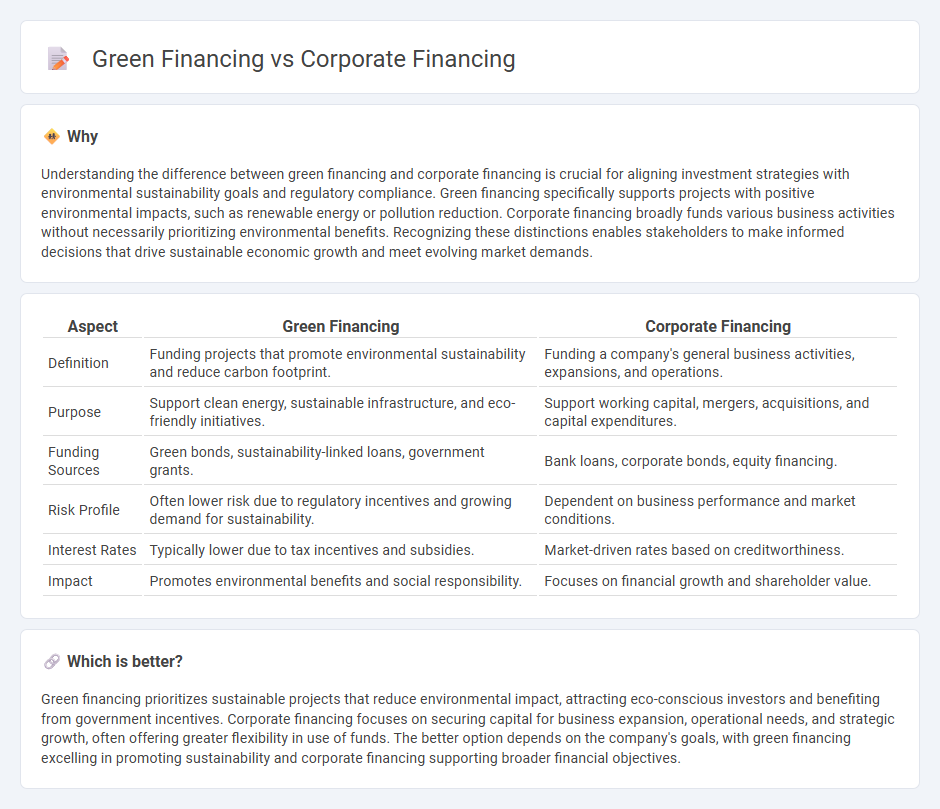

Understanding the difference between green financing and corporate financing is crucial for aligning investment strategies with environmental sustainability goals and regulatory compliance. Green financing specifically supports projects with positive environmental impacts, such as renewable energy or pollution reduction. Corporate financing broadly funds various business activities without necessarily prioritizing environmental benefits. Recognizing these distinctions enables stakeholders to make informed decisions that drive sustainable economic growth and meet evolving market demands.

Comparison Table

| Aspect | Green Financing | Corporate Financing |

|---|---|---|

| Definition | Funding projects that promote environmental sustainability and reduce carbon footprint. | Funding a company's general business activities, expansions, and operations. |

| Purpose | Support clean energy, sustainable infrastructure, and eco-friendly initiatives. | Support working capital, mergers, acquisitions, and capital expenditures. |

| Funding Sources | Green bonds, sustainability-linked loans, government grants. | Bank loans, corporate bonds, equity financing. |

| Risk Profile | Often lower risk due to regulatory incentives and growing demand for sustainability. | Dependent on business performance and market conditions. |

| Interest Rates | Typically lower due to tax incentives and subsidies. | Market-driven rates based on creditworthiness. |

| Impact | Promotes environmental benefits and social responsibility. | Focuses on financial growth and shareholder value. |

Which is better?

Green financing prioritizes sustainable projects that reduce environmental impact, attracting eco-conscious investors and benefiting from government incentives. Corporate financing focuses on securing capital for business expansion, operational needs, and strategic growth, often offering greater flexibility in use of funds. The better option depends on the company's goals, with green financing excelling in promoting sustainability and corporate financing supporting broader financial objectives.

Connection

Green financing supports sustainable projects by providing capital for environmentally friendly initiatives, directly influencing corporate financing decisions aimed at reducing carbon footprints. Corporations increasingly integrate green bonds and ESG (Environmental, Social, and Governance) criteria into their financing strategies to attract socially conscious investors. This synergy enhances both financial performance and environmental responsibility, driving growth in sustainable banking practices.

Key Terms

**Corporate Financing:**

Corporate financing involves securing funds for business operations, expansion, and capital investments through sources such as equity, debt, and retained earnings. It focuses on maximizing shareholder value, managing financial risks, and optimizing the capital structure to support sustainable growth. Explore more insights to understand how corporate financing strategies drive business success.

Debt Instruments

Debt instruments in corporate financing primarily include bonds, loans, and debentures used to raise capital for general business activities, expansion, or restructuring. Green financing debt instruments, such as green bonds and sustainability-linked loans, specifically fund environmentally sustainable projects and initiatives aimed at reducing carbon footprints and promoting renewable energy. Explore the distinctions and benefits of these financing options to better align your investment strategies with sustainability goals.

Equity Capital

Equity capital in corporate financing typically involves raising funds through the sale of shares to investors, providing companies with growth capital while diluting ownership. In green financing, equity capital is directed toward environmentally sustainable projects, attracting investors interested in long-term ecological impact and aligning with ESG (Environmental, Social, and Governance) criteria. Explore the distinctions in equity capital strategies between corporate and green financing to understand their influence on sustainable business growth.

Source and External Links

Understanding Corporate Finance: A Comprehensive Guide - Corporate finance focuses on how corporations structure capital, source funding, and make investment decisions to maximize shareholder value while balancing risk and profitability through both equity and debt financing.

What is Corporate Finance? - Corporate finance involves planning and managing a company's capital structure and investments to increase business value by selecting optimal projects and financing through equity, debt, or both.

Corporate finance - Corporate finance deals with funding sources, capital structure, and financial resource allocation with the primary goal of maximizing shareholder value, including managing capital budgeting and working capital.

dowidth.com

dowidth.com