Open banking revolutionizes financial services by enabling secure data sharing between banks and third-party providers through standardized APIs, enhancing customer control and fostering innovation in payment solutions. Banking APIs serve as the technical foundation, allowing seamless integration of services, real-time data access, and personalized financial products that improve user experience. Discover how open banking and banking APIs are transforming the future of finance by exploring their key benefits and applications.

Why it is important

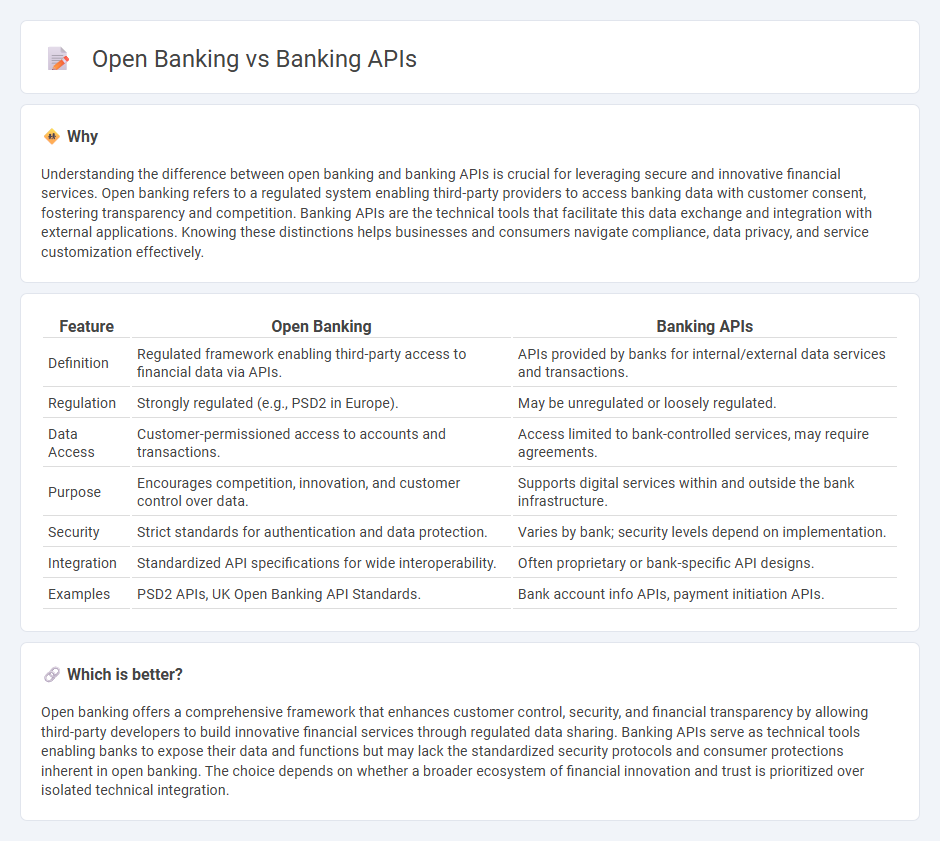

Understanding the difference between open banking and banking APIs is crucial for leveraging secure and innovative financial services. Open banking refers to a regulated system enabling third-party providers to access banking data with customer consent, fostering transparency and competition. Banking APIs are the technical tools that facilitate this data exchange and integration with external applications. Knowing these distinctions helps businesses and consumers navigate compliance, data privacy, and service customization effectively.

Comparison Table

| Feature | Open Banking | Banking APIs |

|---|---|---|

| Definition | Regulated framework enabling third-party access to financial data via APIs. | APIs provided by banks for internal/external data services and transactions. |

| Regulation | Strongly regulated (e.g., PSD2 in Europe). | May be unregulated or loosely regulated. |

| Data Access | Customer-permissioned access to accounts and transactions. | Access limited to bank-controlled services, may require agreements. |

| Purpose | Encourages competition, innovation, and customer control over data. | Supports digital services within and outside the bank infrastructure. |

| Security | Strict standards for authentication and data protection. | Varies by bank; security levels depend on implementation. |

| Integration | Standardized API specifications for wide interoperability. | Often proprietary or bank-specific API designs. |

| Examples | PSD2 APIs, UK Open Banking API Standards. | Bank account info APIs, payment initiation APIs. |

Which is better?

Open banking offers a comprehensive framework that enhances customer control, security, and financial transparency by allowing third-party developers to build innovative financial services through regulated data sharing. Banking APIs serve as technical tools enabling banks to expose their data and functions but may lack the standardized security protocols and consumer protections inherent in open banking. The choice depends on whether a broader ecosystem of financial innovation and trust is prioritized over isolated technical integration.

Connection

Open banking relies on banking APIs to enable secure, standardized data sharing between financial institutions and third-party providers. APIs facilitate real-time access to customer account information, payment initiation, and financial services integration, driving innovation and competition in the banking sector. This connection empowers consumers with greater control over their financial data and fosters the development of personalized banking solutions.

Key Terms

Data Sharing

Banking APIs enable secure data exchange between financial institutions and third-party developers, facilitating innovative services like payment initiation and account aggregation. Open banking is a regulatory-driven framework promoting standardized data sharing to empower consumers with greater control over their financial information. Discover how these technologies revolutionize financial ecosystems and enhance data sharing capabilities.

Customer Consent

Banking APIs facilitate secure data exchange between financial institutions and third-party providers by requiring explicit customer consent before accessing personal financial information, ensuring compliance with regulations like PSD2. Open banking leverages these APIs to empower customers with control over their data, fostering transparency and trust in financial services. Discover how customer consent mechanisms redefine data privacy and innovation in modern banking ecosystems.

Third-Party Access

Banking APIs enable secure data sharing between financial institutions and third-party providers, facilitating services such as payment initiation and account information retrieval. Open banking mandates regulated third-party access, enhancing customer control while promoting innovation and competition in the financial ecosystem. Explore how third-party access in banking APIs and open banking revolutionizes digital finance security and functionality.

Source and External Links

The Ultimate Guide to Bank APIs - This guide provides an overview of banking APIs, focusing on their benefits and role in modern web APIs and open banking.

Open Banking API - Plaid explains how open banking APIs enable users to connect their bank accounts to various financial services, securing data access with customer permission.

Banking API - Modern Treasury describes how banking APIs facilitate digital connections between companies and banks, supporting functions like payments and lending.

dowidth.com

dowidth.com