Account aggregation platforms consolidate financial data from multiple sources into a single dashboard, enabling users to view all their accounts in one place for easier tracking and budgeting. Wealth management platforms, however, provide personalized financial planning, investment advice, and portfolio management to help clients grow and protect their assets. Explore how these distinct technologies can enhance your financial strategy and simplify money management.

Why it is important

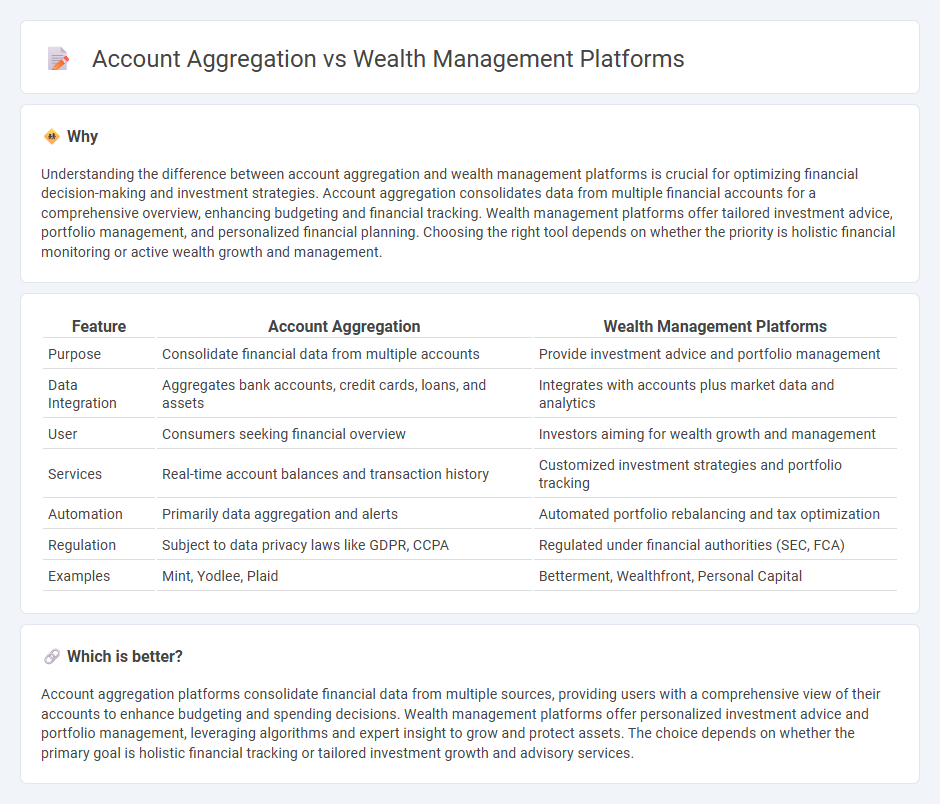

Understanding the difference between account aggregation and wealth management platforms is crucial for optimizing financial decision-making and investment strategies. Account aggregation consolidates data from multiple financial accounts for a comprehensive overview, enhancing budgeting and financial tracking. Wealth management platforms offer tailored investment advice, portfolio management, and personalized financial planning. Choosing the right tool depends on whether the priority is holistic financial monitoring or active wealth growth and management.

Comparison Table

| Feature | Account Aggregation | Wealth Management Platforms |

|---|---|---|

| Purpose | Consolidate financial data from multiple accounts | Provide investment advice and portfolio management |

| Data Integration | Aggregates bank accounts, credit cards, loans, and assets | Integrates with accounts plus market data and analytics |

| User | Consumers seeking financial overview | Investors aiming for wealth growth and management |

| Services | Real-time account balances and transaction history | Customized investment strategies and portfolio tracking |

| Automation | Primarily data aggregation and alerts | Automated portfolio rebalancing and tax optimization |

| Regulation | Subject to data privacy laws like GDPR, CCPA | Regulated under financial authorities (SEC, FCA) |

| Examples | Mint, Yodlee, Plaid | Betterment, Wealthfront, Personal Capital |

Which is better?

Account aggregation platforms consolidate financial data from multiple sources, providing users with a comprehensive view of their accounts to enhance budgeting and spending decisions. Wealth management platforms offer personalized investment advice and portfolio management, leveraging algorithms and expert insight to grow and protect assets. The choice depends on whether the primary goal is holistic financial tracking or tailored investment growth and advisory services.

Connection

Account aggregation technology consolidates financial data from multiple bank accounts, credit cards, and investment portfolios into a single interface, enabling wealth management platforms to provide comprehensive financial insights. Wealth management platforms leverage this aggregated data to offer personalized investment advice, optimize asset allocation, and streamline portfolio tracking. This integration enhances decision-making accuracy and improves client engagement through real-time, holistic financial visibility.

Key Terms

**Wealth Management Platforms:**

Wealth management platforms offer comprehensive services including portfolio management, financial planning, and personalized investment strategies, integrating advanced analytics and AI for optimized asset allocation. These platforms provide seamless access to diverse financial products, real-time performance tracking, and client-centric reporting tools to enhance decision-making and wealth growth. Explore our detailed insights to understand how wealth management platforms can transform your investment approach.

Portfolio Management

Wealth management platforms offer comprehensive portfolio management tools, combining investment tracking, financial planning, and automated rebalancing to optimize asset allocation. Account aggregation primarily consolidates account information from multiple financial institutions, providing a unified view but lacking advanced portfolio management features. Explore how integrating wealth management platforms can enhance your portfolio oversight and decision-making.

Financial Planning

Wealth management platforms offer comprehensive financial planning by integrating portfolio management, goal setting, and personalized investment strategies tailored to individual risk profiles. Account aggregation tools consolidate financial data from multiple accounts into a single interface but lack advanced planning features, limiting their ability to provide holistic financial advice. Explore our detailed comparison to understand how each solution can optimize your financial planning needs.

Source and External Links

Top Wealth Management Software Providers in 2025 | Velmie - This guide provides insights into top-rated wealth management platforms for 2025, highlighting key factors for selecting quality solutions.

Black Diamond Wealth Platform | Home - The Black Diamond Wealth Platform is a comprehensive solution that offers intuitive dashboards and robust functionality to guide clients through their wealth journey.

Integrate Your Software Product with Wealth Management Platform - This article discusses key players in the fintech wealth management space, including Addepar and other platforms that facilitate financial management and integration.

dowidth.com

dowidth.com