Banking as a Service (BaaS) enables third-party providers to offer banking products through APIs, integrating financial services directly into apps without requiring traditional bank branches. Mobile banking focuses on delivering banking functions such as account management, transfers, and payments through smartphone applications designed by financial institutions. Explore key differences and technological advancements to understand how BaaS is transforming the mobile banking landscape.

Why it is important

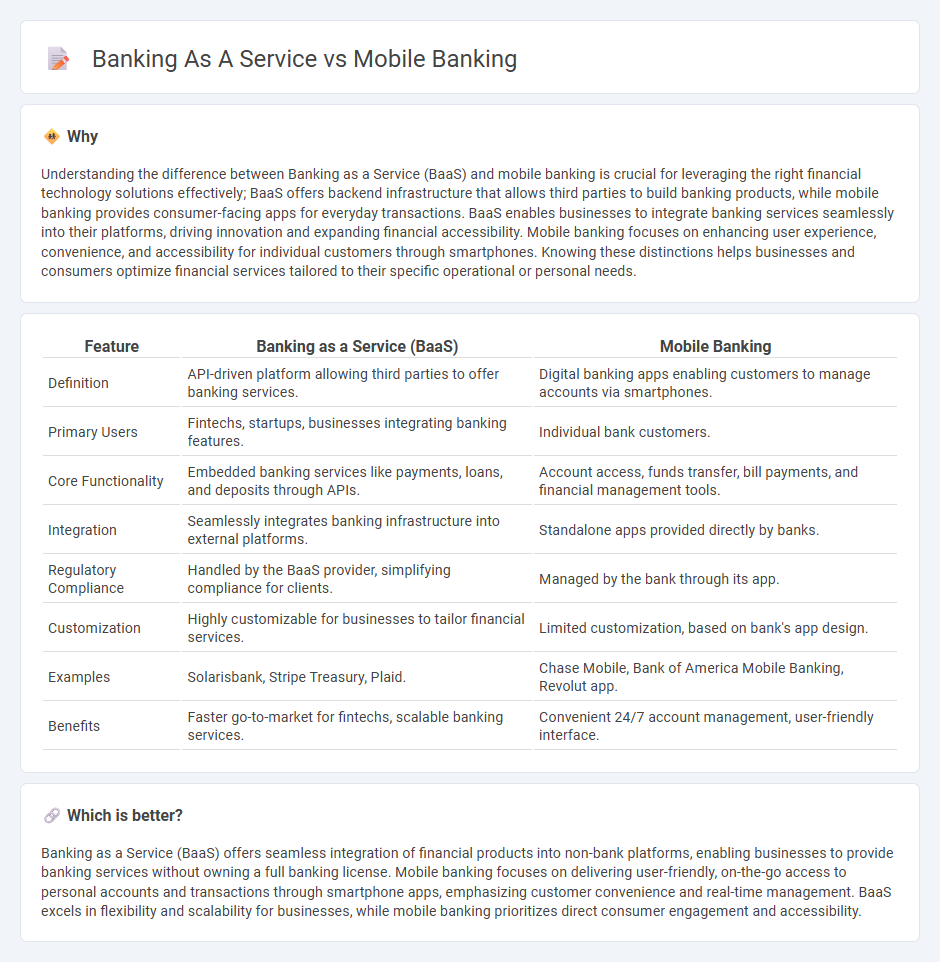

Understanding the difference between Banking as a Service (BaaS) and mobile banking is crucial for leveraging the right financial technology solutions effectively; BaaS offers backend infrastructure that allows third parties to build banking products, while mobile banking provides consumer-facing apps for everyday transactions. BaaS enables businesses to integrate banking services seamlessly into their platforms, driving innovation and expanding financial accessibility. Mobile banking focuses on enhancing user experience, convenience, and accessibility for individual customers through smartphones. Knowing these distinctions helps businesses and consumers optimize financial services tailored to their specific operational or personal needs.

Comparison Table

| Feature | Banking as a Service (BaaS) | Mobile Banking |

|---|---|---|

| Definition | API-driven platform allowing third parties to offer banking services. | Digital banking apps enabling customers to manage accounts via smartphones. |

| Primary Users | Fintechs, startups, businesses integrating banking features. | Individual bank customers. |

| Core Functionality | Embedded banking services like payments, loans, and deposits through APIs. | Account access, funds transfer, bill payments, and financial management tools. |

| Integration | Seamlessly integrates banking infrastructure into external platforms. | Standalone apps provided directly by banks. |

| Regulatory Compliance | Handled by the BaaS provider, simplifying compliance for clients. | Managed by the bank through its app. |

| Customization | Highly customizable for businesses to tailor financial services. | Limited customization, based on bank's app design. |

| Examples | Solarisbank, Stripe Treasury, Plaid. | Chase Mobile, Bank of America Mobile Banking, Revolut app. |

| Benefits | Faster go-to-market for fintechs, scalable banking services. | Convenient 24/7 account management, user-friendly interface. |

Which is better?

Banking as a Service (BaaS) offers seamless integration of financial products into non-bank platforms, enabling businesses to provide banking services without owning a full banking license. Mobile banking focuses on delivering user-friendly, on-the-go access to personal accounts and transactions through smartphone apps, emphasizing customer convenience and real-time management. BaaS excels in flexibility and scalability for businesses, while mobile banking prioritizes direct consumer engagement and accessibility.

Connection

Banking as a Service (BaaS) provides the underlying infrastructure that enables mobile banking applications to offer seamless financial services directly on users' devices. Mobile banking leverages BaaS platforms to integrate APIs for real-time transactions, account management, and personalized banking experiences without the need for traditional brick-and-mortar branches. This integration accelerates innovation, enhances customer accessibility, and drives the digital transformation of financial services.

Key Terms

User Interface (UI)

Mobile banking interfaces emphasize user-friendly navigation and personalized dashboards to enhance customer engagement, featuring intuitive design elements like biometric authentication and real-time notifications. Banking as a Service (BaaS) platforms prioritize seamless API integration and customizable UI components to enable businesses to embed banking functionalities within their own applications efficiently. Explore further to understand how UI innovations differentiate these banking solutions and impact user experience.

API Integration

Mobile banking platforms rely heavily on APIs to connect user interfaces with financial institutions, enabling seamless real-time transactions, account management, and personalized financial services. Banking as a Service (BaaS) offers robust API integration that allows third-party developers to embed full banking functionalities, such as payments, lending, and compliance, directly into their applications. Explore how API-driven innovations in mobile banking and BaaS are transforming the financial ecosystem.

White-label Solutions

White-label solutions in mobile banking enable financial institutions to offer branded digital banking experiences without developing the technology in-house, enhancing user engagement and reducing time-to-market. Banking as a Service (BaaS) platforms provide these white-label capabilities by integrating banking services via APIs, allowing seamless customization and scalability for a variety of financial products. Explore our detailed comparison to understand how white-label solutions transform customer interaction and accelerate innovation in your banking strategy.

Source and External Links

Mobile banking - Mobile banking is a service that allows customers to conduct financial transactions using a mobile device, providing convenience beyond traditional internet banking.

Mobile Banking by PNC - Offers a mobile app allowing users to manage accounts, deposit checks, pay bills, send money via Zelle(r), receive rewards, lock cards, and set travel notifications for enhanced security.

Bank of America Mobile and Online Banking Features - Enables secure access to checking, savings, credit, and investment accounts with features like mobile check deposit, bill payments, money transfers using Zelle(r), and virtual assistant Erica for financial guidance.

dowidth.com

dowidth.com