Income streaming in banking involves steady, predictable revenue sources such as interest on loans and fees for services, offering financial stability and long-term growth. Trading revenue, generated from market activities like buying and selling securities, provides higher volatility and potential for rapid profit but carries increased risk. Explore the balance between these income strategies to understand their impact on banking profitability.

Why it is important

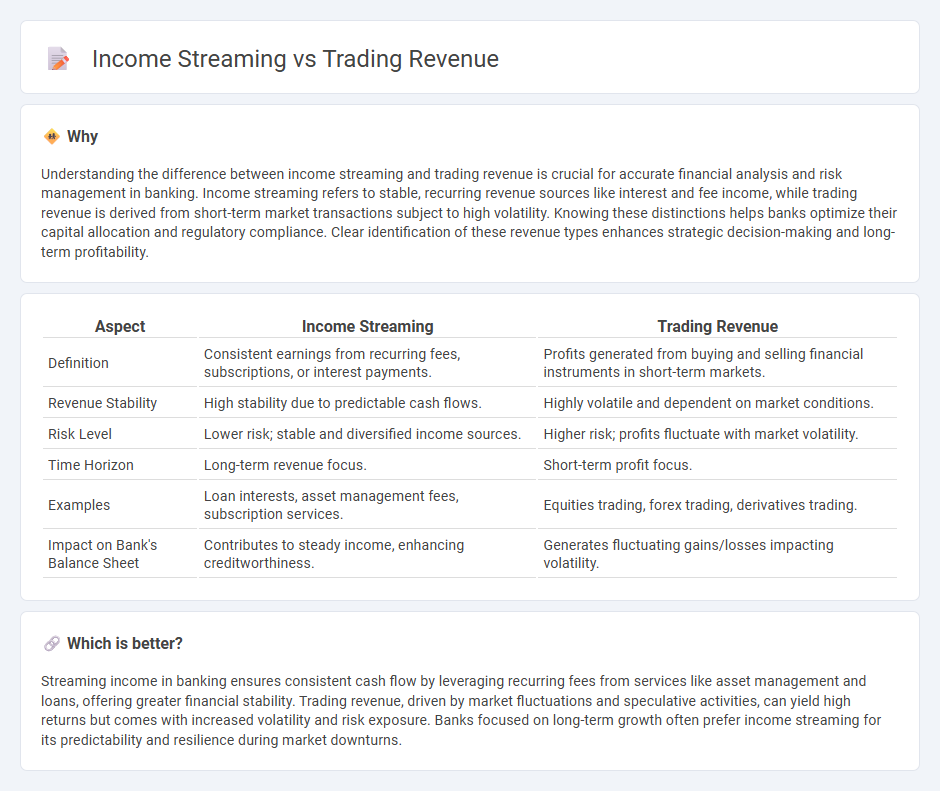

Understanding the difference between income streaming and trading revenue is crucial for accurate financial analysis and risk management in banking. Income streaming refers to stable, recurring revenue sources like interest and fee income, while trading revenue is derived from short-term market transactions subject to high volatility. Knowing these distinctions helps banks optimize their capital allocation and regulatory compliance. Clear identification of these revenue types enhances strategic decision-making and long-term profitability.

Comparison Table

| Aspect | Income Streaming | Trading Revenue |

|---|---|---|

| Definition | Consistent earnings from recurring fees, subscriptions, or interest payments. | Profits generated from buying and selling financial instruments in short-term markets. |

| Revenue Stability | High stability due to predictable cash flows. | Highly volatile and dependent on market conditions. |

| Risk Level | Lower risk; stable and diversified income sources. | Higher risk; profits fluctuate with market volatility. |

| Time Horizon | Long-term revenue focus. | Short-term profit focus. |

| Examples | Loan interests, asset management fees, subscription services. | Equities trading, forex trading, derivatives trading. |

| Impact on Bank's Balance Sheet | Contributes to steady income, enhancing creditworthiness. | Generates fluctuating gains/losses impacting volatility. |

Which is better?

Streaming income in banking ensures consistent cash flow by leveraging recurring fees from services like asset management and loans, offering greater financial stability. Trading revenue, driven by market fluctuations and speculative activities, can yield high returns but comes with increased volatility and risk exposure. Banks focused on long-term growth often prefer income streaming for its predictability and resilience during market downturns.

Connection

Income streaming in banking is closely linked to trading revenue as diversified income streams often include profits generated from trading activities in securities, foreign exchange, and derivatives markets. Trading revenue contributes significantly to a bank's non-interest income, enhancing overall financial stability and profitability. Effective management of trading strategies directly influences the consistency and scale of income streaming within financial institutions.

Key Terms

Capital Gains

Capital gains represent the profit realized from the sale of assets or investments, playing a crucial role in both trading revenue and income streaming strategies. Trading revenue often captures short-term capital gains generated through frequent buying and selling of securities, while income streaming typically involves long-term capital gains coupled with dividends for steady returns. Explore the distinctions and optimize your portfolio by understanding the nuances of capital gains in trading revenue versus income streaming.

Interest Income

Trading revenue primarily arises from the buying and selling of financial instruments, while income streaming, particularly interest income, is generated through lending activities or holding interest-bearing assets. Interest income reflects the earnings from loans, bonds, and other fixed-income securities, serving as a key indicator of a firm's asset performance. Explore more about how interest income impacts overall financial health and revenue diversification strategies.

Fee-Based Income

Fee-based income represents a steadier and more predictable revenue stream compared to trading revenue, which is often subject to market volatility and fluctuations. This type of income primarily comes from advisory fees, management fees, and other service charges, contributing to a company's financial stability and long-term growth. Explore further insights on how fee-based income enhances revenue sustainability.

Source and External Links

Revenue: Explained - This article explains the concept of revenue in trading, highlighting its importance in evaluating a trader's profitability and discussing types like transactional and recurring revenue.

OCC Reports Second Quarter 2023 Bank Trading Revenue - This report details the trading revenue of U.S. commercial banks and savings associations, showing a decrease in revenue from various trading instruments during the second quarter of 2023.

Trading Revenue Definition - Trading revenue refers to income received from customers, including fees for services, rents, and royalties, after accounting for discounts, returns, and allowances.

dowidth.com

dowidth.com