Alternative data lending leverages non-traditional information such as utility payments, rental history, and social media activity to assess borrower creditworthiness, expanding access for those with limited credit histories. Traditional credit scoring relies primarily on credit bureau reports, focusing on payment history, credit utilization, and outstanding debts to determine lending risk. Explore how alternative data transforms credit evaluation and broadens financial inclusion.

Why it is important

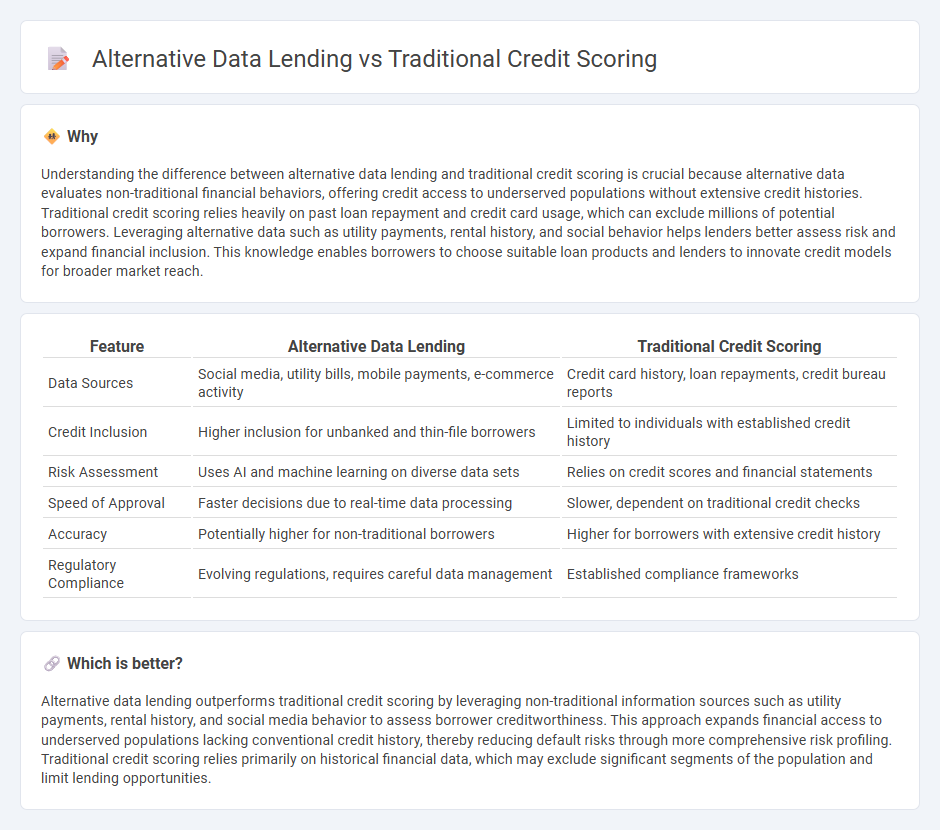

Understanding the difference between alternative data lending and traditional credit scoring is crucial because alternative data evaluates non-traditional financial behaviors, offering credit access to underserved populations without extensive credit histories. Traditional credit scoring relies heavily on past loan repayment and credit card usage, which can exclude millions of potential borrowers. Leveraging alternative data such as utility payments, rental history, and social behavior helps lenders better assess risk and expand financial inclusion. This knowledge enables borrowers to choose suitable loan products and lenders to innovate credit models for broader market reach.

Comparison Table

| Feature | Alternative Data Lending | Traditional Credit Scoring |

|---|---|---|

| Data Sources | Social media, utility bills, mobile payments, e-commerce activity | Credit card history, loan repayments, credit bureau reports |

| Credit Inclusion | Higher inclusion for unbanked and thin-file borrowers | Limited to individuals with established credit history |

| Risk Assessment | Uses AI and machine learning on diverse data sets | Relies on credit scores and financial statements |

| Speed of Approval | Faster decisions due to real-time data processing | Slower, dependent on traditional credit checks |

| Accuracy | Potentially higher for non-traditional borrowers | Higher for borrowers with extensive credit history |

| Regulatory Compliance | Evolving regulations, requires careful data management | Established compliance frameworks |

Which is better?

Alternative data lending outperforms traditional credit scoring by leveraging non-traditional information sources such as utility payments, rental history, and social media behavior to assess borrower creditworthiness. This approach expands financial access to underserved populations lacking conventional credit history, thereby reducing default risks through more comprehensive risk profiling. Traditional credit scoring relies primarily on historical financial data, which may exclude significant segments of the population and limit lending opportunities.

Connection

Alternative data lending leverages non-traditional information such as utility bills, social media activity, and transaction histories to assess creditworthiness, providing a broader financial profile than traditional credit scoring. Traditional credit scoring relies heavily on historical credit data, which can exclude individuals with limited credit history, while alternative data expands access to credit for underbanked populations. Integrating both approaches enhances predictive accuracy, reduces risk for lenders, and promotes financial inclusion in the banking sector.

Key Terms

Credit Bureau Score

Traditional credit scoring relies heavily on Credit Bureau Scores, which aggregate historical credit behavior such as payment history, outstanding debt, and credit inquiries to assess borrower risk. Alternative data lending incorporates non-traditional information including utility payments, rental history, and social behavior, offering a more inclusive credit evaluation, especially for individuals with limited credit history. Explore the evolving landscape of credit assessment to understand how incorporating alternative data can enhance lending decisions.

Alternative Data Sources

Alternative data sources in lending include utility payments, rental history, social media behavior, and mobile phone usage, providing richer insights beyond traditional credit scores. These data points enhance credit assessments for thin-file or unbanked borrowers, improving financial inclusion. Explore how alternative data transforms lending practices and opens new opportunities for credit access.

Risk Assessment Models

Traditional credit scoring relies on historical financial data such as credit history, income, and debt levels to assess borrower risk, often excluding individuals with limited credit records. Alternative data lending incorporates non-traditional information like utility payments, social media activity, and transaction data to create more inclusive risk assessment models, enhancing accuracy for underserved populations. Explore deeper insights into risk models transforming credit evaluations in lending.

Source and External Links

Traditional Vs. Alternative Credit Scoring: Differences and Advantages - Traditional credit scoring models, like FICO, calculate scores based on payment history (35%), amounts owed (30%), length of credit history (15%), credit mix (10%), and new credit (10%), assigning higher scores to those who demonstrate reliable financial behavior.

Understanding Types of Credit Scoring Models in 2024 - These models use established metrics including timely payments, credit utilization, account age, types of credit, and recent inquiries to provide a standardized snapshot of an individual's creditworthiness, though they may overlook those with limited credit histories.

How traditional credit scoring can be a barrier for many consumers - Traditional scoring can disadvantage economically marginalized groups by penalizing negative events like debt collections, often perpetuating existing socio-economic disparities.

dowidth.com

dowidth.com