Cloud core banking offers scalable, real-time data processing and centralized management, enhancing efficiency and customer experience through seamless integration with digital services. Blockchain-enabled core banking introduces decentralized ledgers that ensure transparency, security, and immutable transaction records, reducing fraud and operational risks. Explore how these technologies redefine financial infrastructure for modern banking.

Why it is important

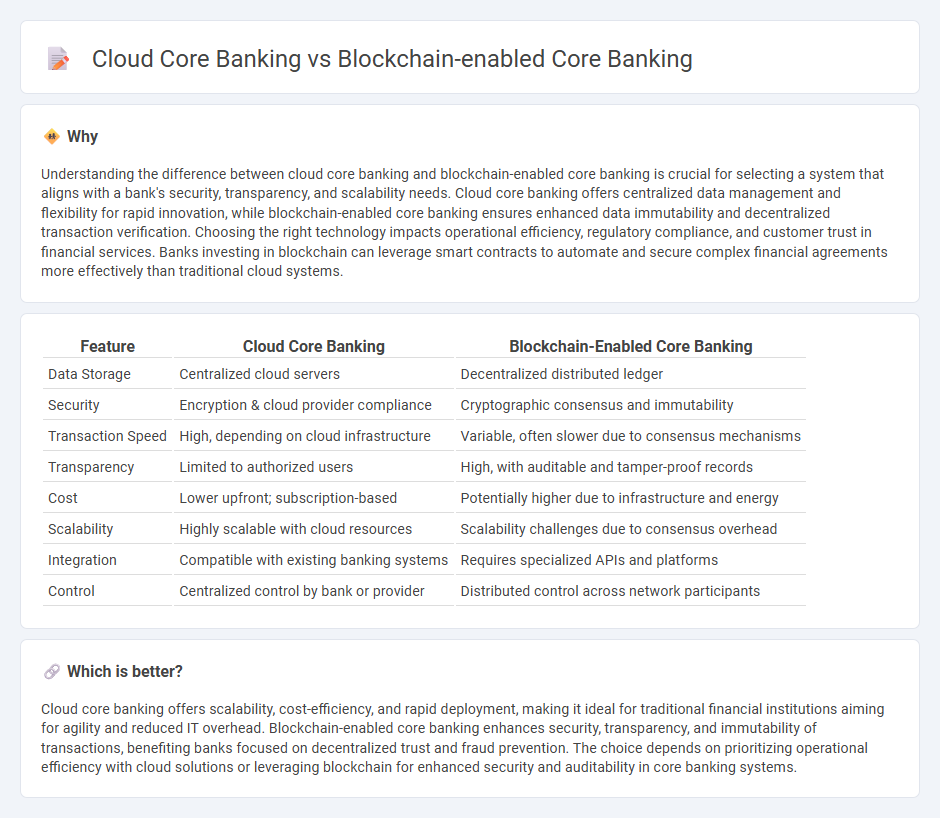

Understanding the difference between cloud core banking and blockchain-enabled core banking is crucial for selecting a system that aligns with a bank's security, transparency, and scalability needs. Cloud core banking offers centralized data management and flexibility for rapid innovation, while blockchain-enabled core banking ensures enhanced data immutability and decentralized transaction verification. Choosing the right technology impacts operational efficiency, regulatory compliance, and customer trust in financial services. Banks investing in blockchain can leverage smart contracts to automate and secure complex financial agreements more effectively than traditional cloud systems.

Comparison Table

| Feature | Cloud Core Banking | Blockchain-Enabled Core Banking |

|---|---|---|

| Data Storage | Centralized cloud servers | Decentralized distributed ledger |

| Security | Encryption & cloud provider compliance | Cryptographic consensus and immutability |

| Transaction Speed | High, depending on cloud infrastructure | Variable, often slower due to consensus mechanisms |

| Transparency | Limited to authorized users | High, with auditable and tamper-proof records |

| Cost | Lower upfront; subscription-based | Potentially higher due to infrastructure and energy |

| Scalability | Highly scalable with cloud resources | Scalability challenges due to consensus overhead |

| Integration | Compatible with existing banking systems | Requires specialized APIs and platforms |

| Control | Centralized control by bank or provider | Distributed control across network participants |

Which is better?

Cloud core banking offers scalability, cost-efficiency, and rapid deployment, making it ideal for traditional financial institutions aiming for agility and reduced IT overhead. Blockchain-enabled core banking enhances security, transparency, and immutability of transactions, benefiting banks focused on decentralized trust and fraud prevention. The choice depends on prioritizing operational efficiency with cloud solutions or leveraging blockchain for enhanced security and auditability in core banking systems.

Connection

Cloud core banking leverages cloud computing to deliver scalable, flexible, and cost-effective banking solutions, while blockchain-enabled core banking integrates distributed ledger technology to enhance security, transparency, and transaction efficiency. Both systems converge by utilizing decentralized cloud infrastructures that support real-time processing, data integrity, and streamlined compliance. This combination facilitates faster settlement times, improved fraud detection, and seamless interoperability across diverse financial institutions.

Key Terms

Distributed Ledger

Blockchain-enabled core banking leverages distributed ledger technology (DLT) to enhance transaction security, transparency, and immutability, providing a decentralized system that reduces fraud and operational risks. Cloud core banking offers scalability and cost efficiency by hosting banking infrastructure on remote servers, but lacks the inherent decentralization and consensus mechanisms of blockchain. Explore how these technologies redefine financial services and drive innovation in core banking systems.

Smart Contracts

Blockchain-enabled core banking integrates smart contracts to automate and secure financial transactions with transparency and immutability, reducing fraud and operational costs. Cloud core banking offers scalability and flexibility but often lacks the decentralized trust and autonomous execution of contracts provided by blockchain technology. Explore the benefits of smart contracts in revolutionizing core banking systems for more insight.

Multi-Tenant Architecture

Blockchain-enabled core banking offers enhanced security and transparency through decentralized ledger technology, making it ideal for multi-tenant architectures that require immutable transaction records and real-time auditability. Cloud core banking provides scalability and flexibility by leveraging virtualized infrastructure to support multiple tenants efficiently, enabling rapid onboarding and customized service delivery. Explore the benefits and challenges of these technologies to understand which multi-tenant architecture best suits your banking needs.

Source and External Links

DBS rolls out Token Services for blockchain-enabled banking for institutions - DBS has integrated its core banking system with a permissioned Ethereum-compatible blockchain to offer institutions tokenized deposits, real-time payments, and smart contract-driven liquidity management.

Is blockchain banking's next disruptor? - Blockchain replaces traditional centralized bank ledgers with a decentralized, cryptographically secure, and automated distributed ledger, streamlining transaction recording and verification for banks.

Smart contract core banking - Vodeno - Vodeno's no-code smart contract platform enables banks to automate and customize core banking products on blockchain, accelerating deployment and ensuring compliance with future regulations.

dowidth.com

dowidth.com