Regulatory sandbox and experimental license are innovative frameworks enabling financial institutions and fintech startups to test new banking products and services under controlled regulatory supervision. These mechanisms foster innovation while ensuring consumer protection and compliance with existing laws. Discover how these models are transforming the banking industry by exploring their distinct features and benefits.

Why it is important

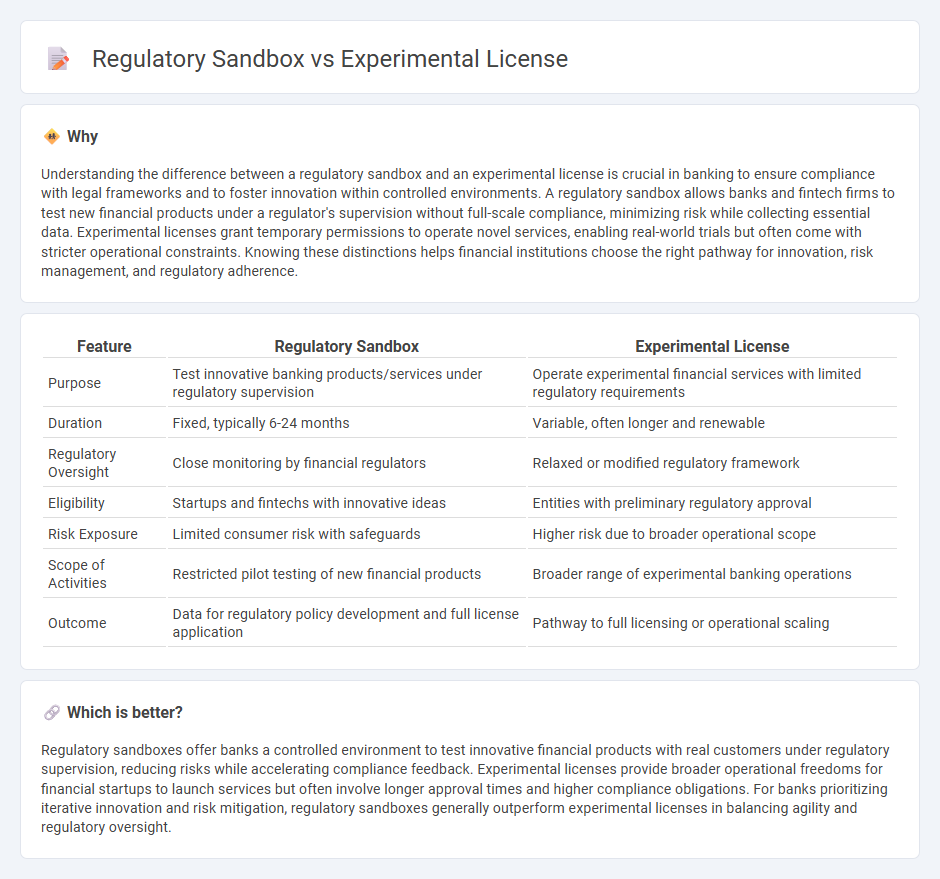

Understanding the difference between a regulatory sandbox and an experimental license is crucial in banking to ensure compliance with legal frameworks and to foster innovation within controlled environments. A regulatory sandbox allows banks and fintech firms to test new financial products under a regulator's supervision without full-scale compliance, minimizing risk while collecting essential data. Experimental licenses grant temporary permissions to operate novel services, enabling real-world trials but often come with stricter operational constraints. Knowing these distinctions helps financial institutions choose the right pathway for innovation, risk management, and regulatory adherence.

Comparison Table

| Feature | Regulatory Sandbox | Experimental License |

|---|---|---|

| Purpose | Test innovative banking products/services under regulatory supervision | Operate experimental financial services with limited regulatory requirements |

| Duration | Fixed, typically 6-24 months | Variable, often longer and renewable |

| Regulatory Oversight | Close monitoring by financial regulators | Relaxed or modified regulatory framework |

| Eligibility | Startups and fintechs with innovative ideas | Entities with preliminary regulatory approval |

| Risk Exposure | Limited consumer risk with safeguards | Higher risk due to broader operational scope |

| Scope of Activities | Restricted pilot testing of new financial products | Broader range of experimental banking operations |

| Outcome | Data for regulatory policy development and full license application | Pathway to full licensing or operational scaling |

Which is better?

Regulatory sandboxes offer banks a controlled environment to test innovative financial products with real customers under regulatory supervision, reducing risks while accelerating compliance feedback. Experimental licenses provide broader operational freedoms for financial startups to launch services but often involve longer approval times and higher compliance obligations. For banks prioritizing iterative innovation and risk mitigation, regulatory sandboxes generally outperform experimental licenses in balancing agility and regulatory oversight.

Connection

Regulatory sandboxes allow fintech companies to test innovative banking products and services under relaxed regulatory conditions, fostering innovation while managing risks. Experimental licenses provide legal authorization for these companies to operate within the sandbox, ensuring compliance and consumer protection. This connection accelerates the development of new financial technologies by balancing innovation with safety.

Key Terms

Innovation Testing

An experimental license allows companies to test innovative products and services within a controlled regulatory framework, enabling real-world trials while ensuring consumer protection. Regulatory sandboxes offer a safe environment where innovators can experiment with new technologies under regulatory supervision without facing immediate compliance penalties. Discover how these frameworks accelerate innovation testing and facilitate market entry by exploring their distinct features and benefits.

Regulatory Oversight

Experimental licenses provide companies with formal authorization to test innovative products under specific regulatory conditions, ensuring compliance and consumer protection through established oversight mechanisms. Regulatory sandboxes allow businesses to trial new technologies in a controlled environment with relaxed regulations and close regulator supervision, enabling risk management and iterative learning. Explore the detailed differences in regulatory oversight to optimize innovation strategies.

Consumer Safeguards

Experimental licenses provide firms with temporary approvals to test innovative products under specific consumer protection guidelines, ensuring transparency and informed consent. Regulatory sandboxes offer a controlled environment where businesses can trial new financial technologies while regulators monitor risks and enforce consumer safeguards dynamically. Explore more to understand how these frameworks balance innovation with consumer rights.

Source and External Links

Experimental License Types (Form 442) - Experimental licenses are issued for specific research or experimentation, product development trials, or market trials, including specialized types like program experimental, medical testing experimental, and compliance testing experimental licenses administered by the FCC.

"Part 5" Experimental Licensing - The FCC issues experimental licenses primarily for experimentation, product development, and market trials under Part 5 rules, with operation on a non-interference basis and prohibiting commercial services or charging fees.

Experimental Permits for Reusable Suborbital Rockets - The FAA provides optional experimental permits specifically designed for developmental reusable suborbital rockets or launch vehicles including guidance on application and safety requirements.

dowidth.com

dowidth.com