Pay by bank offers a seamless payment experience by directly linking your bank account for quick, secure transactions without the need for card details. Bank transfer involves manually sending funds between accounts, often requiring reference information and processing time. Explore more to understand which payment method suits your financial needs best.

Why it is important

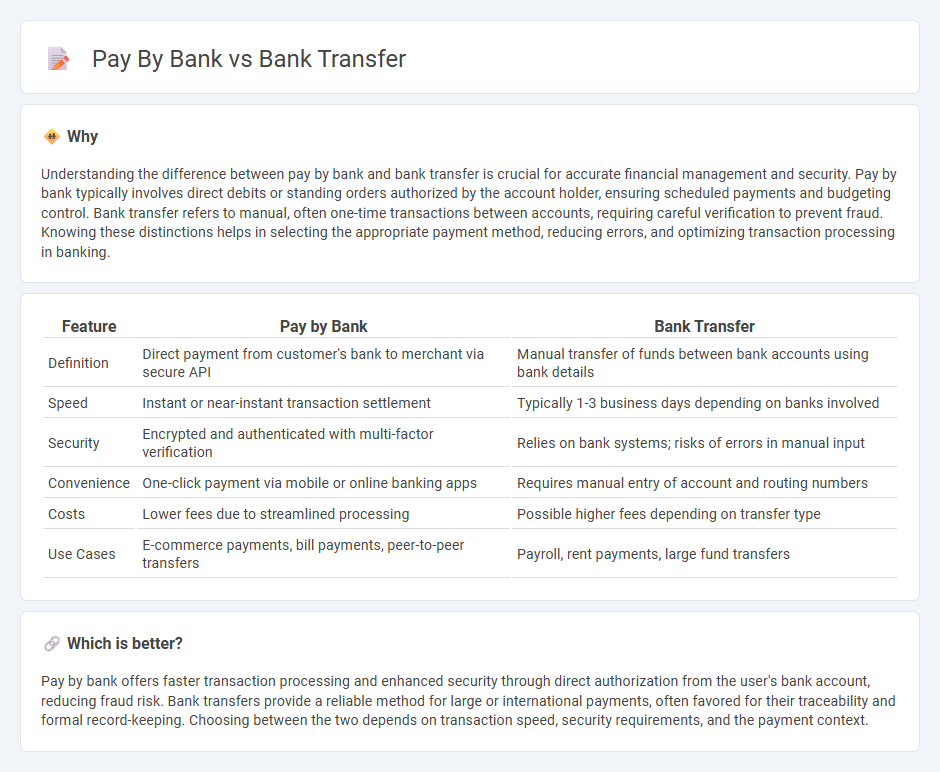

Understanding the difference between pay by bank and bank transfer is crucial for accurate financial management and security. Pay by bank typically involves direct debits or standing orders authorized by the account holder, ensuring scheduled payments and budgeting control. Bank transfer refers to manual, often one-time transactions between accounts, requiring careful verification to prevent fraud. Knowing these distinctions helps in selecting the appropriate payment method, reducing errors, and optimizing transaction processing in banking.

Comparison Table

| Feature | Pay by Bank | Bank Transfer |

|---|---|---|

| Definition | Direct payment from customer's bank to merchant via secure API | Manual transfer of funds between bank accounts using bank details |

| Speed | Instant or near-instant transaction settlement | Typically 1-3 business days depending on banks involved |

| Security | Encrypted and authenticated with multi-factor verification | Relies on bank systems; risks of errors in manual input |

| Convenience | One-click payment via mobile or online banking apps | Requires manual entry of account and routing numbers |

| Costs | Lower fees due to streamlined processing | Possible higher fees depending on transfer type |

| Use Cases | E-commerce payments, bill payments, peer-to-peer transfers | Payroll, rent payments, large fund transfers |

Which is better?

Pay by bank offers faster transaction processing and enhanced security through direct authorization from the user's bank account, reducing fraud risk. Bank transfers provide a reliable method for large or international payments, often favored for their traceability and formal record-keeping. Choosing between the two depends on transaction speed, security requirements, and the payment context.

Connection

Pay by bank and bank transfer both enable direct movement of funds from one bank account to another, enhancing transaction efficiency and security. Pay by bank services often utilize bank transfer protocols like ACH or SEPA, streamlining payments without intermediaries. This connection reduces processing times and fees, fostering seamless digital transactions for consumers and businesses.

Key Terms

Settlement

Bank transfer settlement typically involves processing times ranging from same-day to several business days depending on banks and countries, while Pay by Bank solutions provide near-instant settlement by directly debiting funds from the customer's bank account. The immediacy of Pay by Bank reduces counterparty risk and enhances cash flow efficiency compared to traditional bank transfers that may experience delays due to intermediary banks. Discover how these settlement differences impact transaction security and business liquidity in detail.

Authorization

Bank transfer authorization typically involves a more manual process requiring account holder verification and confirmation of transaction details before funds are moved between bank accounts. Pay by Bank utilizes direct bank-to-merchant authorization through secure APIs, ensuring real-time payment confirmation with enhanced security and reduced fraud risk. Explore further to understand how authorization differences impact transaction speed, security, and user experience.

Clearing

Bank transfer relies on the Automated Clearing House (ACH) system, which processes transactions in batches, resulting in delays ranging from a few hours to several days depending on the banking institutions involved. Pay by bank methods leverage real-time clearing mechanisms like the Faster Payments Service (FPS) or SEPA Instant Credit Transfer, enabling near-instantaneous funds transfer and confirmation between accounts. Explore the benefits and specific clearing technologies behind each method to determine the best fit for your payment needs.

Source and External Links

Wire transfer vs electronic transfer | Western Union ES - A bank transfer is an electronic payment that sends money directly from one bank account to another, often using networks like ACH for domestic transactions and SWIFT for international ones.

Bank transfers | FAQ - WorldRemit - Making an international bank transfer involves providing recipient and bank details, with transfer times ranging from instant to 1-2 working days depending on the destination country.

How a bank transfer, ACH transfer, or wire transfer works | Stripe - Bank transfers are generally safe and processed within a few days, with domestic ACH transfers typically completing in 1-2 business days and wire transfers often within one business day, while international transfers via SWIFT can take 1-5 business days.

dowidth.com

dowidth.com