Virtual cards offer enhanced security by generating unique card numbers for online transactions, reducing fraud risks compared to traditional credit cards. Contactless payments enable quick, tap-to-pay transactions using NFC technology, providing convenience and speed at physical retail locations. Explore how these payment methods transform modern banking and consumer experiences.

Why it is important

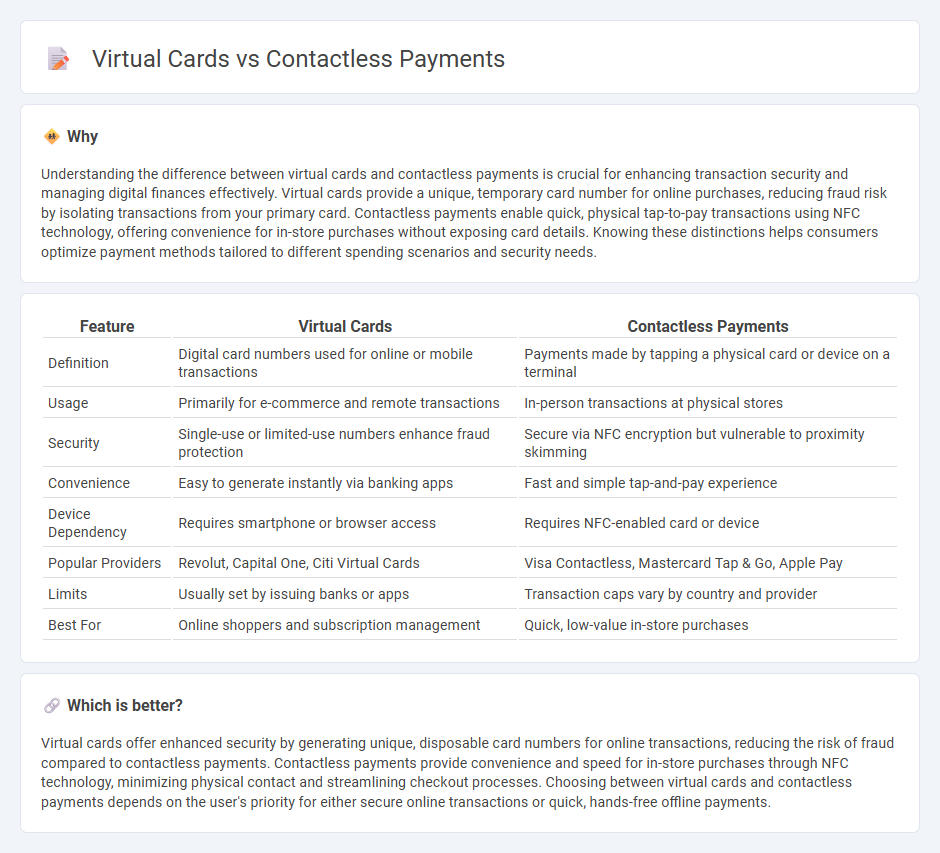

Understanding the difference between virtual cards and contactless payments is crucial for enhancing transaction security and managing digital finances effectively. Virtual cards provide a unique, temporary card number for online purchases, reducing fraud risk by isolating transactions from your primary card. Contactless payments enable quick, physical tap-to-pay transactions using NFC technology, offering convenience for in-store purchases without exposing card details. Knowing these distinctions helps consumers optimize payment methods tailored to different spending scenarios and security needs.

Comparison Table

| Feature | Virtual Cards | Contactless Payments |

|---|---|---|

| Definition | Digital card numbers used for online or mobile transactions | Payments made by tapping a physical card or device on a terminal |

| Usage | Primarily for e-commerce and remote transactions | In-person transactions at physical stores |

| Security | Single-use or limited-use numbers enhance fraud protection | Secure via NFC encryption but vulnerable to proximity skimming |

| Convenience | Easy to generate instantly via banking apps | Fast and simple tap-and-pay experience |

| Device Dependency | Requires smartphone or browser access | Requires NFC-enabled card or device |

| Popular Providers | Revolut, Capital One, Citi Virtual Cards | Visa Contactless, Mastercard Tap & Go, Apple Pay |

| Limits | Usually set by issuing banks or apps | Transaction caps vary by country and provider |

| Best For | Online shoppers and subscription management | Quick, low-value in-store purchases |

Which is better?

Virtual cards offer enhanced security by generating unique, disposable card numbers for online transactions, reducing the risk of fraud compared to contactless payments. Contactless payments provide convenience and speed for in-store purchases through NFC technology, minimizing physical contact and streamlining checkout processes. Choosing between virtual cards and contactless payments depends on the user's priority for either secure online transactions or quick, hands-free offline payments.

Connection

Virtual cards enable secure contactless payments by generating unique, temporary card numbers that can be used for online or NFC-enabled transactions without exposing the physical card details. Contactless payments leverage near-field communication (NFC) technology, allowing users to tap their mobile devices or virtual cards at terminals for fast, fraud-resistant transactions. This integration enhances banking security protocols while offering seamless consumer experiences in retail and digital environments.

Key Terms

Near Field Communication (NFC)

Near Field Communication (NFC) technology enables contactless payments by allowing devices to communicate wirelessly when in close proximity, facilitating fast and secure transactions without physical card swiping. Virtual cards leverage NFC by generating unique, temporary card numbers stored on smartphones or wearables, enhancing payment security and privacy. Discover how NFC-powered virtual cards are transforming the future of seamless and safe digital payments.

Tokenization

Tokenization enhances security by replacing sensitive payment information with unique digital tokens, minimizing fraud risks in both contactless payments and virtual cards. Contactless payments utilize tokenization to secure NFC transactions, enabling seamless, tap-to-pay experiences without exposing actual card data. Discover how tokenization differentiates these technologies and strengthens financial safety in modern transactions.

Digital Wallet

Digital wallets streamline contactless payments by securely storing virtual cards that facilitate fast, tap-to-pay transactions without physical cards. These wallets enhance security through encryption and tokenization, reducing fraud risks while offering convenience across multiple devices. Explore how digital wallets revolutionize payment methods and improve user experience.

Source and External Links

What Is Contactless Payment and How Does it Work (2025) - Square - Contactless payments use NFC technology to let you securely pay by tapping your card, phone, or wearable near a compatible terminal, with no physical contact, PIN, or signature required for small transactions.

The Risks of Contactless Payment Are High Despite Security - While contactless payments offer speed and convenience, they are not entirely immune to fraud and can expose both individuals and businesses to potential monetary loss despite advanced security measures.

Tap to Pay - Learn About Contactless Payments - Visa - Contactless payments can be made using cards, phones, or wearables at terminals displaying the contactless symbol, and you can even add eligible cards to your mobile device if you don't have a contactless card.

dowidth.com

dowidth.com