Loyalty fintech apps focus on rewarding customer behavior through points, cashback, and personalized offers, enhancing user engagement and retention in the banking sector. Wealth management apps prioritize portfolio optimization, financial planning, and investment advisory services to help users grow and protect their assets efficiently. Explore how these distinct solutions transform digital banking experiences and cater to different financial needs.

Why it is important

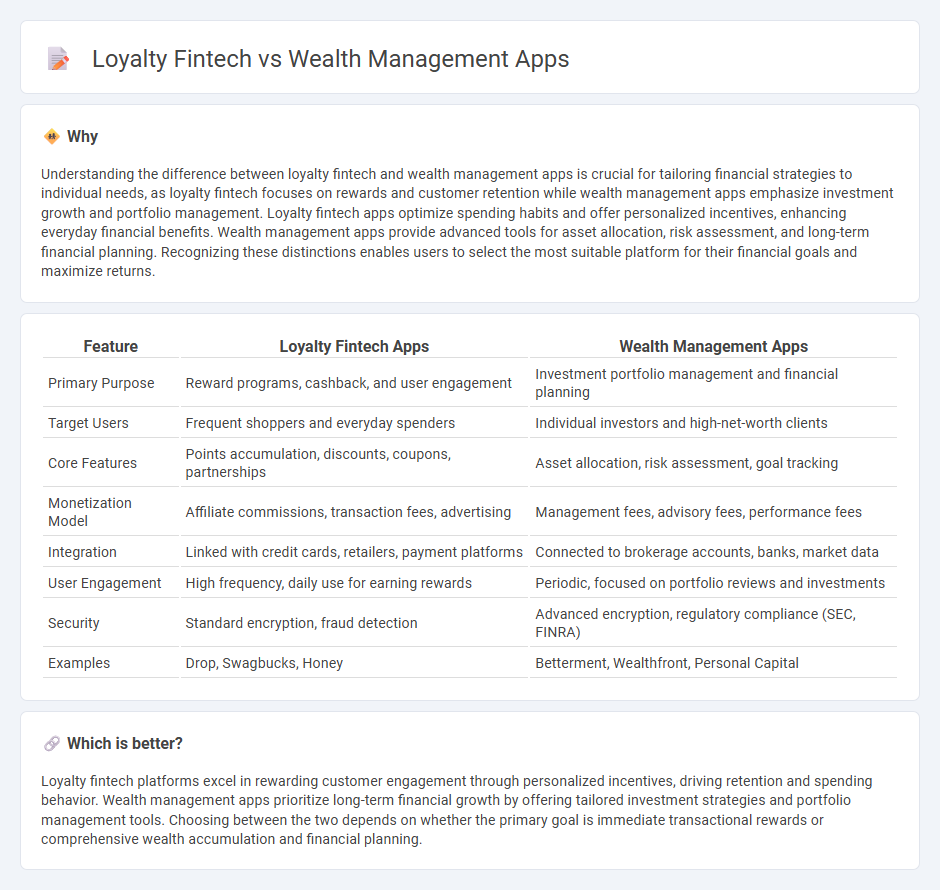

Understanding the difference between loyalty fintech and wealth management apps is crucial for tailoring financial strategies to individual needs, as loyalty fintech focuses on rewards and customer retention while wealth management apps emphasize investment growth and portfolio management. Loyalty fintech apps optimize spending habits and offer personalized incentives, enhancing everyday financial benefits. Wealth management apps provide advanced tools for asset allocation, risk assessment, and long-term financial planning. Recognizing these distinctions enables users to select the most suitable platform for their financial goals and maximize returns.

Comparison Table

| Feature | Loyalty Fintech Apps | Wealth Management Apps |

|---|---|---|

| Primary Purpose | Reward programs, cashback, and user engagement | Investment portfolio management and financial planning |

| Target Users | Frequent shoppers and everyday spenders | Individual investors and high-net-worth clients |

| Core Features | Points accumulation, discounts, coupons, partnerships | Asset allocation, risk assessment, goal tracking |

| Monetization Model | Affiliate commissions, transaction fees, advertising | Management fees, advisory fees, performance fees |

| Integration | Linked with credit cards, retailers, payment platforms | Connected to brokerage accounts, banks, market data |

| User Engagement | High frequency, daily use for earning rewards | Periodic, focused on portfolio reviews and investments |

| Security | Standard encryption, fraud detection | Advanced encryption, regulatory compliance (SEC, FINRA) |

| Examples | Drop, Swagbucks, Honey | Betterment, Wealthfront, Personal Capital |

Which is better?

Loyalty fintech platforms excel in rewarding customer engagement through personalized incentives, driving retention and spending behavior. Wealth management apps prioritize long-term financial growth by offering tailored investment strategies and portfolio management tools. Choosing between the two depends on whether the primary goal is immediate transactional rewards or comprehensive wealth accumulation and financial planning.

Connection

Loyalty fintech and wealth management apps are connected through personalized financial incentives that encourage user engagement and long-term investment behavior. These platforms leverage data analytics and artificial intelligence to tailor rewards and portfolio recommendations, enhancing customer retention and maximizing wealth growth. The integration of loyalty programs within wealth management apps fosters a seamless user experience by combining financial benefits with investment opportunities.

Key Terms

Wealth Management Apps:

Wealth management apps provide personalized investment strategies, real-time portfolio tracking, and automated financial planning to optimize users' asset growth and risk management. These platforms leverage AI-driven analytics and seamless integration with banking services to deliver tailored wealth-building solutions. Explore how wealth management apps can transform your financial future with advanced digital tools and expert insights.

Portfolio Diversification

Wealth management apps provide advanced portfolio diversification tools, leveraging AI algorithms and real-time market data to optimize asset allocation across stocks, bonds, and alternative investments. Loyalty fintech platforms focus primarily on reward-based incentives, offering limited diversification features and emphasizing consumer retention over comprehensive wealth growth strategies. Explore our detailed analysis to understand how each platform supports your investment goals through portfolio diversification.

Robo-Advisor

Wealth management apps leverage Robo-Advisors to provide automated, algorithm-driven financial planning services with minimal human intervention, optimizing portfolio allocation based on individual risk profiles and market trends. Loyalty fintech platforms integrate reward mechanisms to enhance user retention but generally lack the advanced predictive analytics and personalized asset management features found in Robo-Advisors. Explore the evolving capabilities of Robo-Advisors and their impact on wealth management innovation.

Source and External Links

Top 5 Financial Advisor Apps for Wealth Management in 2025 - This article highlights top wealth management apps like Wealthfront, which offers automated portfolio management, goal-oriented investing, and tax-efficient strategies ideal for diversified investment and retirement planning.

The 7 Best Wealth Tracker Apps and Websites - Know Your Net Worth - Reviews apps such as Betterment, a robo-advisor that combines investment management and financial tracking, and Kubera, a premium app focused on tracking diverse portfolios including international assets.

Top 6 Wealth Management Apps to Inspire Your Digital - Features apps like Empower Personal Dashboard for free spending and investment tracking and YNAB for budgeting and expense planning, suitable for users seeking comprehensive financial overview and planning tools.

dowidth.com

dowidth.com